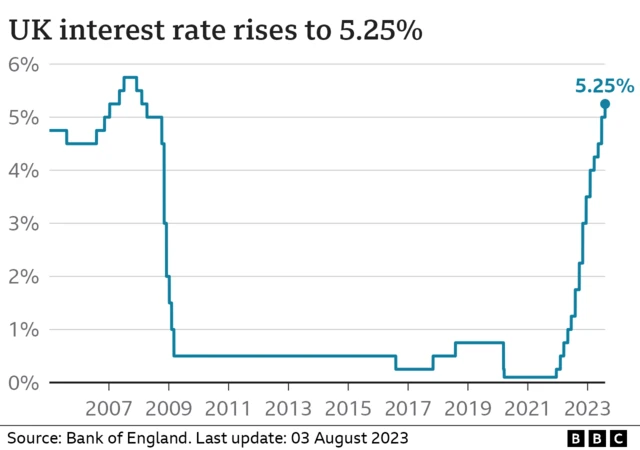

Is pain inevitable?published at 13:15 BST 3 August 2023

Next up, a reporter from the Guardian newspaper asks if the Bank's message for people is that "a certain amount of pain is inevitable".

Bailey replies by saying he "wouldn't use words like pain" - but adds that the Bank does recognise the very serious effect of inflation, particularly on the least well off.

He also says if the Bank don't bring inflation down, then ultimately the effects will be worse.