Autumn Statement 2016: What it means for you

- Published

The Autumn Statement - the government's second big economic statement of the year - has significant implications for your finances.

Philip Hammond described this statement,, external his first as chancellor, as a plan to ensure the UK economy is "match-fit".

It included major announcements on housing, benefits and tax.

So what does it mean for you?

'Middle-class perks'

Salary sacrifice - dubbed by some as middle-class perks - allow some employees to give up some of their salary in exchange for goods and services. This lowers their income tax and national insurance bill because their salary is effectively lower.

The most popular use is for pensions, childcare vouchers and bicycles in the cycle to work scheme - all of which will be unaffected, as will employees getting an ultra-low emission company car.

However, other items bought under the scheme such as computers, gym membership, and health screening will be subject to tax from April 2017. In effect, salary sacrifice will be cancelled on these other items and will prevent people lowering their tax bill with their use.

This could prompt a closing-down sale of these deals before the new rules take effect.

A new savings account

A new savings bond will be launched through National Savings and Investments, with an interest rate expected to be set at about 2.2%.

The bond will be open to those aged 16 and over, subject to a minimum investment limit of £100 and a maximum investment limit of £3,000. Savers must put in their money for three years.

The equivalent best-buy three-year bond on the market now pays interest of 1.62%.

The new product will be available for 12 months from spring 2017. The chancellor said he expected two million people to benefit.

Savings experts described it as an "underwhelming" offer, pointing our that by the time the bond launches next year, interest rates - and returns for savers - may be higher than they are now.

Separately, there will be a limit on the amount of money people can recycle in pensions. Some draw cash from their pension pot tax-free, then put some back into a pension again to get extra tax relief.

To do this, the chancellor plans to reduce the annual tax-free allowance from £10,000 to £4,000 in April 2017 for those who start to take money from their defined contribution pension pot.

The idea is they will have less money to play with to recycle it. This is likely to affect a small number of people, but could cause problems for those who may need to access their pension pot flexibly and find they subsequently would like to put the money back.

Fuel duty frozen...

Fuel duty will be frozen for a seventh year.

The chancellor said this would save the average car driver £130 and the average van driver £350 a year.

But insurance premiums may rise...

While motorists will benefit from the fuel duty freeze, the cost of vehicle insurance may rise as the Insurance Premium Tax will rise from 10% to 12% in June 2017.

That may also affect the price of home cover and other insurance products.

Insurance companies are furious, pointing out that this is the third rise in this tax in 18 months.

The AA said: "The chancellor has created the illusion of being the motorists' friend with a freeze on fuel duty whilst pickpocketing drivers on Insurance Premium Tax."

Hannah Maundrell, of money.co.uk, said: "Yet another hike in Insurance Premium Tax seems crazy as it will add £51 to the average household's insurance bill. The cost of insurance is expected to rise anyway - this will make it so much worse."

Measures had already been announced planning to cut whiplash claims, which it is hoped will cut car insurance premiums by about £40.

Housing 'out of reach'

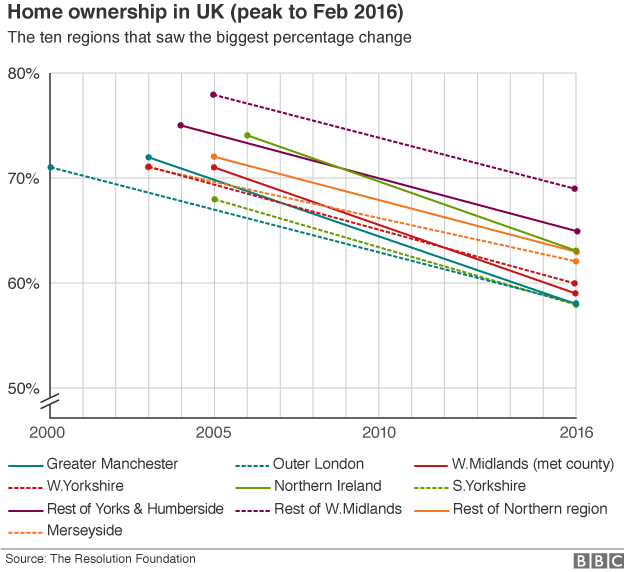

Fewer than two-thirds of the population own their home in much of the UK, with increasing numbers renting as house prices rise.

