How do you work out what something is worth?

- Published

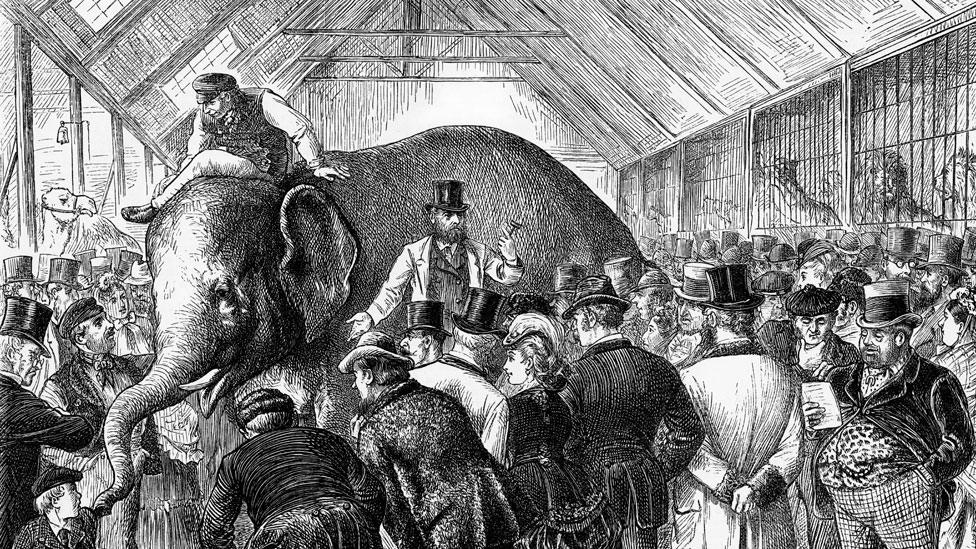

Throughout history, auctions have sold everything from animals to property and slaves

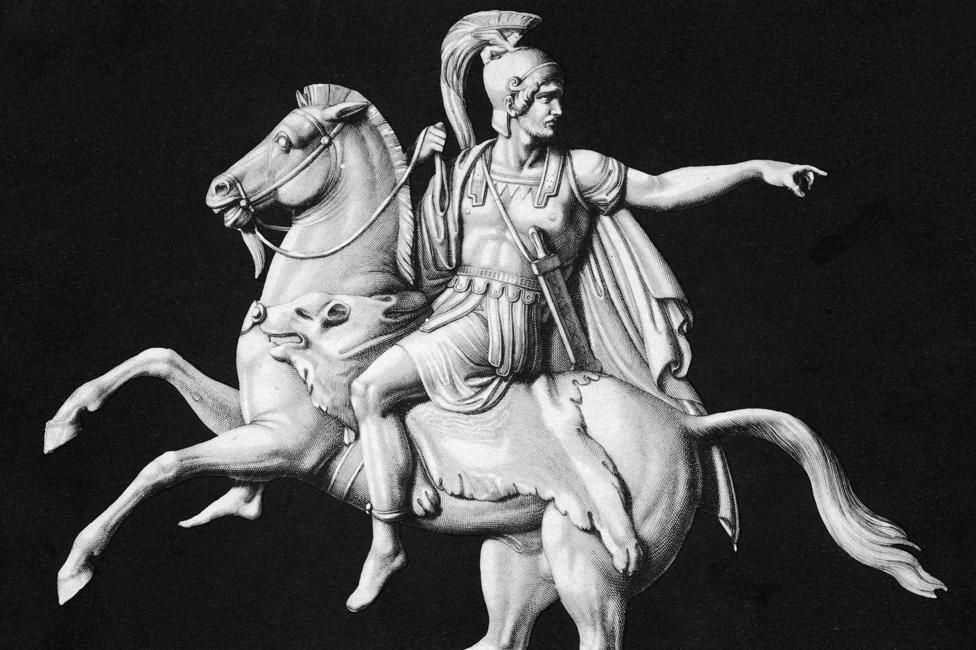

In the year 211BC, Rome and Carthage were engaged in a long war that was to shape the ancient Mediterranean.

The North African general Hannibal had vanquished Roman legions at will. As the Romans regrouped and began to fight back, Hannibal decided on a bold plan: he would march on Rome itself.

Although he had little chance of breaching the city's defences, he hoped the Romans would panic and recall their armies.

Hannibal swore his enmity to Rome as a child

Hannibal set up camp on the banks of the Anio, three miles from the city, but quickly learned that the land on which he had pitched his tent had been sold for a reasonable price via a public auction, external. Rome had seen through the bluff.

If the city rulers were willing to trade at full price the land underneath Hannibal's army, they did not expect his army to linger. It did not: Hannibal withdrew in short order.

