Your questions about interest rates answered

- Published

Are you ready for an interest rate rise?

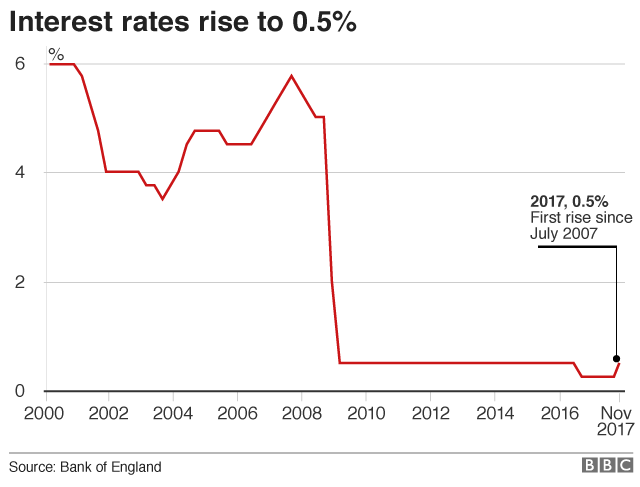

The Bank of England has raised interest rates for the first time in more than a decade.

The official bank rate has been lifted from 0.25% to 0.5%, the first increase since July 2007.

While the move was widely expected, it will affect millions of households on mortgages and savings.

We asked our BBC Personal Finance Correspondent Simon Gompertz to answer your questions.

1. The pound has fallen, loan interest costs will rise and saving rates will stay the same. Other than the banks and loan sharks, who actually benefits from this rise?

Yes, variable rate loans will rise, but fixed rate mortgages, for instance, will stay the same. We are still waiting to hear what the big banks will do with their savings rates, but some players have already said they will put some of their rates up, including Nationwide, TSB and Yorkshire Building Society. What happens to the pound will depend on further interest rate rises and how quickly people in the financial markets believe they will arrive.

We challenged some ten year olds to explain a system that baffles many adults…

2. What will be the effect on house prices?

Higher interest rates lead to higher mortgage costs for some people in the short run and most people in the long run. And in the past that has had the effect of holding back house prices. But this base rate increase is comparatively small, so it's not clear whether it will have much impact.

3. I don't understand how raising interest rates, which will make everything more expensive, controls inflation? Surely it contributes to that very thing?

That's a good point, especially if you include the cost of mortgages in your measure of inflation - though mortgages are not part of the Consumer Prices Index or CPI. What central banks tend to think is that inflation happens when an economy is growing too fast, because firms can put up prices for their goods and people still buy them. The theory is that by raising interest rates you leave people and businesses with less money to spend.

4. Will there be an automatic increase in tuition fees or repayments if there's an interest rate increase?

Current tuition fee interest is inflation (the RPI measure) +3%, so it's not affected by base rate changes.

You may also like:

5. How is this likely to affect the strength of the pound? Will we pay more on our mortgage in exchange for benefits elsewhere?

The pound fell, partly because of hints from the Bank of England that further increases in base rate might be pretty slow in coming. The suggestion was the rate might reach 1% in 2020. The pound's value tends to be affected by investors' judgements on whether they'll receive a good return if they keep their assets in sterling investments.

6. How long before we get back to the 6% norm? Good for savers, investors, strength of the pound and for dampening inflation and house prices!

You will struggle to find many people expecting a 6% base rate any time soon. But it's not impossible. Ten years ago you might have been laughed at for saying a 0.5% rate was on the way. The biggest factor is what happens to inflation. High inflation tends to mean high interest rates.

7. I'm on a fixed rate mortgage deal that's going to end in 18 months. Will the expectation of further increases over the course of my next term be priced into my deal when I renew? Should I plan for my rate to go up significantly?

Interest rate expectations are always priced into fixed rate deals. The lenders tend to cover themselves against the risk of rates going up or down by doing their own deals in the wholesale money markets - and the prices there depend on dealers' predictions (or bets) on what will happen. The signs are that rates will go up more, but the Bank of England seems to be steering us away from expecting big increases.

8. I would like to know that back before the crash mortgage rates followed just above the base rate, hence when there was a move mortgage rates followed. Why then when the rate plummeted to 0.25% mortgage rates held at about 3.5%. Another case of getting ripped off?

Tracker mortgages move in line with Bank base rate but not Standard Variable Rates, or not necessarily. Some SVRs are over 5%. It's something borrowers need to watch like hawks.

- Published3 November 2017

- Published3 November 2017

- Published2 August 2018