'We are on the way' to interest cuts, says Bank's governorpublished at 15:03 GMT 21 March 2024

Image source, EPA

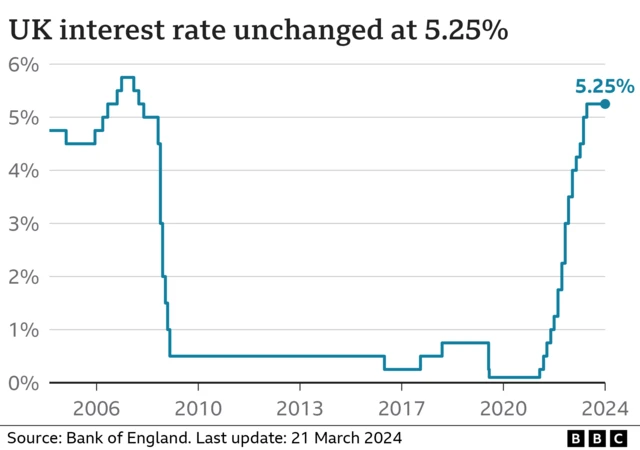

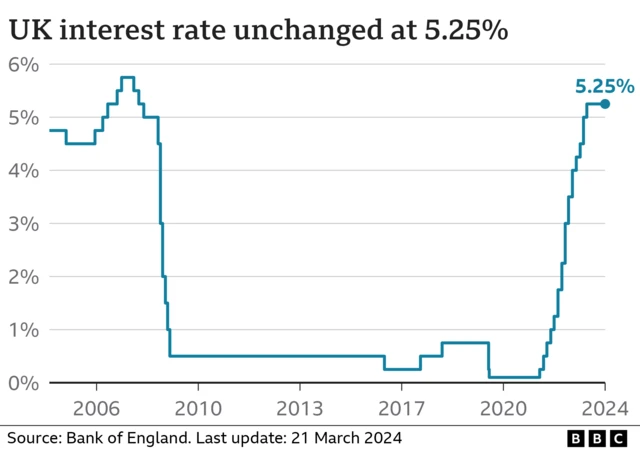

Image source, EPAWe've just heard from the Bank of England's governor Andrew Bailey who says “we are on the way” to interest rate cuts after they were held for a fifth time at 5.25%.

“We do need to see further progress, but do want to give this message very strongly we have had very encouraging and good news," Bailey says.

And with that, we're going to end our live coverage but you can read Andrew Bailey's comments and more here:

- The Bank's boss has said it's 'not yet' time to cut interest rates - read about that here

- To find out how interest rates affect you, you can read our explainer here

- And to read Prime Minister Rishi Sunak's interview with the BBC where he says the UK economy will "bounce back" this year, look here

Thank you for joining us. Today's coverage was brought to you by Emily McGarvey, Nathan Williams, Andrew Humphrey, Ece Goksedef, Alex Smith and Malu Cursino.