UK inflation drops to 6.8%published at 07:03 BST 16 August 2023Breaking

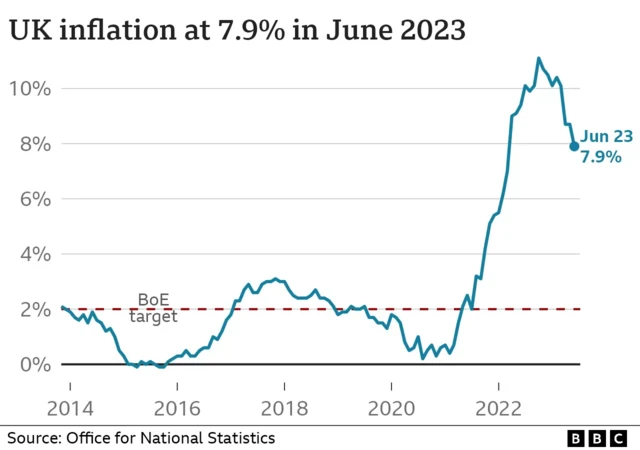

Inflation in the UK dropped to 6.8% in the year to July from 7.9% in June, according to the Office for National Statistics.

Inflation in the UK dropped to 6.8% in the year to July from 7.9% in June

It's the second month in a row that the rate of inflation - how quickly prices are rising - has dropped sharply, and it's now at a 15-month low

The latest figure was driven by a reduction in the energy price cap and food costs rising less rapidly - particularly milk, bread and cereals

But UK inflation remains stubbornly high overall compared to many other nations, and well above the Bank of England's target rate of 2%

The rising costs of hotels, air travel and rents are some of the main things keeping inflation high, according to the Office of National Statistics

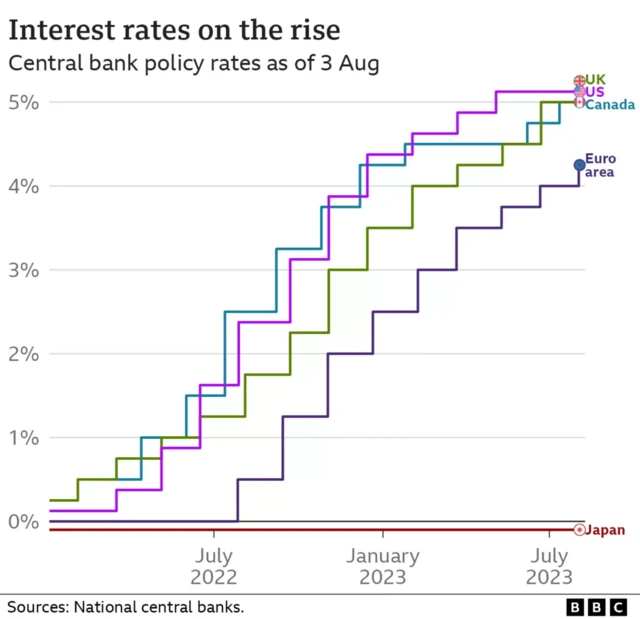

As a result, the Bank of England is expected to raise interest rates again next month in an effort to bring inflation down

Edited by Heather Sharp and Emily McGarvey

Inflation in the UK dropped to 6.8% in the year to July from 7.9% in June, according to the Office for National Statistics.

It's nearly 07:00 and inflation figures in the year leading up to July 2023 are due soon.

Forecasters say the UK's inflation rate is likely to fall further, but will likely remain above the government's target of 2%.

Stay with us as we bring you reaction and analysis to the announcement.

Mary is a Canadian who has been living in the UK for 20 years. She says the recent rise in the cost of the living has hit her hard.

“It’s primarily rent and food. My utility bills have stabilised but they have gone up considerably. Over two thirds of my income goes on bills, it’s insane," she says.

Mary, who lives alone, says sometime it’s so bad she has to choose between eating and paying a bill.

“I’m full time employed and I still struggle, so I can’t imagine what it’s like for people who are part-time or unemployed."

She says she wants utility companies to stop putting up prices and for food prices to come down.

“I would like the government to step in a cap prices,” she adds.

Britons are not alone in feeling a cost of living squeeze, but prices are still higher in the UK than in many other rich nations.

The annual inflation rate for countries which use the euro was estimated to be 5.5% in the 12 months to June, down from 6.1% in May., external

Inflation has also dropped back in the US. It was 3% in the 12 months to June, down from 4% in May, the 12th consecutive monthly fall.

But bucking the trend of rising prices, compared to what they were last year, is China, where the economy has slipped into deflation.

The official consumer price index, a measure of inflation, fell by 0.3% last month from a year earlier.

Image source, .

Image source, .The short answer to this is: not quite.

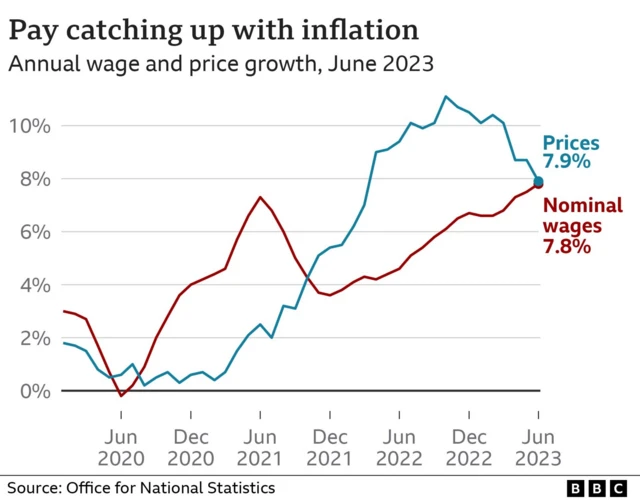

Wages grew at a record annual pace in the April to June period, according to new official figures released yesterday.

