Budget 2016 summary: Key points at-a-glance

- Published

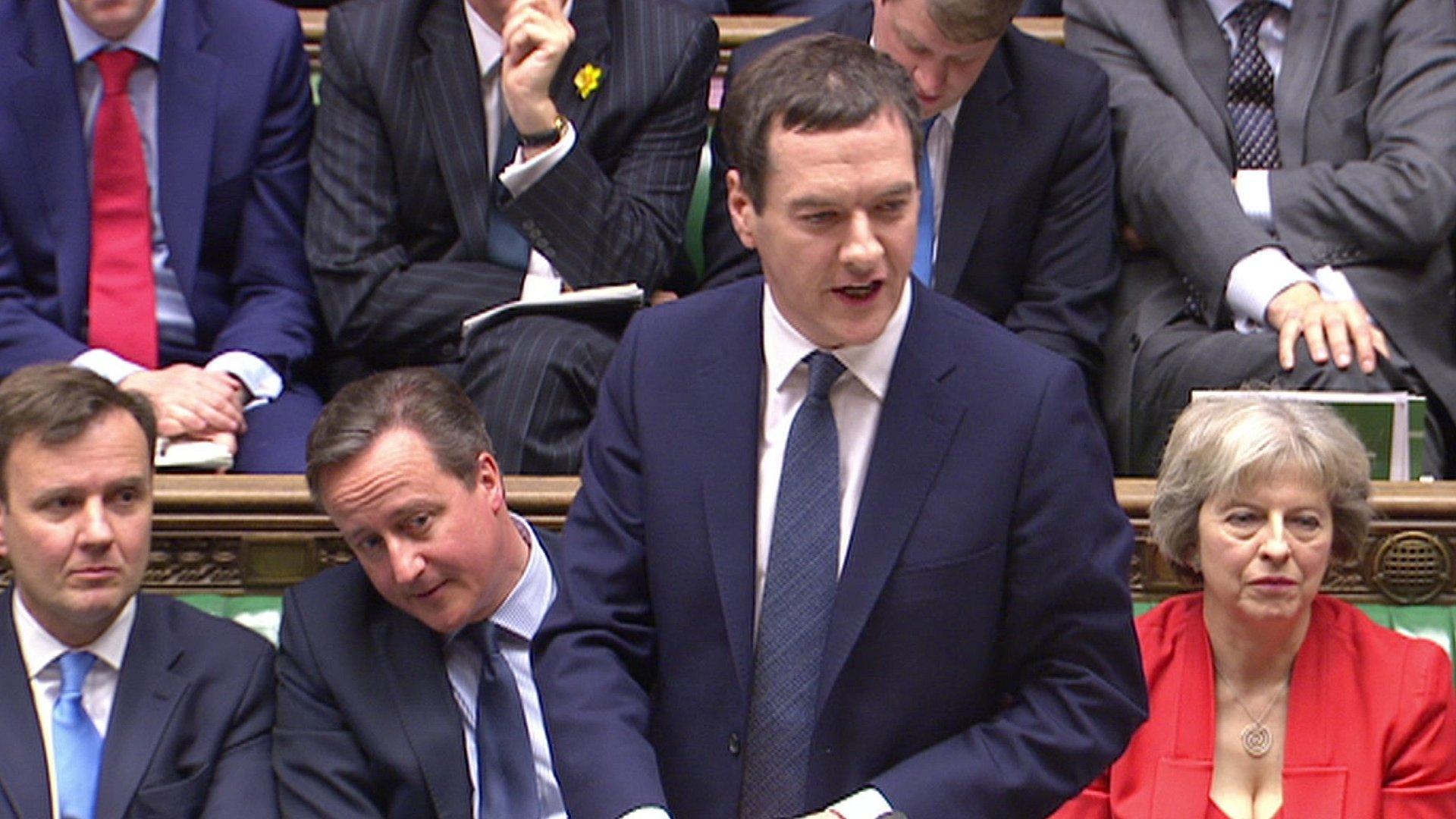

George Osborne has delivered his eighth Budget as chancellor. Here are the main points of what he said.

Health and education

A new sugar tax on the soft drinks industry to be introduced in two years' time, raising £520m a year to be spent on doubling funding for primary school sport in England

Levy to be calculated on levels of sugar in sweetened drinks produced and imported, based on two bands

Pure fruit juice and milk-based drinks to be excluded and small suppliers will be exempt

Secondary schools in England to bid for £285m in new funding for extra after-school activities like sport and art

Plan for all schools in England to become academies by 2022

Compulsory maths lessons until 18 to be looked at

£500m to ensure "fair funding" formula for schools in England

Libor funds to be spent on children's hospital services, specifically in Manchester, Sheffield, Birmingham and Southampton

Analysis: How will sugar tax work?

