Background:published at 14:18 GMT 4 November 2015

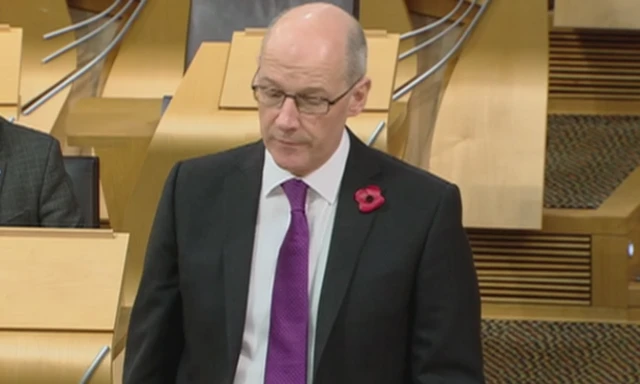

Scotland's Deputy First Minister, John Swinney, is to give councils north of the border the power to cut business rates from the end of this month.

He announce the decision in his speech to the SNP's annual conference in Aberdeen.

Business rates are set centrally in Scotland and retained locally, but Mr Swinney wants greater flexibility.

From 31 October, Scotland's 32 local authorities will be able to cut rates to try and boost economic activity.

They will be able to apply any changes in particular geographical areas or to chosen business sectors.