Public spending squeezed, while tax burden remains highpublished at 16:35 GMT 22 November 2023

Faisal Islam

Faisal Islam

Economics editor

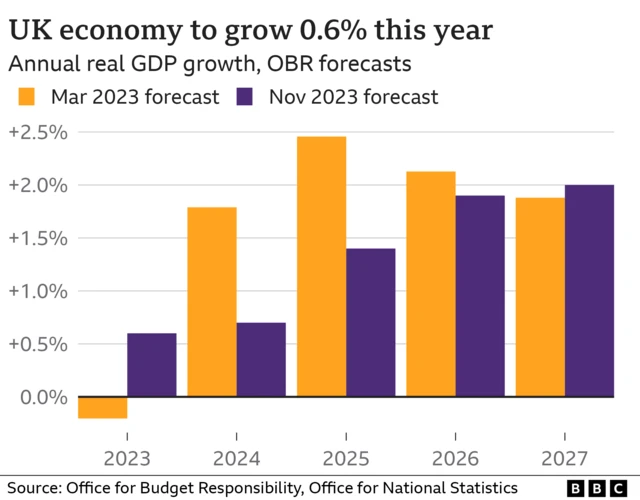

The Autumn Statement does signal a change of gear on the government's economic policy.

Downing Street has clearly decided that the unexpectant buoyancy of tax revenues should be returned to businesses and to workers.

The latter is nicely timed for the election, especially as it will be delivered in January.

They are calculating that the shadow cast by last year’s mini Budget is over, and that having built up market credibility, some can now be spent with a significant set of giveaway decisions.

Other choices were available.

Public spending and investment remains squeezed, after accounting for inflation, at a time when the public has begun to notice severe strains in some health, education and council services.

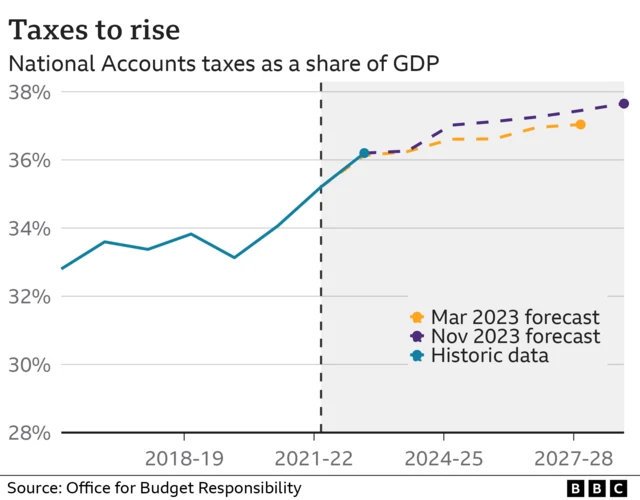

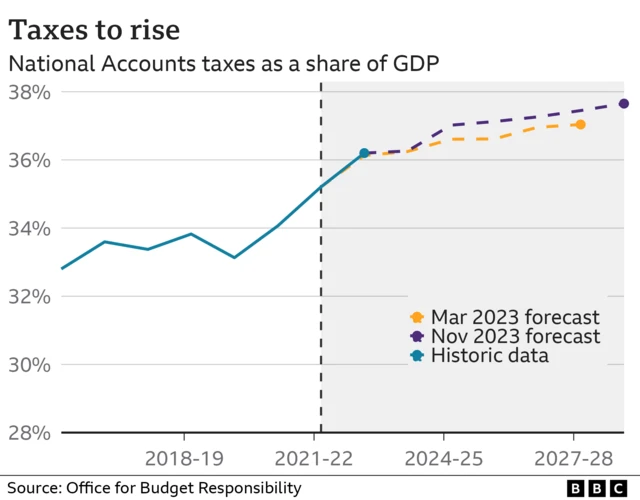

And overall, freezing thresholds is generating so much tax revenue, with inflation higher than forecast, that the tax burden remains at a post war high.

The OBR confirmed that by 2028 a truly astonishing £46bn will be raised by the freezes, in just one year.

The question is whether the public will see this notable National Insurance cut as light at the end of the tunnel, or instead, a partial refund of the significant tax rise seen over the past two years.