Interest rates: How the MPC voted

- Published

There was quite a change to the voting profile of the nine experts that make up the Monetary Policy Committee (MPC) headed by Bank of England governor Mark Carney.

Five members of the panel changed their position compared with the previous interest rate meeting in September.

Here's the full list of who voted and how.

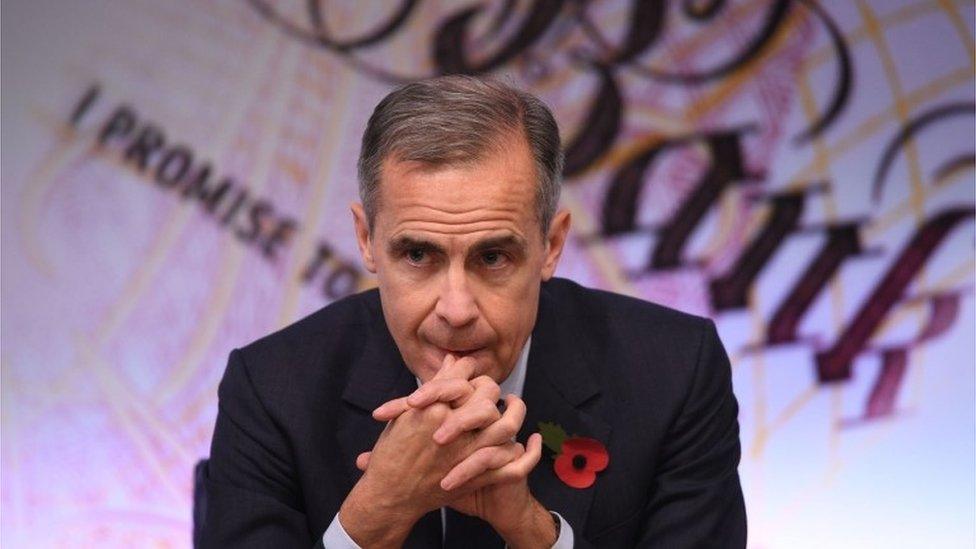

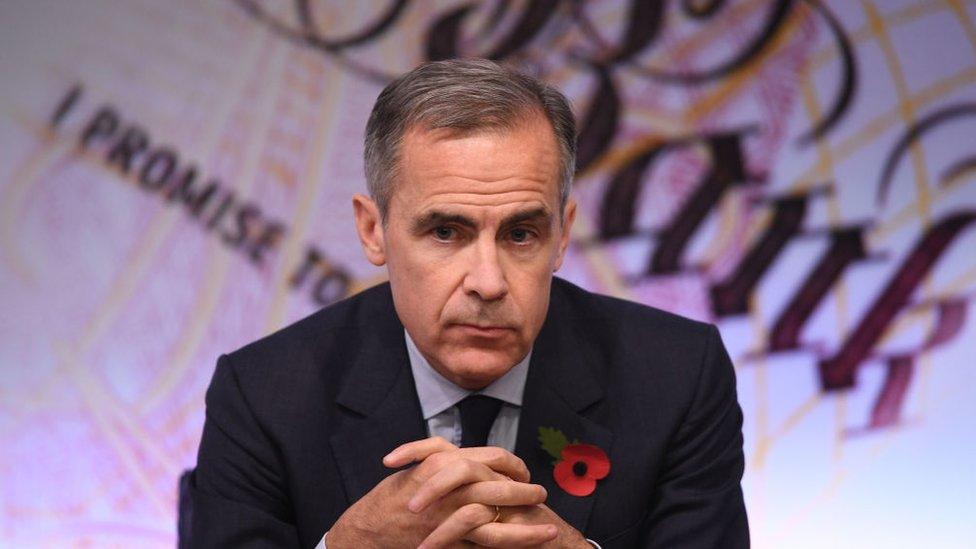

Mark Carney, Bank of England Governor

In late September Mr Carney hinted that he might be inclined to raise interest rates, having previously voted to keep them on hold. But Mr Carney has hinted at interest rate increases in the past, but then not voted for them, which has earned him the nickname "unreliable boyfriend". This time he did make the switch.

Ben Broadbent, Deputy Governor of Monetary Policy

Mr Broadbent switched his position to support a rate increase. Always measured with his words, it has been hard to discern his position. But he is seen as a strong supporter of the Bank governor.

Andy Haldane, Chief Economist

Mr Haldane said in June that the Bank needed to "look seriously" at raising interest rates. So his decision to support a rate rise is not a big surprise.

Silvana Tenreyro, external MPC member

Ms Tenreyro was only appointed to the MPC in June. She voted to keep rates on hold in September, but has switched.

At her appointment hearing in October she said that if slack continued to disappear within the economy then she would be "minded" to vote for an increase.

Gertjan Vlieghe, external MPC member

Mr Vlieghe also changed his view. In September he said: "We are approaching the moment when Bank Rate may need to rise".

Those five were joined by two MPC members who had previously voted for an interest rate increase.

Ian McCafferty, external MPC member

Mr McCafferty has voted for rate increases frequently over the last few years. In July, he said that an interest rate increase would be the "prudent thing to do".

Michael Saunders, external MPC member

Mr Saunders has been voting for a rate increase since June. In August he said "a modest rise" in interest rates was needed to curb high inflation.

Sir Jon Cunliffe, Deputy Governor, Financial Stability

Two members of the MPC voted to keep interest rates on hold. Sir Jon was one of them.

Minutes from the latest meeting showed that he and Sir Dave Ramsden argued that there was a lack of evidence that wage growth was accelerating at a significant pace.

Last month he said he did not see "sustained signs of domestic inflation pressure"., external

In an interview with BBC Radio Wales he said that the timing of possible future interest rate increases as an "open question".

Sir Dave Ramsden, Deputy Governor, Markets and Banking

Sir Dave was the other MPC member who voted to keep rates on hold. Speaking to MPs on the Treasury Committee last month, he said he did not believe a rate rise would be needed "in the coming months" because wage growth showed few signs of picking up.

- Published2 November 2017

- Published2 August 2018

- Published2 November 2017

- Published2 November 2017