Are more interest rate rises ahead?

- Published

- comments

So, the Bank proved it could be a "reliable boyfriend" and did what it suggested it would.

Increasing interest rates became almost inevitable after the governor, Mark Carney, announced on BBC Radio 4's Today programme in September that, if economic growth kept on track, then "you could expect interest rates to increase".

And given that recent growth figures were slightly ahead of expectations, to not act would have been a surprise.

And the Bank of England should rarely be in the surprise industry.

It makes the markets uncomfortable.

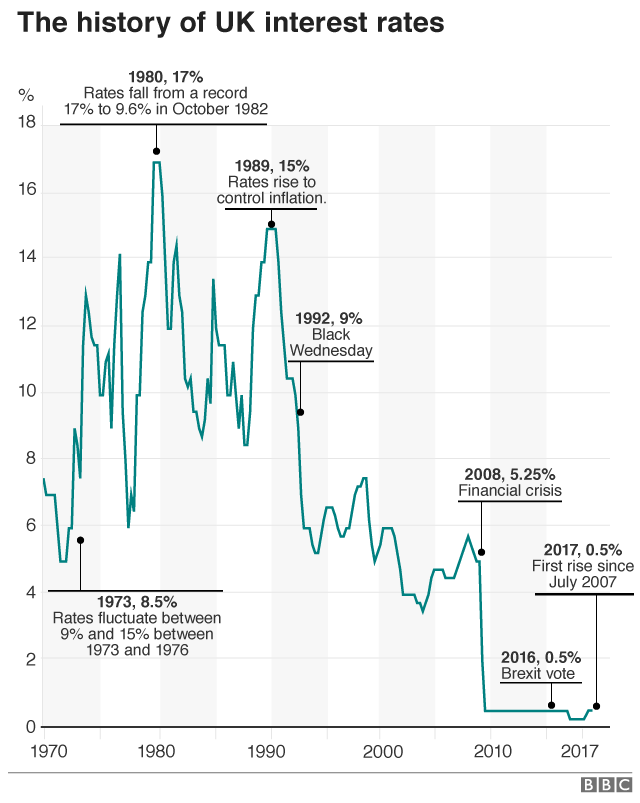

This rise takes the rate back to where it was before the referendum, and at 0.5% is still at low levels historically.

Economic support for the economy from the Bank via asset purchases (quantitative easing) and ultra-low interest rates remains.

The effects of the financial crisis a decade ago still weigh on the economy - and the Bank has again warned that the Brexit process "is having a noticeable impact on the economic outlook".

We still do not live in normal times.

For that reason, the Bank has taken care to signal that any future rate rises will be "gradual and limited".

Inflation easing

The expectation is that rates will rise to just 1%, in two increases of 0.25%, one next year and one in 2020.

The Bank believes that the economy is unlikely to reach pre-financial crisis growth rates anytime soon, if at all.

Yes, inflation is above target - but the Bank argues that the main driver of that is sterling's 18% decline in value since late 2015, with the biggest fall coming directly after the Brexit referendum.

Currency inflation effects tend to push through the economy relatively quickly - sterling's rapid fall leading to an increase in import prices which the Bank says is likely to see inflation peak next month.

It predicts inflation will hit 3.2%, before falling back to the target of 2% over subsequent years.

Although there is some evidence of global energy inflation adding to price pressures - the oil price is up 17% compared with three months ago and global growth is stronger, which can lead to a more general increase in commodity price inflation as demand rises - many of the other price pressures are weak.

Real incomes are still falling.

Productivity is poor.

Growth remains subdued.

Fine margins

Today's rise is a small dab of good news for savers who will see an uptick in the rates they receive on their cash.

But for many millions of others it will mean a rise in the cost of living.

Yes, many will only see a small increase in monthly repayments if they are on a variable mortgage (on average between £10 and £20 a month).

But do not forget that Financial Conduct Authority survey which revealed that many millions of people would find it difficult to find the money to pay an unexpected bill of just £50.

The rise will also generally increase the cost of credit, as it pushes through to the rates banks and other providers charge for people to borrow money - which many millions are doing to make ends meet.

Many households live on very fine economic margins.

The decision by the Bank of England today will make those margins just that little bit tighter.

- Published2 August 2018

- Published2 November 2017