Pressure on banks to provide help for customerspublished at 12:26 BST 22 June 2023

Nick Eardley

Nick Eardley

Chief political correspondent

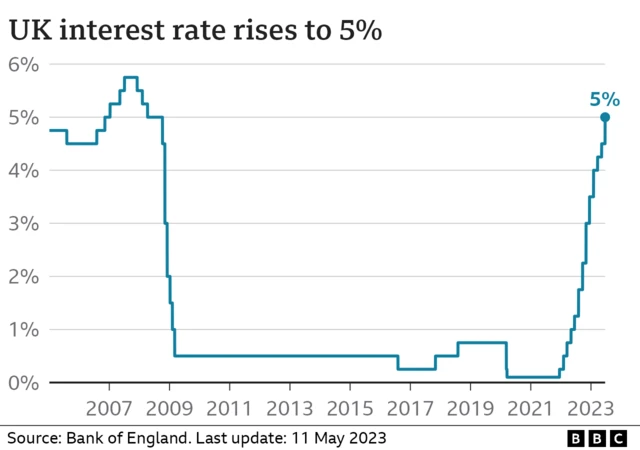

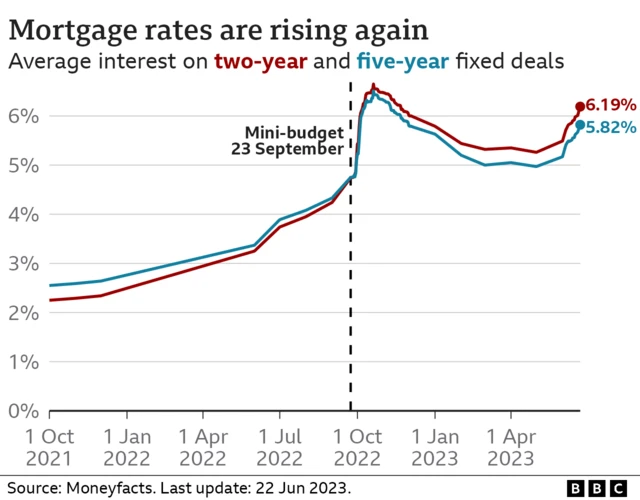

The interest rate rise will be a blow to many households - mortgage holders who face higher borrowing costs and renters who might see those costs passed on.

But the government is extremely reluctant to get involved.

Treasury officials believe any sort of subsidy scheme would make things worse.

Labour agrees - neither of the UK’s main parties think government money can soften the blow.

Instead, they want to put pressure on the banks to provide more flexibility for customers.

There are some politicians though who think the government will have to take action.

The Lib Dems are advocating a fund to help people who are facing a big jump in mortgage costs.

Some Conservatives want tax relief on interest payments, as has happened in the past.

But when the PM responds this afternoon, he will say the best strategy is to keep going with the current strategy to do whatever is required to bring down inflation.

That is likely to mean pain for a lot of households.