Paradise Papers recappublished at 06:38 GMT 7 November 2017

Here are the top stories from overnight:

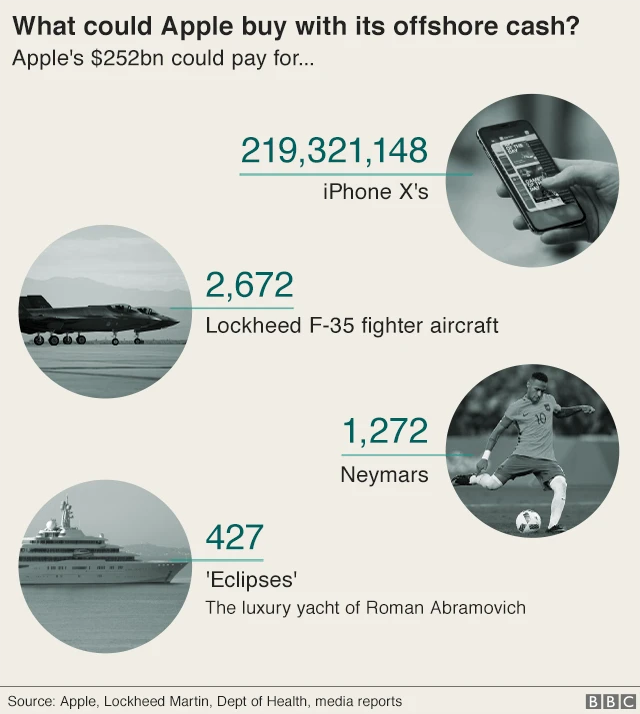

- Apple, the world's biggest tech firm, sidestepped a 2013 crackdown on its controversial Irish tax practices by actively shopping around for a tax haven. They found the Channel Island of Jersey

- Formula 1 champion Lewis Hamilton avoided tax on his £16.5m luxury jet, obtaining a £3.3m VAT refund after the Bombardier Challenger 605 was imported into the Isle of Man in 2013

- Three stars of hit BBC sitcom Mrs Brown's Boys diverted more than £2m into an offshore tax-avoidance scheme

- A Lithuanian shopping mall partly owned by U2's Bono is under investigation for potential tax avoidance

- One of the world's largest firms Glencore loaned a businessman previously accused of corruption $45m and asked him to negotiate mining rights in a poor central African nation.