Bank's committee votes 8 to 1 to hold interest ratespublished at 12:06 GMT 21 March 2024

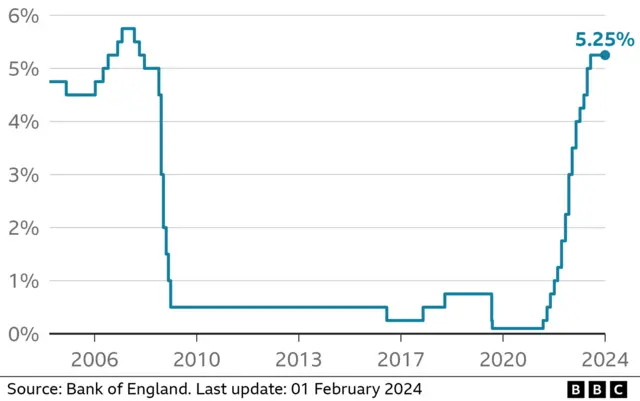

The Bank of England says its Monetary Police Committee voted 8-1 in favour of keeping interest rates unchanged at 5.25%.

It added that one member preferred to reduce the rate down to 5%.

The last time it made a decision on interest - at the start of February - it voted by a majority of 6-3, also to hold rates.

The committee that makes that call is comprised of nine members - the governor Andrew Bailey, three deputy governors, the bank's chief economist, and four external members appointed by the Chancellor.