Budget 2017: Hammond must be cautious, say nervous investors

- Published

- comments

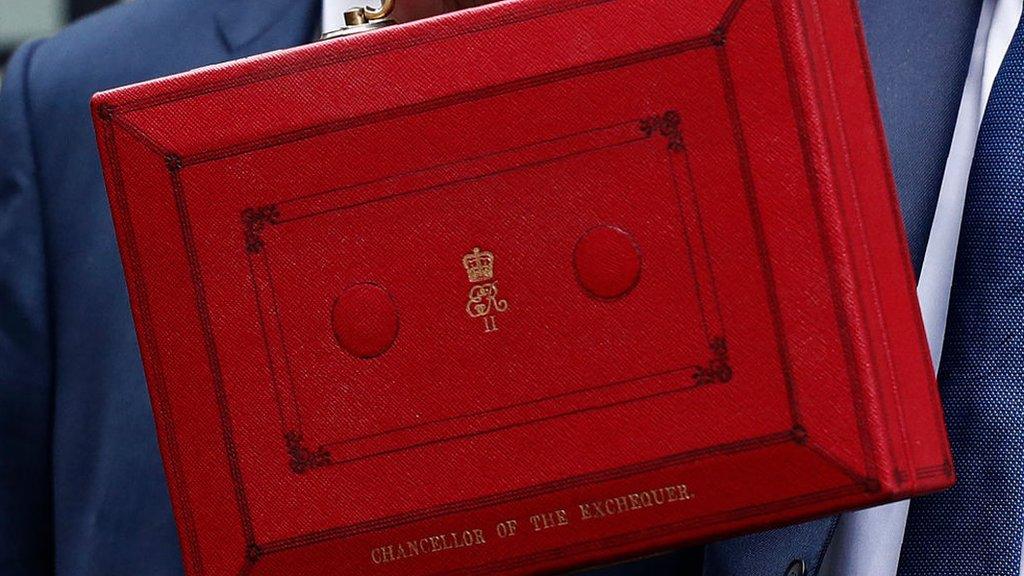

The chancellor has been urged to deliver a "cautious" Budget or risk alienating investors.

Rupert Harrison, former chief of staff to George Osborne, said that Philip Hammond should not radically change strategy by increasing borrowing significantly.

Mr Hammond is under pressure to be "big and bold" in the Budget which he will deliver at 12.30pm.

He will say that he is "optimistic" about the future of the UK economy.

But with a major downgrade expected to productivity - the ability of the economy to create wealth - his room for spending giveaways will be limited.

Mr Harrison told the BBC that with Brexit uncertainty and nervousness about the direction the UK economy is heading, the markets would be keener on a "steady as she goes" message.

"You don't want to surprise the world by saying we're embarking on a new strategy, we're going to borrow lots of money, raise taxes," he said.

"I think in a moment when the world has got some question marks about the UK anyway, it's time for a bit of consistency and a bit of patience."

Rupert Harrison is now a senior figure at BlackRock, one of the largest investment firms in the world with over £4 trillion of funds under its control.

The government relies on international investors to fund its deficit, the difference between what it spends on services and receives in taxes.

And the cost of servicing that debt is rising as inflation (a lot of government debt is linked to the rise in prices) and interest rates rise.

Room to manoeuvre

Mr Harrison said that the chancellor did have some limited wriggle room.

"If we look at the big picture, back in 2010, we had a budget deficit of 10% of GDP [the country's Gross Domestic Product, or national income]," he said.

"That was very high and I think a risk to economic stability. It needed to be dealt with [and] that deficit is now just 3% of GDP."

He added: "That means that it's not an urgent immediate issue - the chancellor has a little bit of wriggle room to maybe spend a little bit more on infrastructure, a little bit on housing.

"But I don't think he should abandon the longer-term ambition to keep the public finances under control and start getting our debt down, because in the end the UK is still vulnerable."

It is expected that the Office for Budget Responsibility - the official economic watchdog - will downgrade its forecasts for growth and productivity when it publishes its economic outlook report alongside the Budget.

Lower productivity means the economy expands less quickly and the government receives less in tax revenues and may have to borrow more.

It also means that people are less likely to receive higher wage increases.

He believes his "fiscal rule" - a promise to balance the government's public finances by 2025 - is vital to investor confidence in the UK economy.

But, with borrowing slightly lower than expected, Mr Hammond is expected to announce a major package of support for new housing as well as more spending on infrastructure such as digital broadband and 5G mobile.

It is possible he will also announce more spending on health, although it is unlikely to be the £4bn demanded by the chief executive of the NHS, Simon Stevens.

Strong and stable?

There have been calls to reverse corporation tax cuts, which are due to fall to 17% by 2020.

But that would appear to be a direct contradiction of a pledge in the Conservative election manifesto to "stick to the plan" to cut the tax.

Mr Harrison said that halting further cuts to business taxes might be possible: "But I think you need to be careful about the signals you send if you put it up".

"I think there's much more nervousness about the UK than there was around the world," Mr Harrison said.

"We used to be seen as a very predictable, reliable, business friendly place to come to do business and to invest, I think people are now starting to question that [and are asking] what is it the UK really wants?"

He said that people do not really understand the whole Brexit process which he said has raised the level of uncertainty.

"So I think that puts a premium for the UK government on trying to signal as much certainty as it can, trying to reduce that uncertainty, set out a clear strategy," Mr Harrison said.

"The next time we have an economic downturn, with high levels of debt, a big banking system, it's a question of how much patience do we have to really put ourselves in the best possible position for the future."

He said: "I think financial markets wouldn't punish the UK in the short term if there was a little bit more spending on infrastructure, if there were good projects that could be shown to produce good economic returns.

"I think where there would be more concern is if there was a sense that the UK government was essentially abandoning its ambitions to deal with the public finances longer term."

- Published22 November 2017

- Published22 November 2017