Thanks for joining uspublished at 11:58 BST 19 July 2023

We'll soon be drawing our live coverage to a close. But before we go, here's a look at some of main developments:

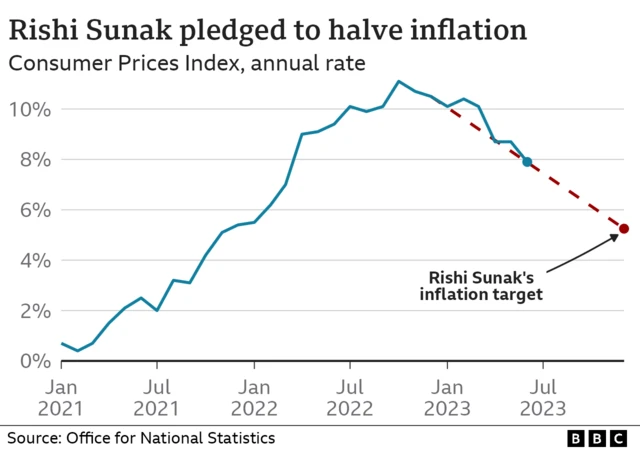

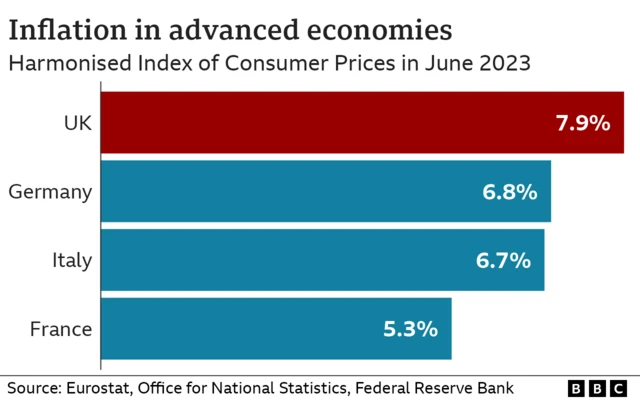

- Inflation in the UK dropped to 7.9% in the year to June, according to the Office for National Statistics

- Today's figures came as a positive surprise to some, as economists had expected a smaller drop to 8.2% - after it had been stuck at 8.7% in April and May

- Chancellor Jeremy Hunt welcomed the drop but said the government knows high prices "are still a huge worry for families and businesses"

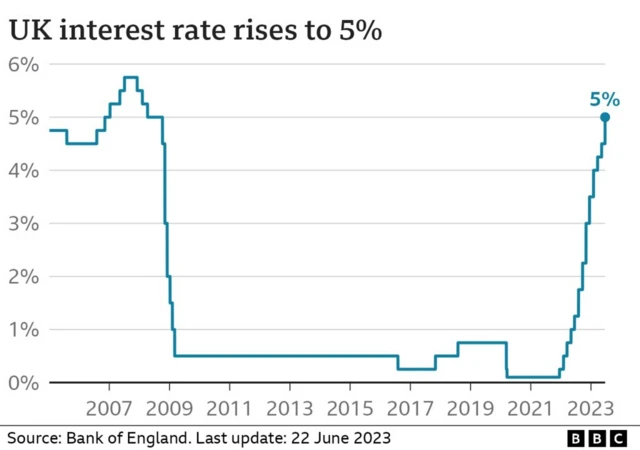

- Interest rates, mortgage repayments and house prices continue to worry many people. Analysts are predicting that, given the latest 7.9% figure, the Bank of England will add 0.25% to the current interest rate of 5% at the Bank's next meeting in August

- The Liberal Democrats and Labour welcomed lower inflation but criticised the government, saying it should do more to help those struggling

Today's coverage was written by Ece Goksedef, Jennifer Meierhans and Malu Cursino. It was edited by Andrew Humphrey and Aoife Walsh.