The typical home in the UK costs £218,000, according to the latest official figures - a rise of £16,000 on a year earlier. First-time buyers would need to find an average deposit of about £33,000 for a mortgage on such a property.

The chancellor said that for many home ownership "remains out of reach", with a pressing need for affordable housing.

He committed to increase funding for home building, with a £2.3bn Housing Infrastructure Fund to deliver infrastructure for up to 100,000 new homes in high demand areas, and £1.4bn towards the construction of affordable homes.

This will take time to increase supply into the housing market. At present, experts say that a lack of homes on the market is pushing up house prices.

Changes to benefits

Some huge changes to the benefits system, announced by Mr Hammond's predecessor George Osborne, are already in place.

The main working age benefits and tax credits were frozen in cash terms for four years from April 2016. That includes entitlements such as jobseeker's allowance and income support. That income freeze could coincide with an acceleration in inflation, pushing up the cost of living and adding pressure to those on low incomes.

Cuts had also already been announced to Universal Credit - the new umbrella benefit gradually being introduced across the UK.

The chancellor is offering some partial respite by changing the so-called taper rate.

This means for every £1 someone on Universal Credit earns in work over the work allowance (the amount you can earn without your benefit being affected), Universal Credit will be reduced by 63p instead of the present level of 65p.

The Resolution Foundation said this would save claimants up to £300, but previous cuts may have cost them more than £2,000.

Mr Hammond said that no more welfare cuts would be announced during this Parliament - but that a cap on welfare spending would remain.

Car-boot giveaway

The government is introducing a new tax relief to help those who buy and sell on a small scale, such as on internet auction sites or at car boot sales. From April 2017, the first £1,000 a year of income will not be taxable.

There will be similar relief for the first £1,000 of property income, such as from letting your room via a website.

Pay rises?

The National Living Wage will rise from £7.20 to £7.50 in April, for those aged 25 and over. This is a smaller rise than had been predicted earlier in the year.

Public sector pay has already been set at a 1% annual rise each year until 2019-20.

Tenants freed from fees

Lettings agents in England will be banned from charging upfront fees to tenants. This will happen "as soon as possible", the chancellor said.

These fees can cost hundreds of pounds and include charges for references, to secure a tenancy, and even a deposit for those wishing to have a pet.

The cost will be shifted to landlords, as is the case in Scotland. The argument is that they have the power to shop around for the cheapest agent when letting out their property.

Charities have welcomed the plan, but the Association of Residential Letting Agents (Arla) described it as "a draconian measure".

Cold calls frozen

Cold calls offering exotic investment opportunities to people cashing in their pension pots will be banned.

Advice services and legitimate companies said such calls had "plagued" the pensions world for years.

The ban, which could be enforced with fines of up to £500,000, will not cover texts and emails.

What we already knew

Announcements in previous Budgets and Autumn Statements include:

The amount people can earn before they are subject to income tax, known as the personal allowance, is currently set at £11,000 and it has already been announced that it will go up to £11,500 in April 2017. The Conservatives have promised to raise this to £12,500 by 2020-21 and increase with inflation after that

The launch of a new Lifetime Individual Savings Account (LISA) for those aged between 18 and 40 to open from April 2017. They can save up to £4,000 a year, and the government will add a 25% bonus if the money is used to buy a home or as a pension from the age of 60

The start of a gradual process in April 2017 allowing people to pass on property to their descendants free from some inheritance tax

Any family which has a third or subsequent child born after April 2017 will not qualify for Child Tax Credit, which can be more than £2,000 per child. This will also apply to families claiming Universal Credit for the first time after April 2017

A sugar tax on soft drinks, expected by about 2018

From September 2017, parents working more than 16 hours a week and earning less than £100,000 a year will be able to claim an additional 15 extra childcare hours

- Published23 November 2016

- Published23 November 2016

- Published23 November 2016

- Published22 November 2016

- Published23 November 2016