Still want to read more?published at 20:11 GMT 22 November 2023

We're closing this page now, but there's lots more to read. Our summary below is just the tip of the iceberg and teams across the BBC have been digging into the detail all afternoon.

The key lines:

For anyone looking for a general overview, here's the main story from the BBC Politics team.

We've written an at-a-glance summary here of the major announcements in the statement.

Our colleagues in BBC Business have taken a detailed looked at a tax break for firms who invest in new technology or equipment.

We've also written a round-up of the gloomy growth predictions issued by the government's official economics forecaster and taken a look at changes to the benefits system.

Expert analysis:

The BBC's cost of living correspondent Kevin Peachey has taken a consumer-focused look at what this means for your finances.

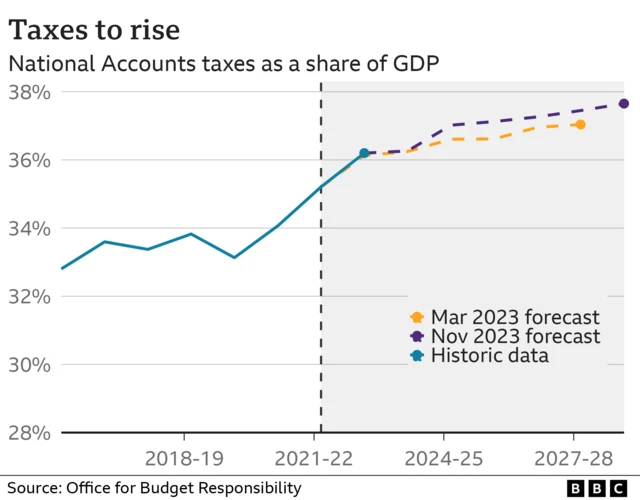

There's also economics editor Fasial Islam's analysis of the UK tax burden remaining at a 70-year high, despite the cuts.

And here's a detailed explainer on the changes to National Insurance and income tax.

Thanks for joining us. Today's page was written by Adam Durbin, Malu Cursino, Dearbail Jordan, Ben King, Tara Mewawalla, Kate Whannel and Sam Francis. It was edited by Owen Amos, Heather Sharp and Sam Hancock.