Corporation tax: Jeremy Hunt confirms rise to 25% from April

- Published

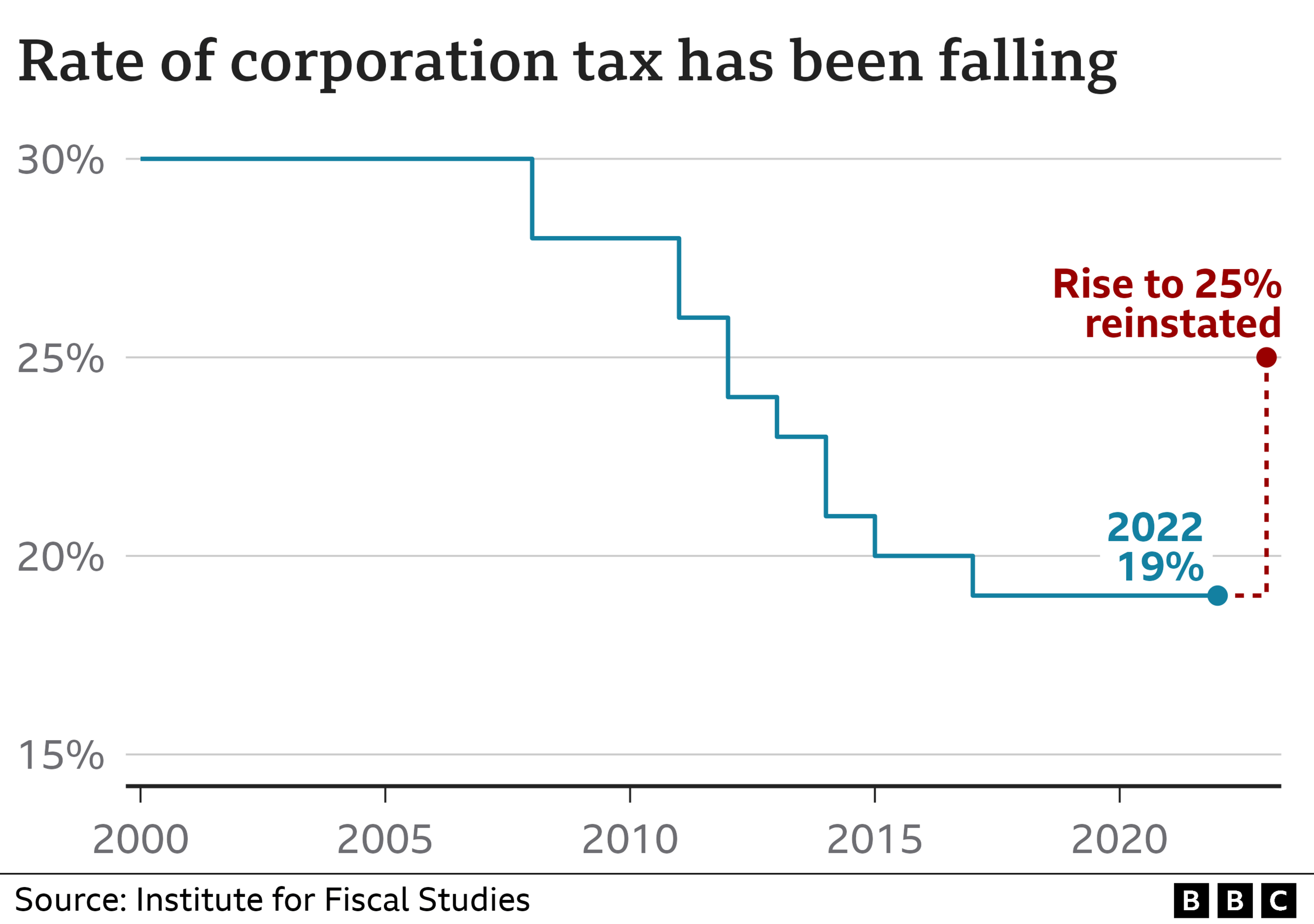

The rate of corporation tax, paid on company profits, will rise next month, the chancellor has confirmed.

It will go up from 19% to 25% for companies with over £250,000 in profits, Jeremy Hunt told the Commons.

He also announced a new scheme to allow every pound invested by businesses in IT equipment, plants or machinery to be deducted in full from taxable profits.

The tax hike, first announced in 2021 when Rishi Sunak was chancellor, has been a source of much political debate.

Ex-PM Liz Truss attempted to scrap the policy in her mini-budget last September and some Conservative MPs still oppose it.