This may be the only example of an auction being used as an attack on enemy morale, but it is not the first recorded auction.

For example, 300 years earlier, Herodotus describes men bidding for the most attractive wives in Babylon.

"The rich men who wanted wives bid against each other for the prettiest girls, while the humbler folk, who had no use for good looks in a wife, were actually paid to take the ugly ones."

Problematic, yes - but ingenious. This auction was a community affair in which funds raised from the high bidders were used to compensate the poorer men.

50 Things That Made the Modern Economy highlights the inventions, ideas and innovations that helped create the economic world.

It is broadcast on the BBC World Service. You can find more information about the programme's sources, external and listen to all the episodes online or subscribe to the programme podcast.

Auctions seem to be almost as common as the marketplace itself.

You can imagine the idea being endlessly rediscovered around the world, whenever some trader offered to pay three obols per jar for a shipment of olive oil and the man next to him said: "Don't take that offer - I'll pay four".

From such simple moments evolved the theatrical event we call the "open outcry" auction - a room full of art or antique dealers, millionaire backers submitting bids by phone, and a dapper auctioneer tickling the whole process along.

Auctions can take many forms

Going once, going twice... gone.

By making clear what others are prepared to pay, such auctions make it hard for the unscrupulous to exploit the gullible.

In the early 19th Century, British traders used auctions to offload large volumes of inexpensive British products in the United States. American consumers were delighted, but American merchants like Henry Niles were outraged.

"[Auctions are] the grand machine by which British agents at once destroy all regularity in the business of American merchants and manufacturers," he declared.

An anti-auction committee lobbied Congress, declaring: "Auctions are a monopoly and like all monopolies are unjust, by giving to a few that which ought to be distributed among the mercantile community generally."

That was special pleading - the "mercantile community" just wanted to preserve its mark-ups.

Yet there is an important grain of truth in the complaint. In any auction, the sellers want to be where the buyers are and the buyers want to be where the sellers are. That makes auctioneering a natural monopoly - there is always a risk that large auction venues abuse their market power.

While the open-outcry auction is the most famous kind, there are many other ways to design an auction.

The 17th-Century diarist Samuel Pepys describes an auction "by an inch of candle", which ended when the flame of the candle stub flickered out. The unpredictability of this moment was intended to prevent people from using the unpopular tactic of submitting a winning bid at the last second.

A candle auction is still used to sell the rights to a piece of land in Aldermaston, UK, every three years

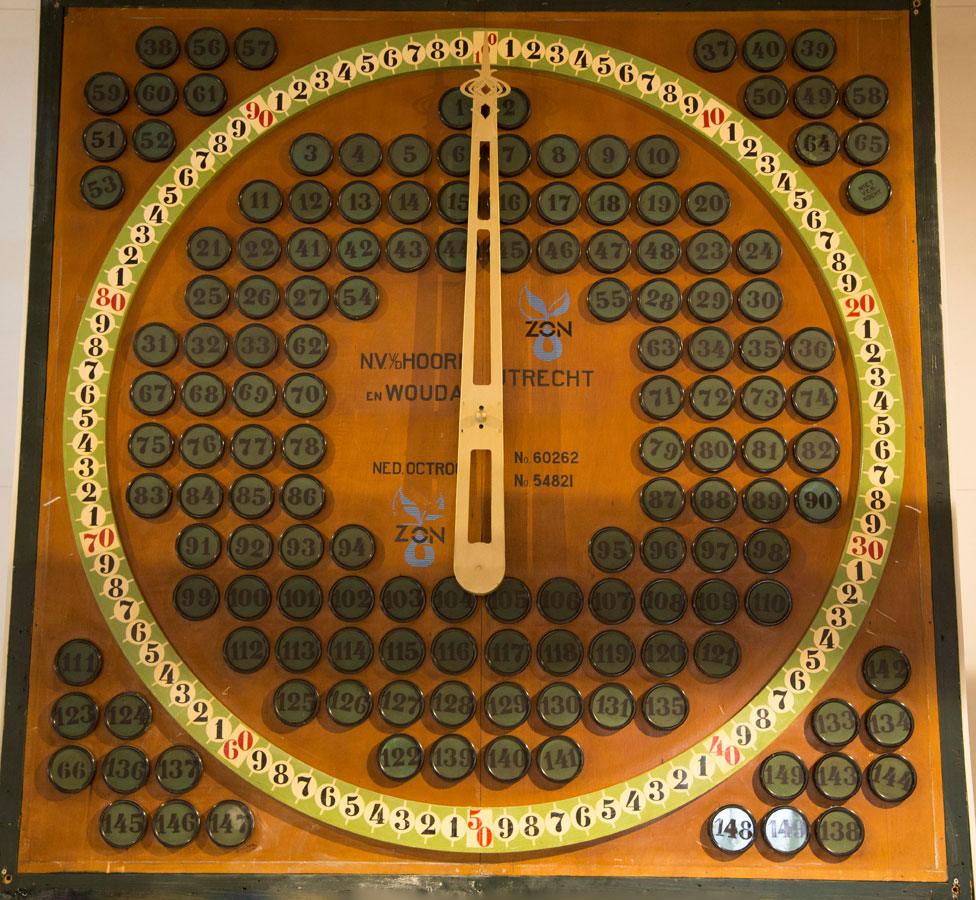

If not by candle, what about an auction by clock?

