Bono linked to tax probe in Lithuaniapublished at 18:39 GMT 6 November 2017

Image source, Getty Images

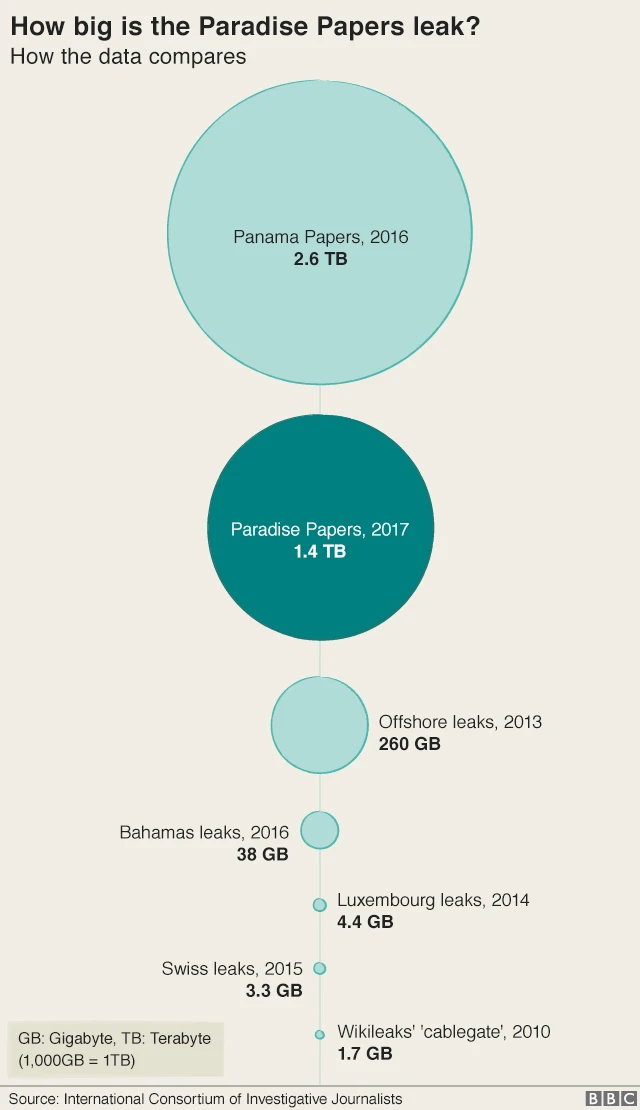

Image source, Getty ImagesA Lithuanian shopping mall partly owned by U2 star Bono is under investigation for potential tax evasion, following a probe prompted by the Paradise Papers.

The mall allegedly avoided paying 47,000 euros (£41,500) in local taxes using an unlawful accounting technique.

The company running the mall, in the city of Utena, denies any wrongdoing.

The leaked documents show that Bono owned a stake in a Maltese holding company that bought the mall, via a Lithuanian holding company, in 2007.

In a statement, the Irish entertainer and anti-poverty campaigner, also known as Paul David Hewson, said he had been "assured by those running the company that it is fully tax compliant".