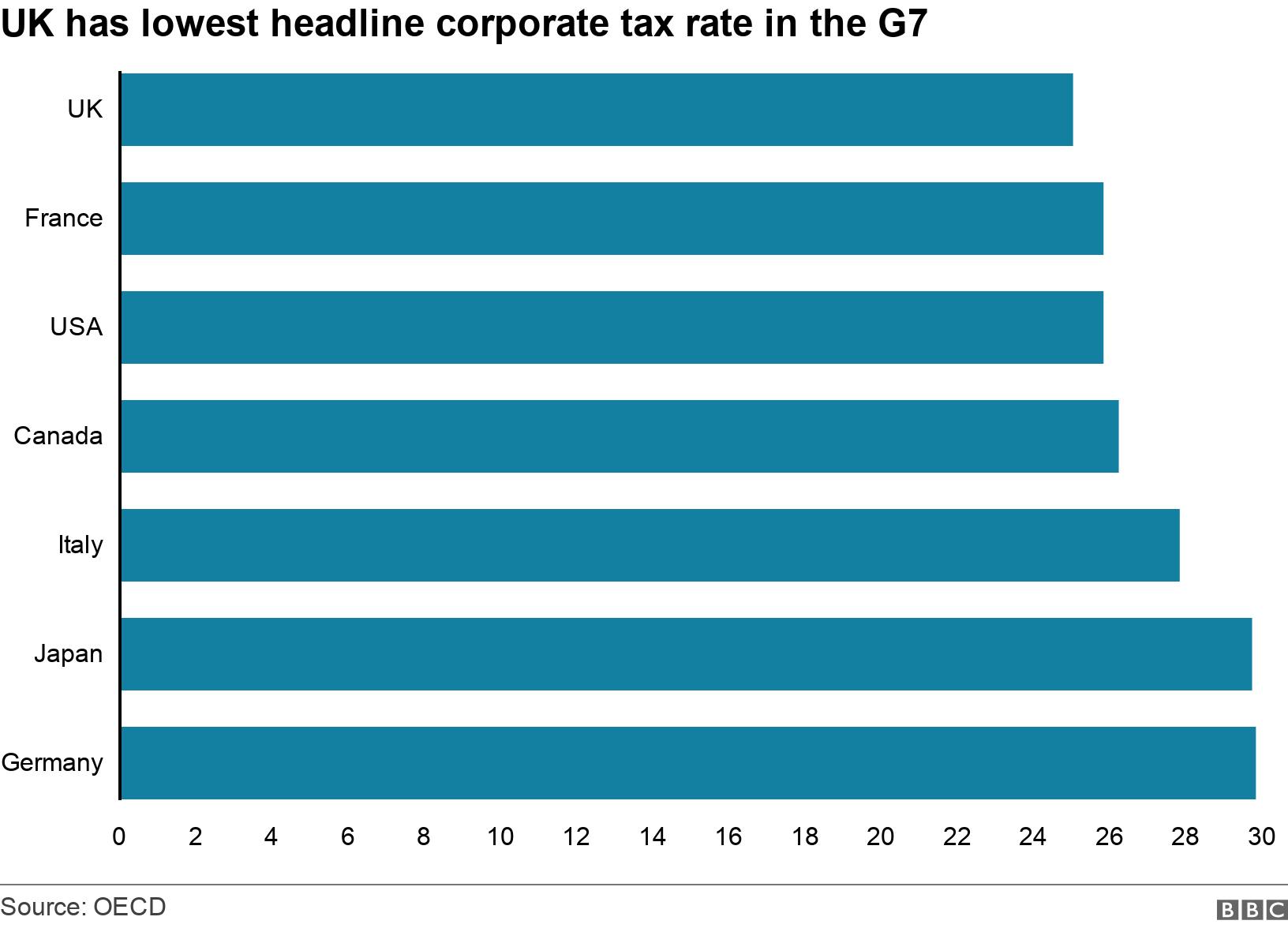

Delivering his Spring Budget, Mr Hunt said the UK would still have the lowest headline rate of corporation tax in the G7, a group of the world's seven richest nations, even after the rise in April.

He said only 10% of businesses would pay the full rate and anticipated that his new "full capital expensing" policy was equivalent of a corporation tax cut worth an average of £9bn a year.

He told the Commons it would lead to a 3% increase in business investment a year and without it, the UK would have "fallen down international league tables on tax competitiveness and damaged growth".

The "full capital expensing" policy will mean companies can deduct spending on investment from profits, meaning they have to pay lower amounts of corporation tax.

The policy would be in place for three years initially but the government hoped to make it permanent "as soon as we can responsibly do so", the chancellor said.

Independent analysis by the Office for Budget Responsibility (OBR) said that as a temporary measure, it provided a strong incentive for businesses to bring forward any investment that had been planned for a later date.

At its peak, the scheme could see business investment up by about 3%, the OBR report said. However it also pointed out that this was lower than the 5% rise under the super-deduction scheme which this policy replaces.

Mr Hunt made the announcement after he confirmed the OBR forecasts the British economy is to avoid a technical recession in 2023 but contract by 0.2%, before returning to growth in 2024.

Plans to hike corporation tax to 25% were first put forward by Rishi Sunak two years ago, when he was chancellor under Boris Johnson.

The rise was justified as a means to claw back some of the billions of pounds worth of public money that had been used to prop up businesses during the Covid-19 pandemic.

Mr Sunak deferred the rise by two years, and in the time since, the policy has been axed, reinstated and divided opinion in the Conservative Party.

Keeping corporation tax at 19% was a key plank of Liz Truss' low-tax leadership platform when she beat Mr Sunak to become prime minister.

On 23 September, then-chancellor Kwasi Kwarteng confirmed the move in the Commons, telling the country it would boost growth - but his Budget quickly unravelled.

Three weeks later, Mr Kwarteng was sacked and the 25% policy was readopted by Ms Truss as she sought to get investors and her own party back onside.

Some Tory MPs publicly oppose the rise, including Mr Johnson, despite the fact he signed off on it when he was PM.

During a speech earlier this month, Mr Johnson said the government should be "cutting corporation tax to Irish levels or lower". The rate is as low as 12.5% for some companies in Ireland.

Former business secretary Jacob Rees-Mogg echoed that view, saying the best approach to tax policy was low rates with few exclusions.

He told the Commons: "We have a rise now in corporation tax but we then sort of salami slice it a bit with some capital allowances to pretend it's not much of a rise. This is not a good approach to tax policy."

Related topics

- Published15 March 2023