Interest rate rises to 5.25%published at 12:00 BST 3 August 2023Breaking

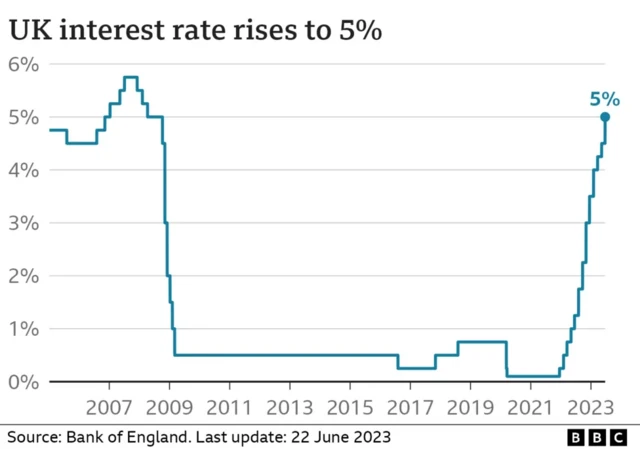

The UK's interest rate has been raised to 5.25% by the Bank of England, as it continues trying to control soaring prices.

This means the Bank has increased the rate by 0.25% from 5% - the 14th hike in a row.

The last time the base rate was this high was in April 2008.