Chancellor begins the Autumn Statement - 110 measures to go...published at 12:35 GMT 22 November 2023Breaking

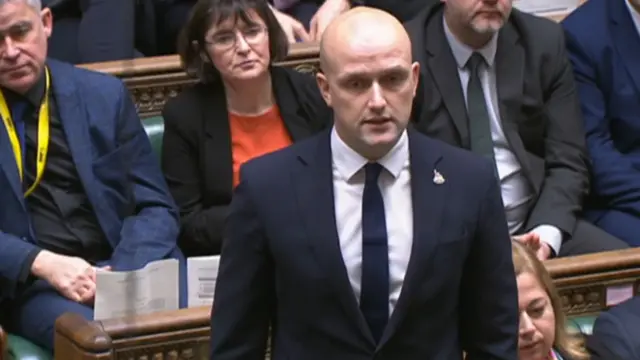

Image source, UK Parliament

Image source, UK ParliamentJeremy Hunt is on his feet, beginning his Autumn Statement.

As we reported earlier, he says - in total - there will be 110 measures to "help grow the economy".

Deep breath, and let's begin...