The state of the economy

Growth forecasts revised down markedly for next five years

Growth forecast to be 2% in 2016, down from 2.4% in November's Autumn Statement

GDP predicted to grow 2.2% and 2.1% in 2017 and 2018, down from 2.4% and 2.5% forecast four months ago

Outlook for global economy is "materially weaker" and UK "not immune" to slowdown elsewhere

The UK still forecast to grow faster than any other major Western economy

A million jobs forecast to be created by 2020

Inflation forecast to be 0.7% for 2016, rising to 1.6% next year

Analysis: Kamal Ahmed on Osborne's 2020 surprise

Public borrowing/deficit/spending

Further cuts of £3.5bn by 2020, with spending as a share of GDP set to fall to 36.9%

Debt targets to be missed. Forecast debt as a share of GDP revised up in each of the next five years to 82.6% in 2016-17 and 81.3%, 79.9%, 77.2% and 74.7% in subsequent years

Debt to be £9bn lower in 2015-16 in cash terms

Annual borrowing in 2015-6 forecast to be £72.2bn, £1.3bn lower than forecast in November

Public finances still projected to achieve a £10.4bn surplus in 2019-2020

But borrowing forecasts revised up to £55.5bn (+£5.6bn), £38.8bn (+£14bn) and £21.4bn (+16.8bn) in 2016-7, 2017-8 and 2018-9 respectively

The deficit as a share of GDP is projected to fall to 2.9% in 2016-17, 1.9% in 2017-18 and 1% in 2018-19

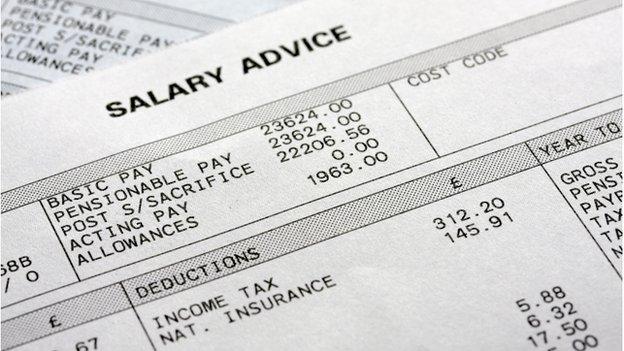

Personal taxation

The threshold at which people pay 40% income tax will rise from £42,385 now to £45,000 in April 2017. Will only apply to Scotland if adopted by Scottish government

Tax-free personal allowance, the point at which people pay income tax, to rise from £11,000 in April 2016 to £11,500 in April 2017

Capital Gains Tax to be cut from 28% to 20%, and from 18% to 10% for basic-rate taxpayers

Insurance premium tax to rise from 9.5% to 10%

Class 2 National Insurance contributions abolished, which the government says gives a tax cut of more than £130 to three million self-employed workers from 2018

Analysis: What the Budget means for you?

Alcohol, tobacco, gambling and fuel

Fuel duty to be frozen at 57.95p per litre for sixth year in a row

Beer, cider, and spirits duties to be frozen

Inflation rise in duties on wine and other alcohol

Excise duties on tobacco to rise by 2% above inflation

Pensions and savings

Annual Isa limit to rise from £15,240 to £20,000

New "lifetime" Isa for the under-40s, with government putting in £1 for every £4 saved

People who save a maximum of £4,000 towards a home deposit or retirement will get a £1,000 top-up from the state every year until they turn 50

New state-backed savings scheme for low-paid workers, worth up to £1,200 over four years

The Money Advice Service, which has provided financial advice to consumers since 2010, is to be abolished

Business

Headline rate of corporation tax - currently 20% - to fall to 17% by 2020

Annual threshold for 100% relief on business rates for small firms to rise from £6,000 to £12,000 and the higher rate from £18,000 to £51,000, exempting 600,000 firms

Supplementary charge for oil and gas producers to be halved from 20% to 10%

Debt interest payments used by larger firms to cut corporation tax bills will be capped at 30% of earnings.

Petroleum revenue tax to be "effectively abolished"

Anti-tax avoidance and evasion measures to raise £12bn by 2020

Use of "personal service companies" by public sector employees to reduce tax liabilities to end

Crackdown on foreign firms selling products online in UK without paying VAT

Commercial stamp duty 0% rate on purchases up to £150,000, 2% on next £100,000 and 5% top rate above £250,000. New 2% rate for high-value leases with net present value above £5m. Effective from midnight

Analysis: Simon Jack on the winners and losers

Housing/infrastructure/transport/regions/energy/culture

Powers over criminal justice to be devolved to Greater Manchester and Greater London Assembly to retain business rates

New rail lines to get green light, including Crossrail 2 in London and the HS3 link between Manchester and Leeds

More than £230m earmarked for road improvements in the north of England, including upgrades to M62

£700m for flood defences schemes, including projects in York, Leeds, Calder Valley, Carlisle and across Cumbria

Tolls on Severn River crossings between England and Wales to be halved by 2018

£115m to tackle rough sleeping and homelessness, funding 2,000 places

In Scotland, Libor bank fines to pay for community facilities in Helensburgh and for naval personnel at Faslane

New elected mayors for cities and towns in southern England

New tax relief for museums to boost temporary and touring exhibitions

New Shakespeare for the North theatre in Knowsley, Merseyside

- Published16 March 2016

- Published16 March 2016

- Published16 March 2016

- Published16 March 2016