Budget will be aimed at turbocharging prosperitypublished at 11:40 GMT 15 March 2023

Dharshini David

Dharshini David

Economics Correspondent

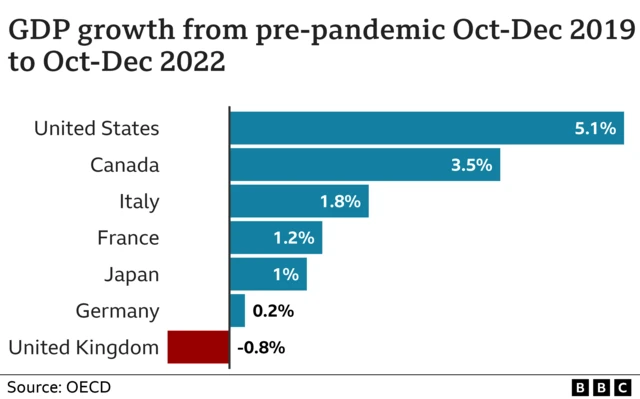

All Chancellors say their budgets are about growth, making us better off - but this one comes at a crucial time. The UK is the only major rich economy - unlike France, Italy and the US for example - that remains smaller than prior to the pandemic.

And Jeremy Hunt is likely to have to concede that our long-term prospects are likely to be less lucrative than hoped.

Put bluntly, strip out inflation and households will be thousands of pounds worse off than they would have been had our economy continued on its pre-pandemic path - giving us, and the Chancellor, less to play with than we could have had. Some of that is down to global factors - the pandemic, the energy price shock, some down to past policy.

So the plans today from boosting childcare to investment are about turbocharging our productive powers, our prosperity. How much impact they have, we won’t know for some time, in the meantime, the tough times aren’t over.