Tackling inflation is not easy - Sunakpublished at 14:39 BST 22 June 2023

Image source, Pool

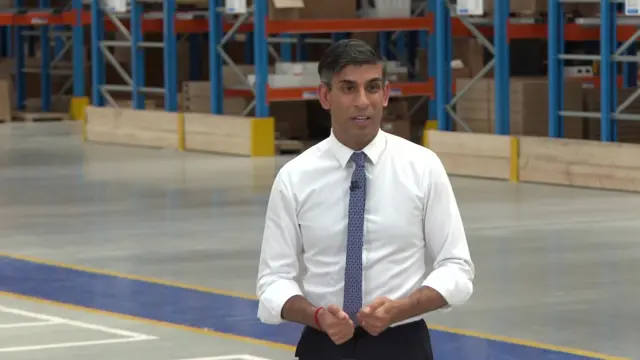

Image source, PoolThe prime minister reiterates the government's support to help with the cost of living, through the energy price cap, freezing fuel duty and capping bus fares.

"We are on it," he repeats, adding that tackling inflation is "not easy" and "if anyone tells you it's easy and can happen overnight, they're not being straight with you".