Greece debt crisis: Bank boss says 'insane' not to reach deal

- Published

Louka Katseli, chair of the National Bank of Greece: "The uncertainty cannot prevail"

The head of Greece's biggest bank has said it would be "insane" not to reach an agreement at emergency talks on Monday on the country's debt crisis.

Greek Prime Minister Alexis Tsipras will meet the leaders of the 18 other eurozone nations at a Brussels summit.

Louka Katseli, chair of the National Bank of Greece, told the BBC that banks were not under immediate threat of running out of money.

But she said the situation was serious, and without a deal would become severe.

Her remarks came as Mr Tsipras presented a Greek proposal for a deal during a conference call with German Chancellor Angela Merkel, French President Francois Hollande and EU Commission President Jean-Claude Juncker.

"The prime minister presented the three leaders Greece's proposal for a mutually beneficial agreement that will give a definitive solution and not postpone addressing the problem," Mr Tsipras's office said in a statement.

'Lack of leadership'

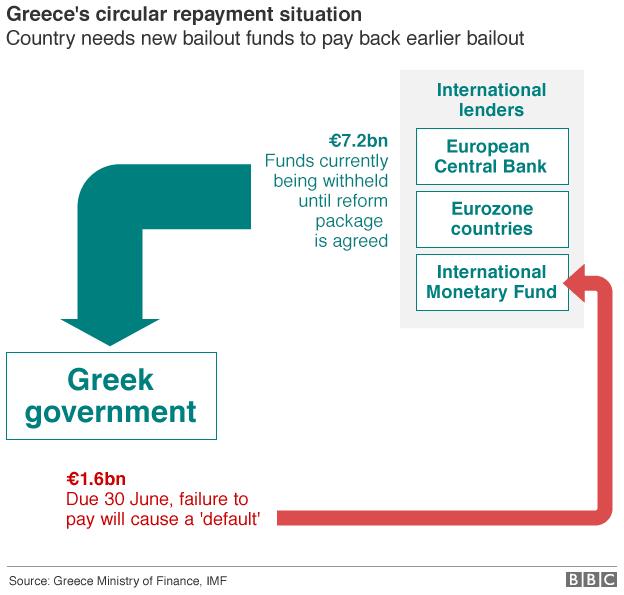

The proposal comes amid attempts to prevent Greece defaulting on a €1.6bn (£1.1bn) IMF loan repayment.

Greece has until the end of June to make the payment or risk crashing out of the single currency and possibly the EU.

The European Commission, the IMF and the European Central Bank (ECB) are unwilling to unlock bailout funds until Greece agrees to economic reforms they want to see introduced.

They want Greece to implement a series of economic changes in areas such as pensions, VAT and on the budget surplus before releasing €7.2bn of funds, which have been delayed since February.

However, Mrs Katseli told BBC Radio 4's World This Weekend programme that negotiations had been badly handled with "a lack of leadership" from the European Union side.

She also said that there could not be an agreement that deepened inequality and poverty in Greece.

Greek Prime Minister Alexis Tsipras (l) and EC President Jean-Claude Juncker have been in weekend talks

In addition she predicted that Greece would not be forced to leave the euro because "the cost for the eurozone, which they are down-playing, is really serious."

She added: "If the markets decided the eurozone is not an irrevocable decision and a government can be declared insolvent, then the first thing that would happen is that there will be a speculative attack by the markets on the next weakest participant in the eurozone or the euro."

It has been reported that withdrawals by Greek savers between last Monday and Friday reached about €4.2bn, representing about 3% of household and corporate deposits held by Greek banks at the end of April.

But Greek banks are expected to open as normal on Monday following a loan from the ECB on Friday.

Greece's debt dilemma explained in 75 seconds

Earlier, Greek State Minister Alekos Flambouraris had said that new proposals would be put to creditors ahead of Monday's summit but he did not give details.

He also told Greek media he believed the ECB would not allow Greece's banks to collapse.

Mr Tsipras has said he believes "there will be a solution based on respecting EU rules and democracy which would allow Greece to return to growth in the euro".

Greece - deal or no deal?

Option 1: No deal: Greece defaults on IMF and ECB repayments; ECB pulls plug on emergency bank assistance leading to run on Greek banks, capital controls and potential Grexit

Option 2: Greece agrees reform deal with creditors at last minute and avoids default, staying in euro

Option 3: No deal reached but both sides paper over cracks and Greece stays in euro for now

But Mrs Merkel has warned there must be a deal between Greece and its creditors ahead of Monday's summit.

Otherwise, she said, the summit would not be able to make any decision.

Greek debt talks: main sticking points

Greece will not accept cuts to pension payments or public sector wages, saying two-thirds of pensioners are either below or near the poverty line

International creditors want pension spending cut by 1% of GDP - it accounts for 16% of Greek GDP. They say they want to target early retirement not lower-income pensioners

EU officials say Greece has agreed to budget surplus targets of 1% of GDP this year, followed by 2% in 2016 and 3.5% by 2018. Greece says nothing is agreed until everything is agreed

Creditors also want a wider VAT base; Greece says it will not allow extra VAT on medicines or electricity bills

Greece complains creditors focus on increasing taxes instead of cracking down on tax evasion; IMF is concerned Athens is not offering credible reforms