IMF support is a major boost for Reevespublished at 11:05 GMT 31 October 2024

Dearbail Jordan

Business reporter

The International Monetary Fund's support for Rachel Reeves's Budget is a huge boost for the chancellor.

It is very unusual for the IMF to comment in this way. And people care what the organisation has to say because it helps oversee global economic stability and bails out countries in trouble.

The added bonus for Reeves of the IMF's response is that it couldn't contrast more starkly with what it said about the now infamous mini-Budget, given two years ago under the short-lived premiership of Liz Truss.

That proposed £45bn in unfunded tax cuts, unleashing financial market turmoil which pushed up mortgage rates.

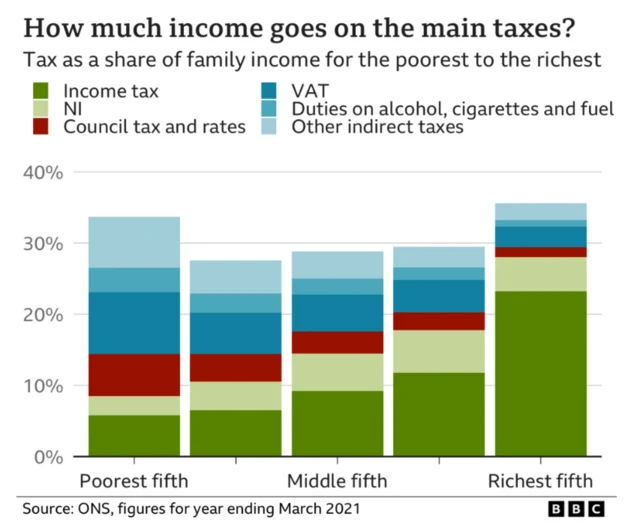

This was at a time when the cost of living crisis was particularly acute and the IMF warned the tax cuts risked stoking inflation and increasing inequality between rich and poor.

Truss ended up sacking her chancellor Kwasi Kwarteng before she resigned after 49 days in the job.

The IMF's intervention wasn't the final blow but it certainly didn't help matters.