Markets are 'once-bitten, twice shy'published at 09:48 GMT 9 November 2016

Dominic O'Connell

Dominic O'Connell

Business Presenter, BBC Radio 4 Today programme

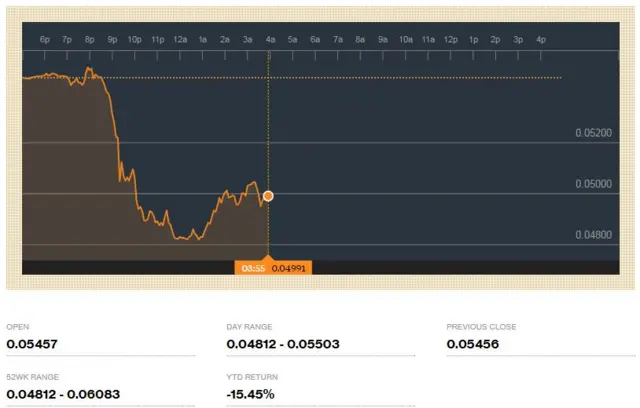

Overnight the FTSE 100 futures contract indicated the British market would slump – down 4%, was the call. In the end, the indicators were wrong. Early on the FTSE 100 fell 1.4% but recovered to be down just 0.5% after the first hour’s trading. It was a far cry from the sharp fall the day after the Brexit vote, and mild after the heavy sell-off on Asian markets overnight.

Why are traders so sanguine? Part of the explanation may be an attempt to second-guess what happened after the European referendum. Then, markets recovered all their lost ground in six weeks, and the FTSE 100 eventually went to an all time-high. Once bitten, twice shy.

Investors were also trying to pick winners from the Trump victory. Gold and other commodities were up, while shares that might suffer from trade wars were down.

In the end though, the most likely explanation for the market’s relative calm is confusion. The markets know as little about a Trump presidency as anyone else, and trying to seek a safe haven when no-one quite knows the direction of the world’s largest economy is tricky. Better to sit on your hands, and see what happens.