The "Dutch clock auction" is used at the vast flower market of Aalsmeer, with the clock face showing not the time, but the price.

That price ticks down and down, until somebody stops the clock by pressing a button. Whoever stopped the clock buys the flowers at the price specified.

At first glance, the method could hardly be more different from an open outcry auction. But in fact the fundamentals are not so very different - and they make the process even faster, as befits a product that will quickly wilt if it cannot be sold and shipped.

Then there is the sealed-bid auction, beloved of estate agents: write down your bid, slip it into an envelope and seal it tight. Highest bid wins the prize.

But here's a curiosity: under the surface, the sealed-bid auction is exactly the same as the Dutch flower clock auction.

In each case, you simply need to pick your price. Unlike in an open outcry auction, you'll learn nothing about anybody else's willingness to pay until it's too late.

The Nobel laureate economist William Vickrey produced a famous theorem demonstrating that under ideal conditions, all auctions can be expected to raise the same amount, external of revenue.

Like any economic theorem that oversimplifies the case.

Auction details can matter a lot - if an auction opens up a loophole for cheats, or discourages bidders from bothering, it can fail badly.

More things that made the modern economy:

One might ask why auctions are used in some circumstances, while in other cases sellers post a take-it-or-leave-it price? Your local supermarket, for example, does not auction off the cabbages.

The answer is that auctions come into their own when nobody is quite sure of the value of what is being sold.

Second-hand products sold on eBay are an obvious example, but there are many others: a permit to drill for oil in unexplored terrain, a painting by Leonardo da Vinci, or a licence to use radio-spectrum to provide mobile phone services.

This common resource - the radio spectrum - used to be handed out to favoured companies for trivial sums. Now governments auction it off for billions.

Another example is the complex type of auction run by the US Forest Service for the right to conduct logging and remove timber.

The US Forest Service makes about 49 million acres of forested land available for timber harvest

These "incredibly exciting" auctions have been extensively analysed by Susan Athey, external, the first woman to win the prestigious Bates Clark Medal in economics. In particular, she and colleagues have explored the importance of the private information held by bidders in shaping the bids made and final prices paid.

After all, in each of these cases, the true value of the item for sale is unknown.

Each bidder makes use of their own information. The auction brings together all of that data, and transforms it into a price to be paid. It is quite a trick.

And it is something the Romans understood when they reported the results of their auction to tell Hannibal that they were not scared.

While auctions may seem reassuringly old-school, they take place at the cutting edge of the modern digital economy, and not just because of the success of internet auction sites like eBay and eBid.

Think about what happens when you type a search term into Google.

Alongside your search results, you'll see advertisements. Those adverts are there because they have won a complex and largely invisible auction, external.

This auction assigns them more or less prominent positions depending both on their maximum so-called "cost-per-click bid" - how much money a company has offered to pay Google for every person who clicks on its advert - and on how good the algorithm thinks the advert itself is.

For example, an art dealer might offer a high fee to appear next to searches for "Picasso", but an advertiser selling Picasso posters might expect many more clicks - and win top spot in the auction for a lower per-click bid.

EU competition commissioner Margrethe Vestager has criticised Google for abusing its advertising dominance

These auctions take place every time someone types a search into Google, and their scale is unnerving. Google's parent company, Alphabet, makes more than $2bn (£1.56bn) profit every month. Most of that is from advertising, and most of the advertising is sold by auction.

In 2019 Google was estimated to have taken more revenue from advertising than its two biggest rivals, external - Facebook and Alibaba - combined.

Often you see an advert for Google's own products. Is it a problem that Google bids in its own auctions?

It is hard to be sure. You can imagine how any company might benefit from intimate knowledge of its rivals' strategies in bidding for ad space, though Google insists it gets no unfair advantage from its dominant market position.

Henry Niles, the anti-auction activist, would no doubt have had something to say about that.

The author writes the Financial Times's Undercover Economist column. 50 Things That Made the Modern Economy is broadcast on the BBC World Service. You can find more information about the programme's sources, external and listen to all the episodes online or subscribe to the programme podcast.

- Published19 June 2019

- Published20 March 2019

- Published11 October 2018

- Published14 January 2015

.jpg)

- Published12 October 2014

- Published13 December 2010