That's it from the live team todaypublished at 17:17 BST 3 August 2023

Emma Owen

Emma Owen

Live reporter

As ever, there's plenty of detail and analysis on our website for you to read at your leisure:

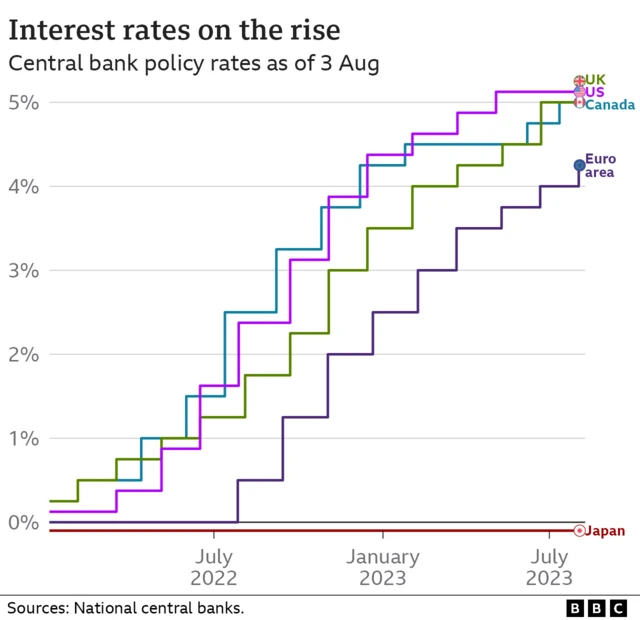

Start here: Read our news story covering today's rate rise.

How it affects you: Read our guide on what it means for your money.

What does it all mean? Our economics editor Faisal Islam shares his thoughts here.

Need help? We have a guide to some practical things you can do if you're struggling.

Thanks for joining us, and have a good evening.