Budget 2016: Growth forecasts cut for next five years

- Published

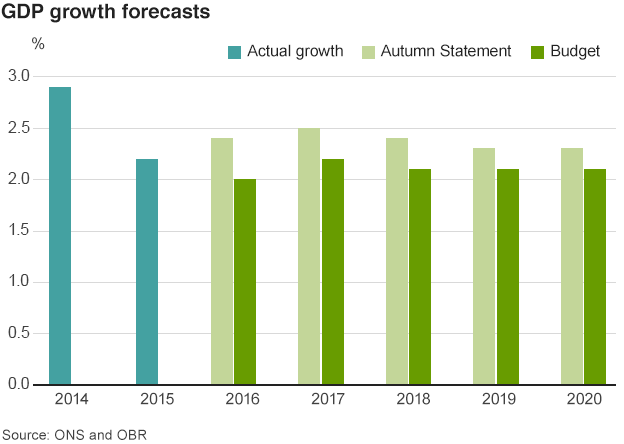

The UK economy will grow more slowly in the next five years than had been expected in November, the Office for Budget Responsibility (OBR) has said.

The OBR had previously forecast that the economy would grow 2.4% this year, but is now predicting a rate of 2.0%.

Chancellor George Osborne said the cuts had been due to a reduction in the OBR's forecasts of productivity.

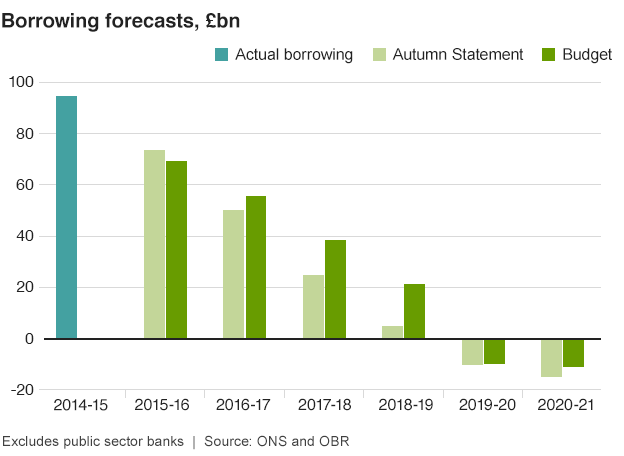

The amount the government is expected to have to borrow this year has fallen, but it has gone up for the next three.

However, the chancellor confirmed that he was still on-track to meet his target of having a budget surplus by 2019-20.

Under the OBR's new forecast, the estimate for economic growth in 2017 has been cut to 2.2% from 2.5%, and to 2.1% from 2.4% in 2018. Growth in both 2019 and 2020 is now estimated at 2.1% compared with the previous forecast of 2.3%.

The OBR also said the cut to growth forecasts was due to less growth being expected elsewhere in the world.

"In the short time since our November forecast, economic developments have disappointed and the outlook for the economy and the public finances looks materially weaker," it said.

At a news conference, OBR head Robert Chote said that productivity growth in the last three months of 2015 had been considerably worse than expected, wiping out gains made earlier in the year and making the OBR question whether UK productivity was likely to recover to pre-crisis levels.

"With the period of weak productivity growth post-crisis continuing to lengthen, we have placed more weight on that as a guide to future prospects - although this judgement remains highly uncertain," the OBR said.

The OBR unexpectedly reduced the amount it expects the government to borrow in the current financial year from £73.5bn to £72.2bn.

In the first 10 months of the financial year, the government has already borrowed £66.5bn, external, so many commentators predicted that the forecast would have to be raised.

The OBR said it had cut the forecast because it was expecting smaller contributions to the EU in the next two months because more of the 2016 contributions would be paid in the next financial year.

In addition, it predicted lower borrowing by housing associations, lower spending on tax credits and a smaller-than-expected take-up of married couples' tax allowance.

However, the OBR warned that the fall it expected "may not be reflected fully in the initial outturn data due in April".

It explained that this was because spending by local authorities tends to take longer to come into the Office for National Statistics, which is also not yet used to calculating figures for housing associations who have only recently been included in public sector debt figures.

'Shuffling receipts'

The borrowing forecasts for the following three years have been increased considerably, although the OBR still expects the government to achieve a surplus in 2019-20 and 2020-21, in line with its supplementary target on the deficit.

Mr Chote said that if no measures had been taken in this Budget then the government would have had to borrow £3bn in 2019-20, but he added that Mr Osborne had met "the letter of the mandate" by "shuffling" receipts into that year and spending out.

On the total amount of government debt (as opposed to the amount borrowed in a single year) the chancellor admitted that the figure as a proportion of GDP would be higher than it was last year as a result of lower GDP, but that the total amount owed would actually be £9bn lower.

So, in the current financial year, total debt is expected to be 83.7% of GDP, up from 83.3% in 2014-15.

Mr Chote referred back to the £27bn that the chancellor was given by changes to the borrowing forecasts in November. He said that in this Budget, there would be £56.3bn less to spend for much the same reason.

"The sofa swallowed £2 this time for every £1 it yielded last time," he commented.

He also said that excessive optimism about the amount of money that could be saved by welfare changes was an ongoing problem.

Analysis: Michael Buchanan, Social affairs correspondent

The OBR says the government is going to breach its own welfare cap in every remaining year of this Parliament.

Forecasts by the OBR in November indicated that spending on benefits would be within the cap towards the end of the Parliament.

But their updated analysis today says spending will "exceed the permitted amount in every year, and by a larger margin than in November."

The additional spending is mainly caused by more people than expected being eligible for disability benefits.

The predicted increase comes despite changes to one disability benefit, Personal Independence Payment (PIP), announced last week. The tighter rules are expected to see 290,000 fewer people being eligible for PIP with a further 80,000 getting a lower award. The OBR estimate the measure will save £1.3bn in 2019-20 and 2020-21.

Despite the increased costs, by 2020-21, the percentage of GDP spend on welfare will be at its lowest level in 30 years according to the OBR.

- Published16 March 2016

- Published16 March 2016

- Published16 March 2016