What can be done to tackle inflation?published at 06:21 BST 19 July 2023

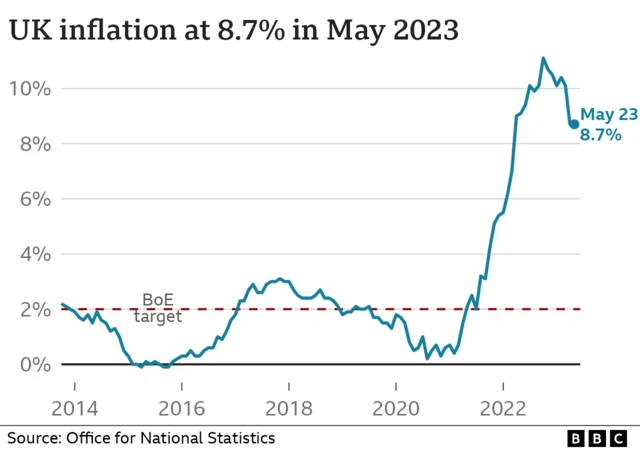

The Bank of England has a target to keep inflation at 2%, but the current rate is still more than four times that.

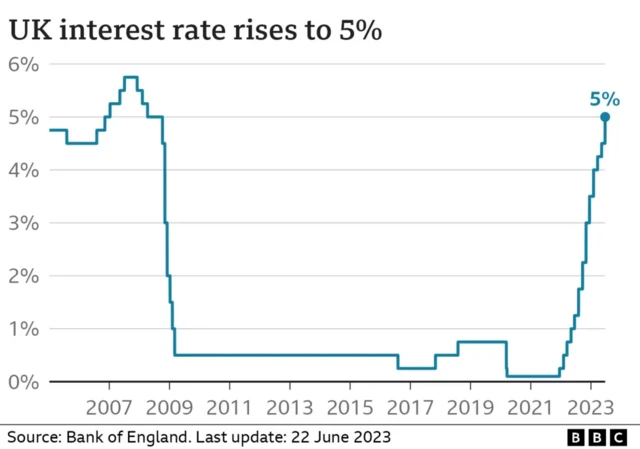

Its traditional response to inflation rising is to put up interest rates.

This makes borrowing more expensive, and can mean some people with mortgages see their monthly payments go up. Some saving rates also increase.

When people have less money to spend, they tend to buy fewer things, which can reduce demand for goods and slow price rises.