Budget 2016: Capital Gains Tax and National Insurance cut for some

- Published

Big changes to Capital Gains Tax (CGT) and National Insurance contributions (NICs) will affect several million taxpayers.

From 2018, the self-employed will no longer have to pay what are known as Class 2 NICs.

Currently about 3.4 million people pay this at a rate of £2.80 a week, which contributes to their state pension entitlement and other benefits.

The higher rate of CGT will be cut from 28% to 20% this April.

In addition, the basic rate of CGT will be cut from the current 18% rate to 10% at the start of the new tax year, in three weeks' time on 6 April.

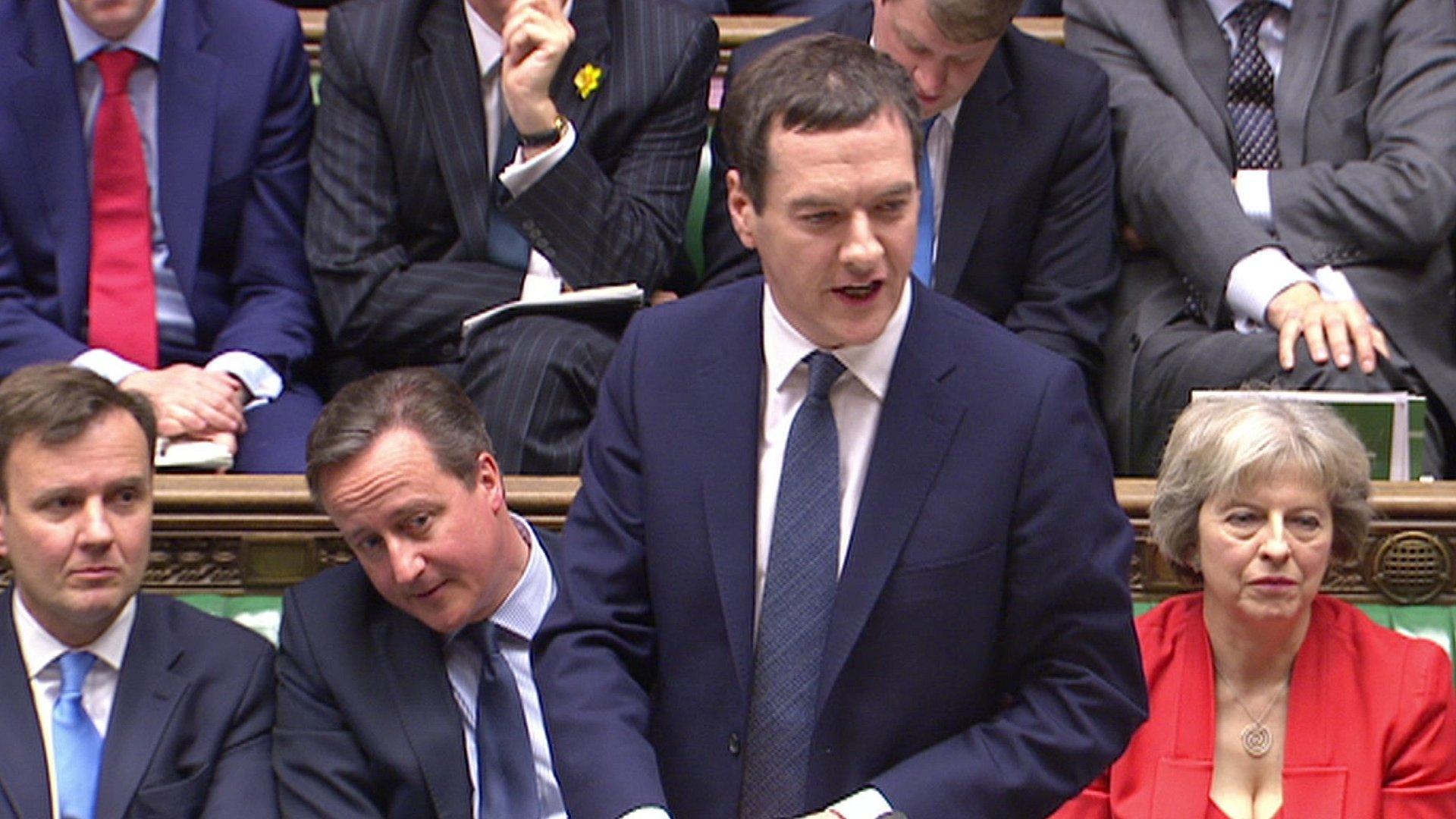

The changes would help to "put rocket boosters on the backs of enterprise and productive investment", Mr Osborne told MPs.

Capital Gains Tax

The Budget documents show that the government estimates the changes to CGT will cost it more than £600m a year from 2017-18 onwards.

CGT is charged on the annual profit made from the sale of assets - such as a business, a second home or shares - if that total profit is greater than an individual's current CGT allowance.

That allowance currently stands at £11,100, and the tax as a whole brought in £5.6bn to the government in the 2014-15 tax year.

However, there are two important exemptions to the chancellor's reforms.

The old higher rates will still apply to gains on the sale of a residential property that is not your main home (such as a second home or a buy-to-let property), and also to "carried interest" - the jargon name for profits made by executives in private equity investment firms.

David Kilshaw, of accountancy firm EY, said: "The chancellor's cut to the headline CGT rates will be a shot in the arm for the stock market, with investors in stocks and shares being the main winners."

However, Richard Lambert, chief executive of the National Landlords Association, was unhappy about landlords being left out of the latest changes.

"The steady upward ratchet of taxation on landlords over the past year shows that George Osborne is determined to bear down on the private rented sector," he said.

National Insurance simplified

Doing away with Class 2 NICs, an important piece of tax simplification, will cost the government about £360m a year.

"This will allow millions of self-employed individuals to keep more of their money and invest it back into growing their business, as well as ending an outdated and complex feature of the NICs system," said the government.

At the moment the self-employed pay Class 2 NICs if they earn a profit of £5,965 or more a year, but they also have to pay Class 4 NICs if their annual profit is more than £8,060 a year.

From April 2018 only Class 4 NICs will still be payable.

However the government explained that the system of paying these contributions would be changed to ensure the self-employed could continue to build up their entitlement to some contributory benefits, such as the state pension.

- Published16 March 2016

- Published16 March 2016

- Published16 March 2016