Japan's shares fall 3% as yen surges again

- Published

The Bank of Japan decided not to boost its stimulus programme further after its two-day meeting which concluded on Thursday

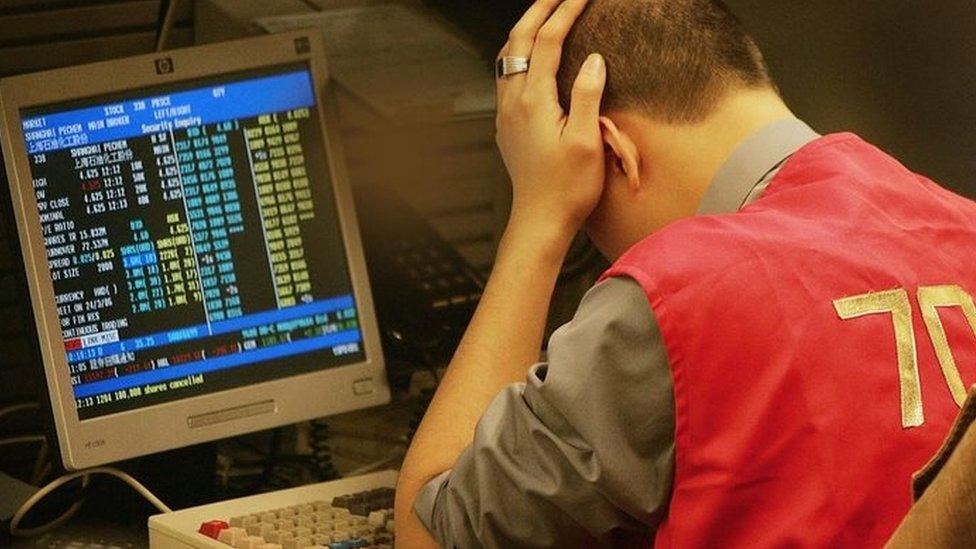

The Nikkei has closed down 3% for the second time this week after another rise in the Japanese yen against the dollar threatened exporters' prospects.

At one point the dollar fell to 104.06 yen, its lowest since August 2014.

The benchmark Nikkei 225 index closed down 3.05% to 15,434.14 points.

The Bank of Japan boosted the yen, which has been gaining ground as a haven for nervous investors, further after it ended its meeting saying it would not add new stimulus.

Continuing worries around the upcoming EU referendum in the UK are adding to general unease about the lack of economic growth.

Comments by the Federal Reserve head, Janet Yellen, overnight sounded a warning over a possible British exit from the EU.

A stronger yen hurts Japan's big exporters.

It makes their goods more expensive to buy overseas and affects their bottom line when they repatriate earnings.

In China, Hong Kong's Hang Seng index fell 2.1% to 20,038.42, while the Shanghai Composite closed 0.5% lower at 2,872.82.

Elsewhere in Asia

News that the Federal Reserve would keep interest rates unchanged for the moment was initially welcomed by several markets in Asia.

In Australia, the S&P/ASX 200 index opened up 0.5% and continued to rise in morning trade. It later closed flat at 5,146 points.

In New Zealand, the benchmark S&P/NZX 50 index spent much of the day in positive territory and closed up 0.28% at 6,888.56.

Investors there were given a boost by positive economic growth numbers released earlier. Official statistics showed New Zealand posted faster-than-expected growth in the first quarter, up 2.8% from a year earlier.

Stocks in South Korea opened in positive territory but lost some ground later, with the benchmark Kospi index closing down 0.86% at 1,951.99.

Analysts said investors would continue to be wary of news from the UK and whether voters there will move to leave the EU.

The possibility of Brexit was one of the factors that led the US Federal Reserve to keep interest rates on hold, Federal Reserve Chair Janet Yellen said.

Ms Yellen said the decision to be made on 23 June could have consequences for economic and financial conditions in global financial markets.

The Federal Reserve raised rates in December for the first time in nearly a decade.

- Published13 June 2016

- Published15 June 2016

- Published15 June 2016

- Published9 June 2015

- Published9 June 2015