Corporate leaders scrap shareholder-first ideology

- Published

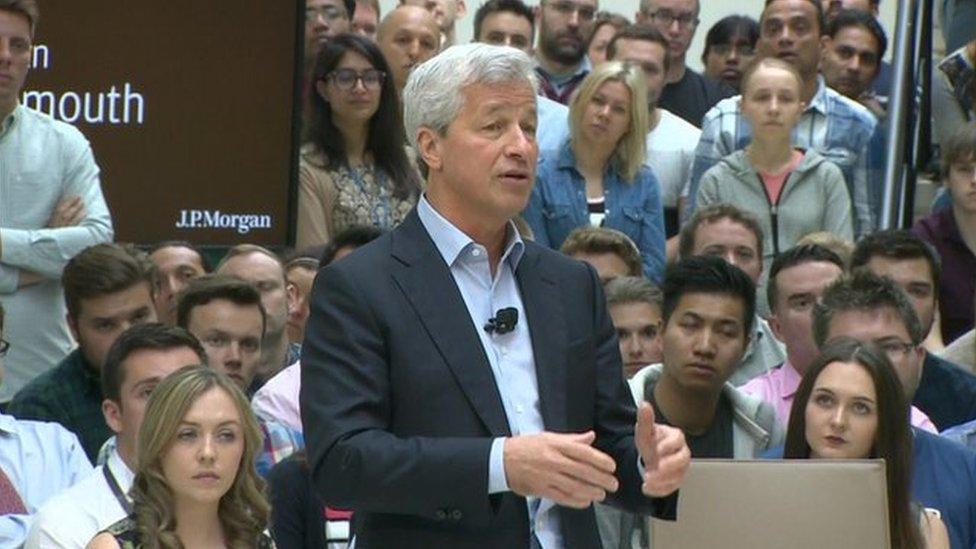

Jamie Dimon, head of banking giant JP Morgan, chairs Business Roundtable

One of the US's most powerful business groups has abandoned the shareholder-first idea that has driven capitalism for decades.

The Business Roundtable said the pursuit of shareholder interests is no longer the central purpose of corporate America.

Companies should focus on social responsibilities as well as profits, the organisation said.

Business Roundtable members include some of the biggest firms in the US.

A statement released, external on Monday, titled Business Roundtable Redefines the Purpose of a Corporation to Promote "An Economy That Serves All Americans", was signed by the heads of more than 180 US companies. These included the chief executives of Amazon, American Airlines, and America's biggest bank, JPMorgan Chase.

The statement marks the first time the nearly 50-year-old group has said shareholder value is not the first priority. Shareholder primacy was an ethos championed by Nobel Prize-winning economist Milton Friedman and has been the foundation of corporate purpose.

The new mission statement comes at a time when companies are increasingly taking stances on issues outside of the corporate sphere due to pressure from activists amplified by social media and demands from their own employees.

The statement outlines five priorities, including commitments to invest in employees by providing fair wages and "important benefits," support communities where they operate and dealing ethically with suppliers.

'American dream fraying'

"The American dream is alive, but fraying," said Jamie Dimon, chairman and chief executive of JPMorgan Chase, and chairman of Business Roundtable.

"Major employers are investing in their workers and communities because they know it is the only way to be successful over the long term. These modernized principles reflect the business community's unwavering commitment to continue to push for an economy that serves all Americans."

Johnson & Johnson chief executive Alex Gorsky added: "This new statement better reflects the way corporations can and should operate today. It affirms the essential role corporations can play in improving our society when CEOs are truly committed to meeting the needs of all stakeholders."

Other signatories include General Motors' boss Mary Barra, Ford's Jim Hackett, and Apple's Tim Cook.

But some critics were sceptical, with Larry Summers, who served as US Treasury secretary under President Bill Clinton, saying there was no legal requirement on firms to change their approach.

He told the Financial Times, external: "I worry the Roundtable's rhetorical embrace of stakeholders is in part a strategy for holding off necessary tax and regulatory reform."

- Published30 June 2019