Thank you for joining us!published at 16:52 BST 22 June 2023

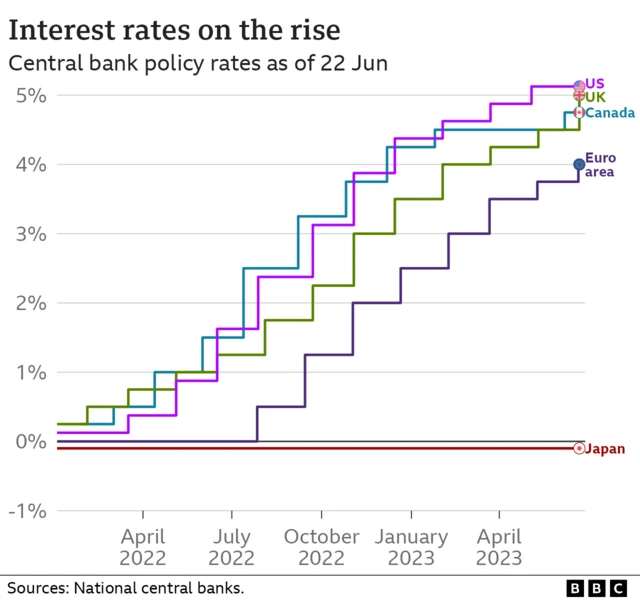

We're now closing our live coverage of the Bank of England's 13th successive interest rate hike.

For more reading, reaction and analysis have a look at:

- Bank of England governor admits rise painful for many

- 'I saved £50,000 living abroad but still can't afford a mortgage'

- Force banks to offer mortgage help, says Labour

- Five ways to save money on your mortgage deal

- How the interest rate rise affects you and your money

Or, if you're feeling a bit baffled by all this economics, have a listen to this BBC podcast series - Understand: The Economy.

Today's page was written by Michael Race, James Harness and Thomas Mackintosh and edited by Heather Sharp.