Interest rate rise to cause 'some pain', says bank deputy

- Published

- comments

Ben Broadbent is the bank's deputy governor for monetary policy

The rise in UK interest rates will cause "some pain" for homeowners, but should be kept in context, a Bank of England deputy governor has said.

Ben Broadbent told the BBC that the rate rise announced on Thursday was "moderate", and that interest payments on debt were still at record lows.

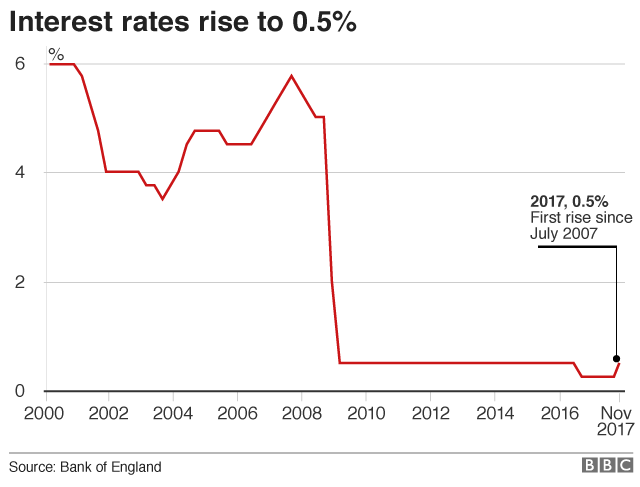

The Bank raised rates from 0.25% to 0.5%, the first hike in 10 years.

Mr Broadbent also said that the Bank's signal of two more rate rises in the next three years was "not a promise".

Almost four million households face higher mortgage interest payments after the rate rise.

Households on variable or tracker mortgages will see their monthly costs increase by about £15, according to Nationwide.

Savers will see a modest lift in their returns, although Barclays, HSBC and Lloyds are yet to announce if they will pass the full rise on to customers.

'Pain'

Asked if households - already seeing inflation outpace wage growth - would suffer some "pain" from the rate rise, Mr Broadbent agreed they would.

But he told BBC Radio 4's Today Programme: "I think one should keep the scale of this in context."

Not all home owners have variable mortgages, and interest payments on debt are "lower than they've ever been relative to income", he said.

Virgin Money chief executive Jayne-Anne Gadhia, was also reassuring.

She told the Today programme: "People shouldn't worry - I don't think that credit card rates will go up. It's not quite so directly associated with the bank rate as mortgages are.

"I think that what this particular base rate increase does is just say to customers be thoughtful about what you're spending and manage your own financial position well."

Two more

Mr Broadbent was one of seven members on the Bank's nine-person Monetary Policy Committee to vote for a rate rise.

He said he had changed his mind because of rising inflation and unemployment hitting record lows.

Bank governor Mark Carney signalled on Thursday that rates were likely to rise twice more over the next three years.

Mr Broadbent repeated that prediction, saying the rises could be needed to "get inflation back on track while at the same time supporting the economy".

But he added: "That is not a promise, and it never could be a promise."

The Bank estimated in its Quarterly Inflation Report, released with the announcement on rates, that inflation was likely to peak this month at 3.2%.

- Published3 November 2017

- Published2 August 2018

- Published3 November 2017

- Published2 November 2017

- Published2 November 2017

- Published2 November 2017