Regular pay rose by 7.8%, the highest annual growth rate since comparable records began in 2001. And as we’ve been reporting, inflation - which measure the rate at which prices rise - has eased but remains high at 7.9%.

Darren Morgan, from the ONS, said the latest figures suggested real pay growth, which takes into account the rate of inflation, is "recovering".

However, wage growth is not quite outstripping the pace of price rises. Morgan told the BBC that real pay growth was "still falling a little", dropping by 0.6%.

Image source, .

Image source, . Dharshini David

Dharshini David

Chief economics correspondent

The owner of Nigerian food store Naija High Street in South London says he has limited price hikes, despite some costs doubling.

Feyisara, who runs the business with his wife, says a box of plantain cost £16 five years ago. Now it’s between £35 and £40. The cost of meat and beans and other imported ingredients has also risen.

“Everything’s gone up but somehow we’ve been able to absorb it,” he says. He says he’s fortunate to be on a busy street market and footfall is steady.

But if wholesale costs don’t ease soon he fears the shop will have to put up its prices.

“If they don’t fall, we’ll have to unfortunately increase our prices, so that we’re able to absorb it. So that the business can cope.”

As we mentioned earlier, inflation is the rate at which the cost of goods and services is rising. The Bank of England tries to limit this to 2%, but the figure’s been well above that by some time.

Typically, central banks respond to inflation by raising interest rates. Higher interest rates make it more expensive for people to borrow money to buy things, meaning they are instead encouraged to save their money.

The theory is that they will then generally buy fewer things – reducing the demand for goods and services and therefore slowing inflation.

People who have already borrowed money and are repaying it with interest - such as those with mortgages - will be among the hardest hit, as their monthly payments will go up. The Bank has put up rates 14 consecutive times since December 2021.

Image source, .

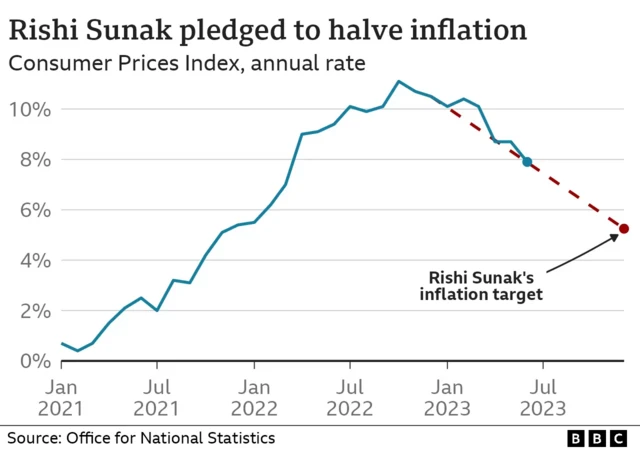

Image source, .Halving inflation is one of Rishi Sunak’s top five priorities, external for 2023.

Inflation was at 10.7% in the three-month period between October and December 2022. Half of that would be around 5.3%.

Inflation fell to 7.9% in June, its lowest level in more than a year. In response, Sunak said, external that last month’s figure was proof that his policies were working.

Image source, .

Image source, .This inflation figure is presented as a percentage. It tells us how fast prices of goods and services are rising in the country.

Inflation in June dropped to 7.9% - a better-than-expected reading, following the 8.7% in April and May.

It had hit 10.4% in February and 11.1% last October. The recent drop doesn’t mean that prices are dropping - just that they’re rising less fast than before.

Dharshini David

Dharshini David

Chief economics correspondent

A fall in the energy price cap on 1 July took some of the heat out of bills – and is likely to mean inflation dropped last month.

But the pain’s not over: overall prices are still likely to have been more than 6% up on a year ago. That’s because other items were still getting more expensive – most notably food.

Although some ingredients got cheaper, retailers still faced higher bills for the likes of wages and transport. And it’s often customers who pick up the tab.

Strip out food and energy, and so-called core inflation is likely to have remained high. That suggests households still have the funds to treat themselves to non-essentials.

And it’s that discretionary spending that the Bank of England is aiming at when it raises interest rates. With inflation still several times higher than its 2% target, most analysts expect a further rate rise come September.

Image source, Getty Images

Image source, Getty ImagesInflation measures how quickly prices are rising (or very occasionally falling) for goods and services.

And a series of recent shocks to the economy has caused high inflation, the Bank of England says.

First, the Covid pandemic pushed prices up as more people bought goods - but there were problems getting enough of the goods, particularly with importing them from abroad.

Second, the war in Ukraine led to large increases in the price of gas and food.

Then, a big fall in the number of people available to work meant employers began offering higher wages to job applicants, with many businesses increasing their prices to cover these costs.

Emily McGarvey

Emily McGarvey

Live reporter

Welcome to our live coverage. New figures out shortly will reveal the UK's inflation rate in the year leading up to July 2023.

Last month's figure of 7.9% continued a downward trend and put inflation at its lowest level for more than a year.

But inflation (the rate at which the cost of living is rising) remains stubbornly high overall.

We’ll have the latest figure for you at 07:00 BST. My colleagues Malu Cursino, Jacqui Howard, Barbara Tasch and I are here to bring you the key numbers as well as the reaction.