Shenzhen-Hong Kong trading scheme kicks off

- Published

Overseas investors will have access to 900 Shenzhen-listed firms.

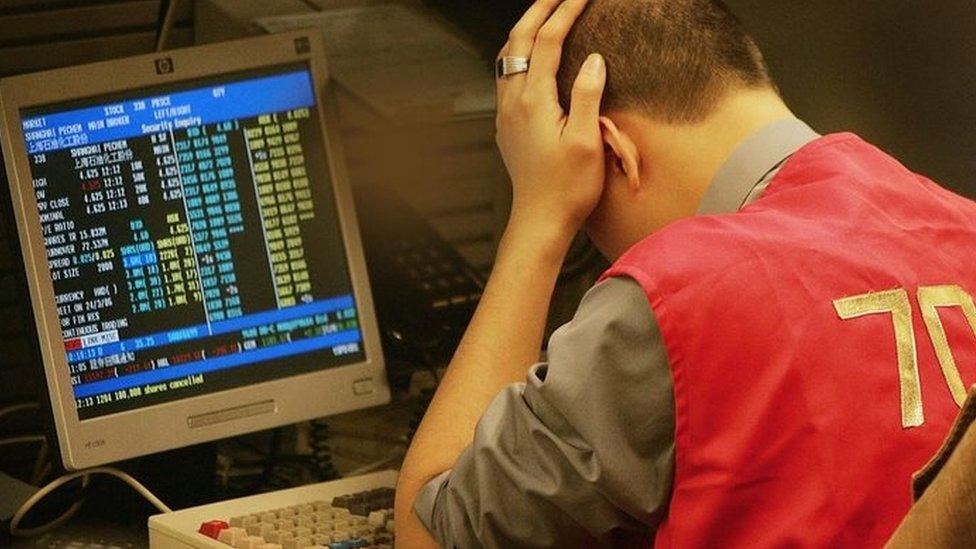

Investors in Hong Kong can buy stocks on the Shenzhen Stock Exchange and vice-versa from today, following the official launch of the Shenzhen - Hong Kong trading link.

The link was supposed to launch at the end of last year, but was delayed due to Chinese market volatility.

Shenzhen has been promoted as a hub for technology and its stock market has been linked to the US-based Nasdaq.

As a result, foreigners will be able to trade shares in almost 900 firms.

Shenzhen is Asia's busiest exchange with monthly turnover of more than $1 trillion, according to the World Federation of Exchanges data.

At the scene: Helier Cheung, BBC News, Hong Kong Stock Exchange

This is being described as a "historic" launch in the Hong Kong media.

Leader CY Leung said the stock link would make the territory "a superconnector between China and the rest of the world".

Hong Kong has traditionally been seen as a bridge for international investors hoping to benefit from China's rise, but experts say the money is now also flowing in the other direction.

Until recently, it had been difficult for Chinese wealth to diversify beyond China's borders, Charles Li, chief executive of the Hong Kong Exchange, told the BBC.

The connect programme "allows Chinese national wealth to be deployed beyond China, and the first thing they can do is come through Hong Kong", Mr Li says.

It also offers opportunities for more international companies to list in Hong Kong, he adds.

Some Hong Kong companies will also benefit from the new link - the Shenzhen connect will offer access to about 100 companies on the Hang Seng Small Cap index - which were not directly available to mainland Chinese investors before.

China has been working on ways to open up its $6.5 trillion (£5.1 trillion) equity markets to foreign investors.

Beijing has also been pushing to have its bourses included in global index providers MSCI but their latest bid was rejected in June.

The link up between Shenzhen and Hong Kong follows the launch of the Shanghai-Hong Kong Stock Connect in November 2014.

It allowed international investors to trade in 568 Shanghai-listed A shares, and 315 Hong Kong stocks.

Hong Kong has benefited from the Stock Connect scheme as mainland investors look to buy overseas assets to counter the weakening Chinese yuan.

- Published15 June 2016

- Published10 November 2014

- Published17 November 2014