Reality Check: Is the UK going into recession?

- Published

The claim: The UK economy will not go into recession in the next few years.

Reality Check verdict: The Bank of England thinks the UK will probably avoid a recession, although one is not all that unlikely, and its forecasts are based on the assumption the results of recent surveys are an overreaction that will correct in the coming months.

Bank of England governor Mark Carney found himself in a slightly odd position when announcing a range of stimulus measures for the UK economy on Thursday.

When the BoE published its last quarterly inflation report in May, he warned that a vote to leave the European Union could lead to a recession.

But the latest inflation report does not predict a recession, or rather, it thinks it is more likely that there will not be one.

The difference is that the predictions in May were made excluding any possible stimulus measures, while the post-Brexit forecasts included the rate cut and increases to quantitative easing, purchases of corporate bonds and very low interest loans to banks.

So, his committee's actions should make his warnings less likely to come true.

So how likely does the BoE now think it is that we will see the two quarters of negative growth that would constitute a recession?

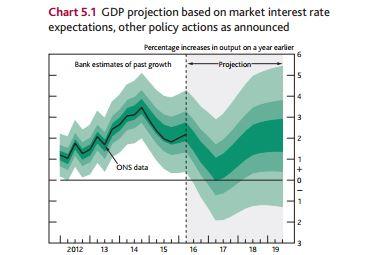

The Quarterly Inflation Report, external includes fan charts of its forecasts, which show the likelihood of various outcomes.

Fan charts are a useful tool for stressing the uncertainty surrounding forecasts.

The way the fan chart works is there should be:

a 30% chance the outcome will be in the darkest green section

a 30% chance the outcome will be in one of the two lighter green sections

a 30% chance the outcome will be in one of the two lightest green section

a 10% chance the outcome will be completely outside the green

So zero growth in the middle of 2017 is in the darkest green section, just, but you have to go to the lighter green to see a recession that year.

As for this year, the BoE has warned there will be "little growth in GDP [gross domestic product] in the second half of the year".

That view was supported by the National Institute of Economic and Social Research earlier in the week, which predicted stagnation rather than recession.

But at Thursday's news conference, Bank of England deputy governor Ben Broadbent also said the forecast of any growth this year was based on an optimistic reading of recent surveys such as the Markit/CIPS surveys.

"They are reliable indicators - these and a few other surveys - and I would point out that if you took them at face value they would suggest the economy is actually contracting," he said.

He added the reason the BoE had taken an optimistic view was that big shocks could lead to overreactions in such surveys.

"We would need them to recover in the coming months to meet the forecasts we have, which is for a little bit of growth during the second half of the year," he said.

- Published4 August 2016

- Published4 August 2016

- Published4 August 2016

- Published22 February 2016