Inflation drop 'cold comfort' to families - Lib Demspublished at 08:17 BST 19 July 2023

Let's now turn to some reaction from the Liberal Democrats.

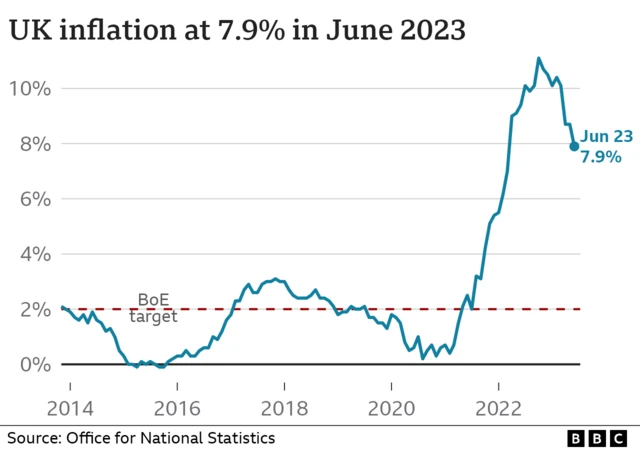

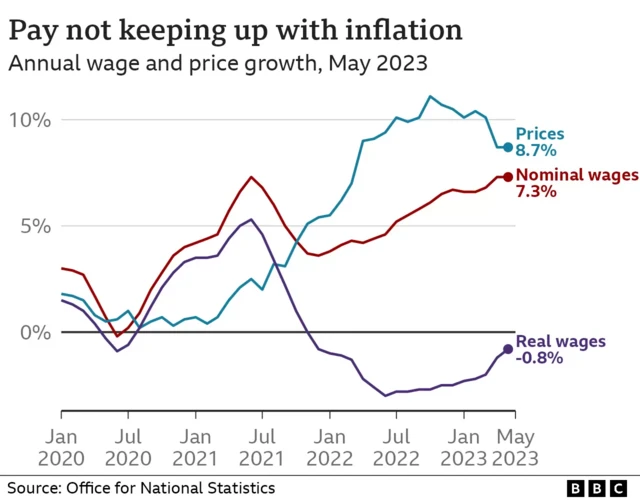

In response to inflation lowering to 7.9%, Lib Dem treasury spokesperson Sarah Olney says "this will bring cold comfort to countless families worried about their mortgage going up".

Olney says "people are sick and tired of being told to hold their nerve when it's this Conservative government that crashed the economy in the first place".

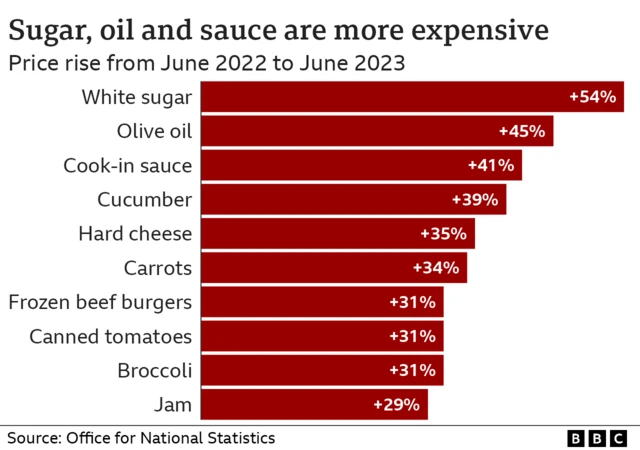

She adds: “The government must take action to bring down food prices, and help those worried about the roof over their head due to spiralling mortgages and rents.”