How much have different foods gone up?published at 10:32 BST 16 August 2023

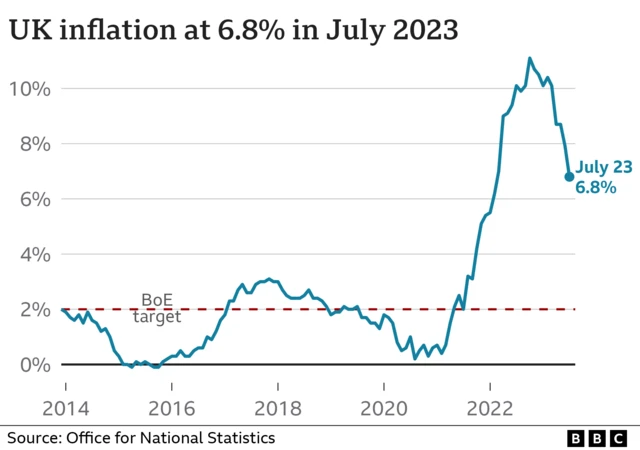

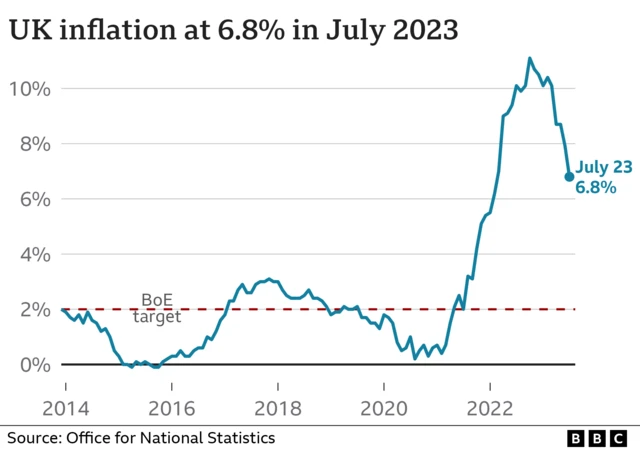

We've been reporting that overall inflation has dropped to 6.8% in the year to July - but that figure is made up of figures from lots of different categories.

An important one is food and drink, which has seen a much higher rate of price rises - it's dropped to 14.9%, external in the year to July, down from a June figure of 17.4%.

The ONS noted that food prices, particularly milk, bread and cereals, had a "notable" effect pushing the headline inflation figure downwards.

The food and drink inflation figure is itself calculated from a mix of different products and you can see in the graphic below how price increases over the past year have varied across various items.

Image source, .

Image source, .