What do economists expect today?published at 10:01 GMT 21 March 2024

Charlotte McDonald

Business reporter

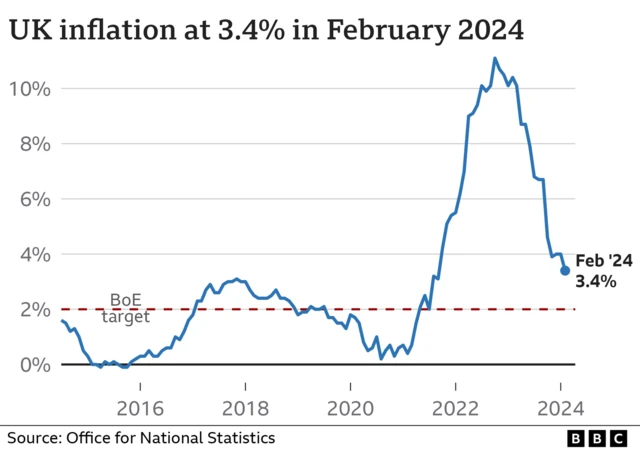

The Bank of England is likely to resist signalling interest rate cuts despite the lower rate of inflation at 3.4% announced yesterday.

Governor Andrew Bailey and his colleagues are expected to leave the key rate at a 16-year high of 5.25%, as he has reportedly been more cautious in talking about a pivot to lower borrowing costs.

However, due to a decrease in wage pressures from the job market and a recession at the end of 2023, investors believe the Bank of England will lower rates before the end of summer.

The inflation fall to 3.4%, announced yesterday, could strengthen these beliefs.