Thanks for joining uspublished at 13:24 BST 16 August 2023

We're ending our live coverage now, thanks for following along.

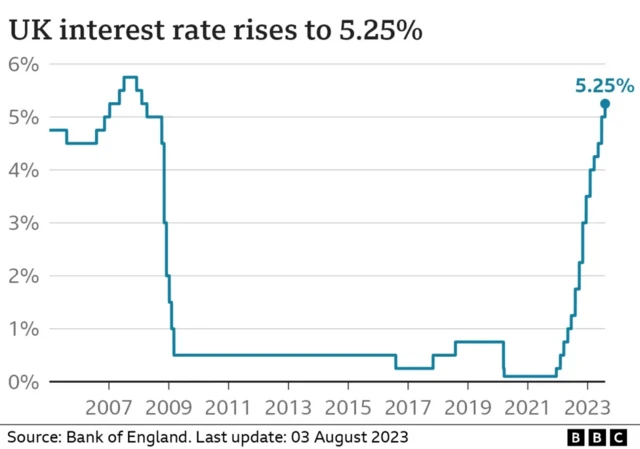

Official figures showed inflation has slowed to 6.8% - down from a peak in October of 11.1%, but with signs that the rate of price rises remains stubbornly high, analysts say we're still likely to see interest rates go up in September.

Want to read more?

- There's a full write up here, including the all the key numbers and reaction to today's figures

- You can read more on the rising cost of renting here

- Not sure exactly what inflation is and why it's been so high - try our explainer, here

- Thinking abour your own finances? See how you're affected with our inflation calculator here, or find personalised money-saving tips in our guide here

This page was edited by Heather Sharp and Emily McGarvey. The writers were Jamie Moreland, Barbara Tasch, Malu Cursino, Jacqueline Howard, James Harness, Thomas Mackintosh and Emily Atkinson.