Budget 2016: Fuel duty frozen for sixth year in a row

- Published

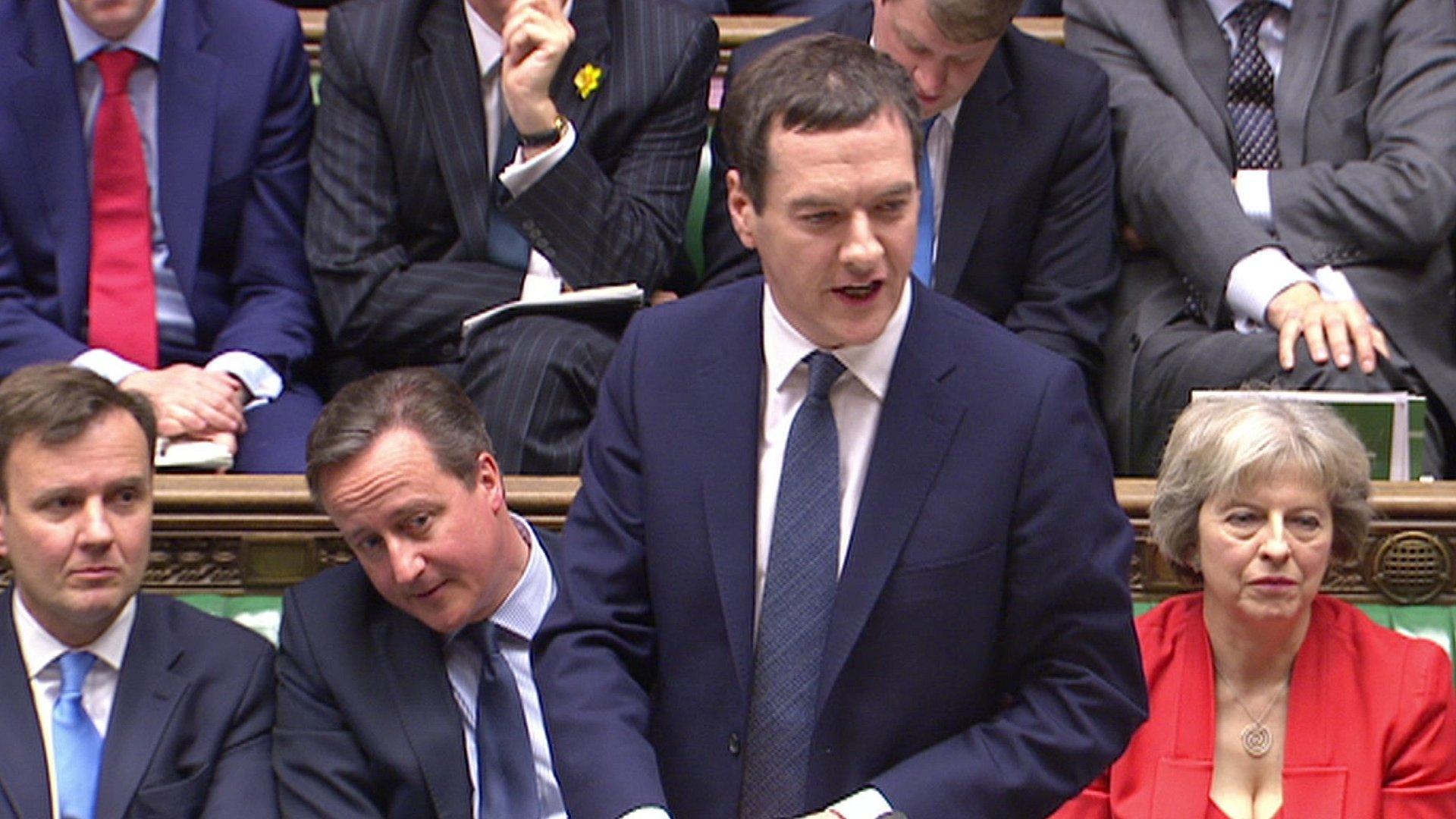

Fuel duty will be frozen for the sixth year in a row, Chancellor George Osborne has said.

Presenting the Budget, the chancellor said consumers should be able to benefit from the recent slide in oil prices.

Fuel duty has been held at 57.95p per litre since the March 2011 Budget, when it was cut by a penny.

Mr Osborne also froze duty on beer, cider and spirits, but raised taxes on tobacco products.

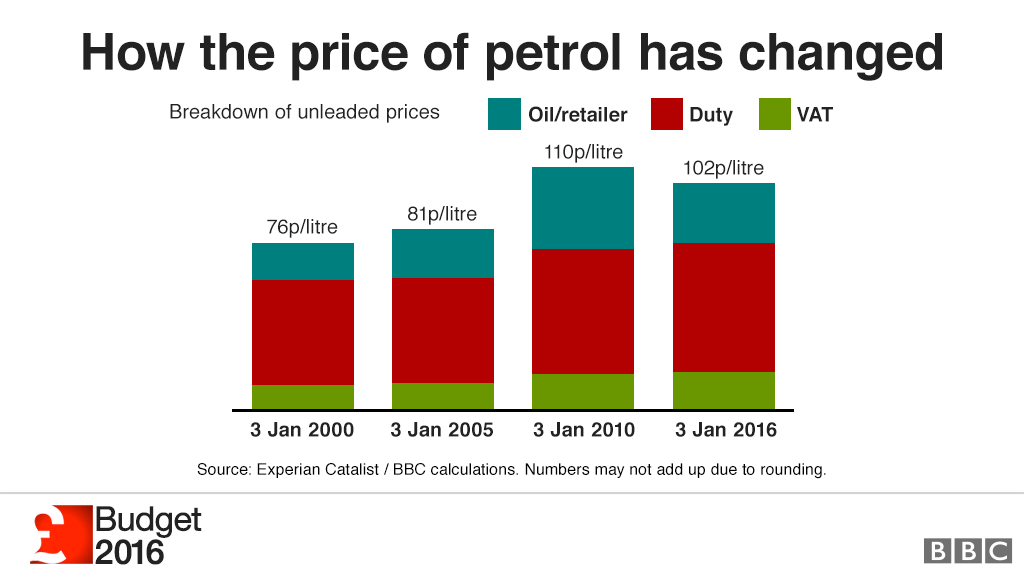

Fuel duty remains the biggest component of the price of diesel and petrol. Motorists also pay 20% value added tax on those fuels.

As of 14 March, the average price of petrol in the UK was 102.72p a litre and the price of diesel was 102.91p, according to the RAC Foundation.

The duty was last increased in January 2011 from 58.19p to 58.95p a litre.

In the July 2015 summer Budget, Mr Osborne scrapped a planned fuel duty increase for 1 September.

A barrel of Brent crude oil changed hands for $39.52 a barrel on Wednesday, up from prices of below $28 in January, but way below a peak of $115 a barrel in June 2014.

While beer, cider and spirits' duty will stay unchanged, the duty rates on most wine and higher-strength sparkling cider will increase at the same rate as the Retail Prices Index (RPI) from 21 March. RPI currently stands at 1.3%, external.

Duty rates on most tobacco products, such as cigarettes, will increase by 2% above RPI. Duty on hand-rolling tobacco will increase to 5% above RPI. These changes will come into effect from 6pm on Wednesday.

- Published16 March 2016

- Published7 January 2015