Robots to take on more supermarket tasks

- Published

Analysts forecast rising demand for automated warehousing and picking facilities

The next time you pack your bags at the supermarket checkout, give yourself a small pat on the back.

A task which is so simple for humans - quickly and efficiently packing a bag of groceries of different sizes and shapes without crushing anything - is something that until recently has been beyond the abilities of robots.

It requires vision systems to locate the produce, a flexible and strong hand to grab items and a sophisticated artificial intelligence which knows that a carton of eggs should not be stacked under a four-pint bottle of milk.

It is a problem that James Matthews, the chief executive of Ocado Technology (part of the Ocado Group) is wrestling with in the warehouses that handle online orders.

The company has a sophisticated warehouse in Erith in east London, which is already highly automated.

Ocado's James Matthews: "How we pack is critical to the economics of our business"

Hundreds of robots zip around a grid, collecting groceries and bringing them to a member of staff who will pack them into boxes, which are then loaded on to trucks for delivery.

"We're typically picking say 50 different items of different shapes and sizes, and how dense we pack them is absolutely critical to the economics of our business.

"If we put one thing per box on the road, then we're going to use a lot of vans very inefficiently."

Ocado sell its system to supermarkets all over the world, but those customers are demanding ever greater efficiency, so training robots to pack the bags would make economic sense.

The company had already been working with five robotic arms at the Erith warehouse,

"It's a very challenging space. It's not one where you can plot a very direct path to a solution there. Some of this stuff is still warm from academia," says Mr Matthews.

But now the process is accelerating with two big acquisitions. Ocado is paying $262m (£198m) for Kindred Systems, a San Francisco-based firm that makes a robotic sorting systems.

In addition, it is buying Las Vegas-based Haddington Dynamics for $25m (£19m) which makes lighter-weight, and highly sensitive robotic arms.

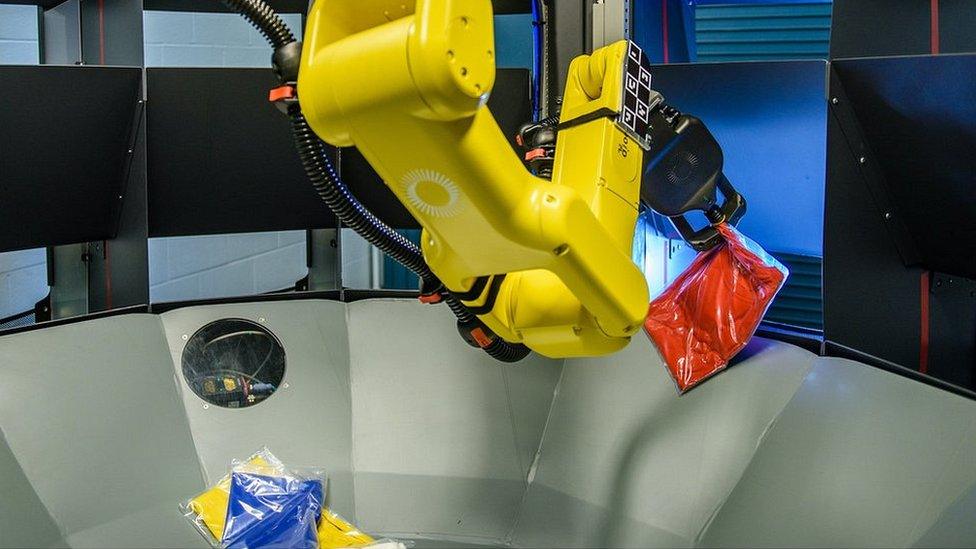

Kindred's sorting system is already used to pick products in clothing warehouses, including some owned by Gap.

Kindred Systems robots already help assemble customers' orders in clothes warehouses

Mr Matthews thinks this tech can be adapted and developed for the grocery sector.

"The two systems, we now intend to bring together. It will have some of our machine learning models that is very specific to grocery problems, and it will have some aspects of the Kindred platform that they've gone much deeper on."

In particular, Kindred is more advanced on tele-operation, or supervised autonomy, which is where humans monitor and control multiple robots remotely.

"They [Kindred] can watch hundreds of these robots. And in the very small percentage, but critical moments, when the robot needs some help, they can provide that remote system very, very effectively."

So over the next year Ocado will be training the artificial intelligence used by Kindred, on grocery products.

The company hopes to have a robot that can replace human pickers within two or three years, but people will not be completely replaced.

"I think we are going to see an acceleration of the deployment of automation in the next three to five years. And so that's going to take a big bite out of those manual tasks. But I suspect in 10 years, there's still going to be a sizable portion of activities that are human led," says Mr Matthews.

Haddington Dynamics makes a lightweight robot arm

Mr Matthew is less forthcoming about the way Ocado plans to use technology from Haddington Dynamics, the maker of lightweight robotic arms, which can move very precisely.

"We've got some interesting, somewhat 'secret squirrel' use cases where lighter is a big play," he says.

Mr Matthews is not giving much away, but says there is a limit to what a robotic arm can do if it just uses cameras to sense objects - imagine packing a bag if you could only use your eyes and not feel the products.

Haddington's robotic arms are highly sensitive, so Ocado is researching how they might be integrated into the warehouse system.

There's little doubt that the demand for such technology is only going to grow.

Back in July the chief executive of Ocado Group, Tim Steiner said: "The world as we know it has changed.

"As a result of Covid-19, we have seen years of growth in the online grocery market condensed into a matter of months; and we won't be going back."

Analysts say that means supermarkets will have to upgrade their systems.

"I think that what the pandemic has showed is that the infrastructure that retailers had in place for moving in the e-commerce world, really failed spectacularly," says Miriam Burt, managing vice-president at the research firm Gartner.

In particular she points to the so-called "last mile" - the picking, packing and delivery of groceries.

"It's very difficult to do last mile fulfilment profitably, partly because most of it is human labour," she says. So technology from the likes of Ocado will be in high demand.

Ocado already uses lots of warehouse robots, and plans to use even more of them in future

However, rivals like Norway's AutoStore and US-based Takeoff will also be looking to take market share.

"Companies everywhere will up their game - both those that will want to use Ocado and those that will want to compete with it," says James Lockyer, a technology analyst at Peel Hunt, in a recent research report.

"It doesn't surprise us that there is more noise from start-ups trying to take on Ocado at its own game, such as Takeoff. However, that does not take away from Ocado's chances of being the global leader."

In time, Mr Lockyer sees Ocado expanding beyond groceries.

"From vertical farming, to automation of fresh food delivery fulfilment, to the robotic meal prep of ready-to-eat meals, Ocado Group could actually end up revolutionising the entire supply chain."