State pension age crucial for lower earners

- Published

- comments

Low earners are more likely to keep working for longer when the state pension age rises, a report has concluded.

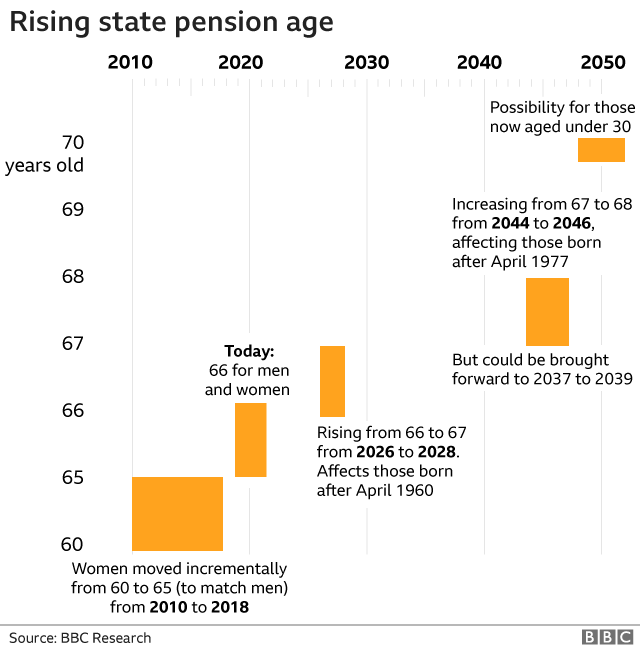

The age at which people are entitled to claim the state pension rose from 65 to 66 between 2018 and 2020.

Researchers at the Institute for Fiscal Studies (IFS) found employment rates at 65 rose faster in less affluent areas.

Campaigners say the findings should be considered amid plans to raise the state pension age further.

The IFS said that in the most deprived fifth of areas, the employment rate for women aged 65 rose from 15% to 28%, and from 24% to 34% for men.

In the most prosperous areas, employment rates at age 65 rose more gently, from 23% to 27% for women and from 38% to 43% for men.

This almost certainly reflected the greater need for income at older ages among those living in poorer areas, the IFS said.

Jonathan Cribb, an author of the report, said: "The sharp increases in employment have come in particular from those in poorer areas, and for those who have lower levels of education, suggesting that without a state pension they cannot afford to retire."

In general, more than nine in 10 people aged 65 did not change their plans to keep working or not at the age of 65 purely because of the higher state pension age.

That was because most had either stopped working earlier, or had always had plans to work beyond state pension age. Some were unable to work for health reasons.

Emily Andrews, deputy director for evidence at the Centre for Ageing Better, which funded the research, said there should be "meaningful support" to help workless people in their 60s get back into paid work.

At present, the age at which people are eligible for the state pension is set to be raised to 67 by 2028, and then eventually to 68 - although there have been calls for a reconsideration.

In December, the Department for Work and Pensions (DWP) announced that the next review of the state pension age would start, headed by Baroness Neville Rolfe.

"The government needs to make sure that decisions on how to manage its costs are, robust, fair and transparent for taxpayers now and in the future. It must also ensure that as the population becomes older, the state pension continues to provide the foundation for retirement planning and financial security," the DWP said.

Related topics

- Published20 December 2021

- Published18 January 2022

- Published12 October 2021

- Published6 October 2020

- Published7 September 2021