Autumn Statement: Big increase in borrowing predicted

- Published

- comments

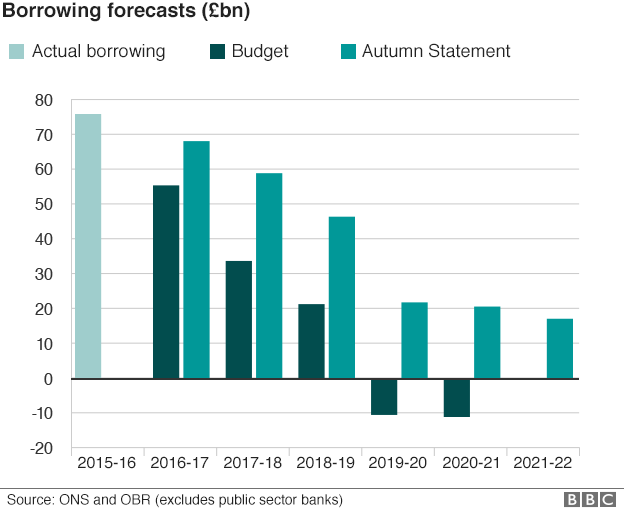

There will be substantial increases in government borrowing in each of the next five years, according to the Office for Budget Responsibility (OBR).

Chancellor Philip Hammond confirmed he would abandon the government target to spend less than it earned by 2019-20.

The OBR predicts it will now borrow £21.9bn that year, compared with the £10bn surplus previously forecast.

Overall, the government will borrow an extra £122bn by 2020-21, half of which the OBR attributes to the Brexit vote.

There has also been a big change in its prediction for the total amount of government debt amassed by 2020-21.

The new total is £1.95 trillion, an increase of £210bn from the £1.74 trillion the OBR predicted in March.

Those figures include the amount of money the Bank of England is borrowing to support the economy via its asset purchase facility (APF).

That money counts as part of national debt, but not as part of the net borrowing figure.

Growth curtailed

There have also been cuts to the expected growth rate in 2017 and 2018.

The OBR expects the economy to grow by 1.4% in 2017, down from the 2.2% it predicted in March, while the forecast for growth in 2018 has been cut to 1.7% from 2.1%.

The growth forecast for this year has been raised slightly to 2.1% from 2.0%.

But Mr Hammond stressed in his Autumn Statement speech that the forecast for 2017 was still equal to the International Monetary Fund's prediction for the German economy and ahead of its forecast for "many of our European neighbours including France and Italy - a fact that will no doubt be a source of very considerable irritation to some".

Instead of trying to balance the budget in 2019-20, the government will instead aim to do so as soon as possible in the next Parliament as part of its new targets.

The OBR warned that there was greater uncertainty than usual surrounding these forecasts, especially for the last two years of the period, because it does not know the terms on which the UK will leave the European Union.

"Our economy forecast is not based on a precise prediction of the outcome of the Brexit negotiations, but rather on broad-brush judgements consistent with a range of possible outcomes," the OBR document said, external.

"We have been given no information about the government's goals and expectations for the negotiations that is not already in the public domain. And we would not in any event wish to base our forecast on assumptions we could not be transparent about."

The lower growth next year is blamed on lower investment and weaker consumer demand "driven respectively by greater uncertainty and by higher inflation resulting from sterling depreciation".

Slowing economic growth is expected to increase unemployment - rising from the current rate of 4.8% to reach 5.5% by the end of 2018.

"This relatively modest increase in the rate equates to around 200,000 more people unemployed," the OBR said.

Much of the slowdown in the economy predicted by the OBR is due to rising inflation as a result of the weakness of the pound.

CPI inflation next year is expected to be 2.3%, up from the previous forecast of 1.6%, while the prediction for 2018 has risen to 2.5% from 2%.

The OBR said that its forecasts were "somewhat less pessimistic" than the Bank of England's predictions from earlier this month and also the Treasury's analysis from before the EU referendum.

The Treasury had predicted that the economy would contract in the first quarter after a vote to leave the EU, although that was based on the assumption that Article 50 would be triggered immediately, starting the process of leaving.

The figures were still too gloomy for some, with Capital Economics saying: "Once some of the uncertainty surrounding Brexit has passed, the economy can still enjoy a few more years of above-trend growth."

But Grant Lewis, from Daiwa Capital Markets, stressed the risks on the downside: "If Brexit turns out to be harder than expected, or the OBR has underestimated the impact of even the soft Brexit it has assumed, then growth will be weaker, and deficits therefore larger, than even included here."

Reduced migration

The OBR unexpectedly included a chapter in its analysis comparing its forecasts with what would have happened to the economy if the vote had gone the other way.

It concludes that the vote to leave the EU will cut growth by reducing migration, slowing the growth of productivity and increasing inflation.

Debt as a proportion of economic output is expected to continue rising until 2017-18, when it peaks at 90.2%.

The forecast was based on a judgement that import and export growth would slow for the next 10 years.

At a news conference, OBR chief Robert Chote said that the government had provided all the information needed to make the forecast, but that when the Treasury had been asked if any assurances had been given to Nissan that could pose a risk to the forecast, it declined to say.

Last month, Nissan announced that it would build two new models in Sunderland following government "support and assurances".

But the government has now said that it has not taken on any new liabilities to persuade the carmaker to stay in the North East of England.

- Published23 November 2016

- Published23 November 2016

- Published17 November 2016