That's everything for nowpublished at 21:25 GMT 5 November 2017

We're letting our live coverage end for now but we will be back with more in the morning.

Here's what happened so far:

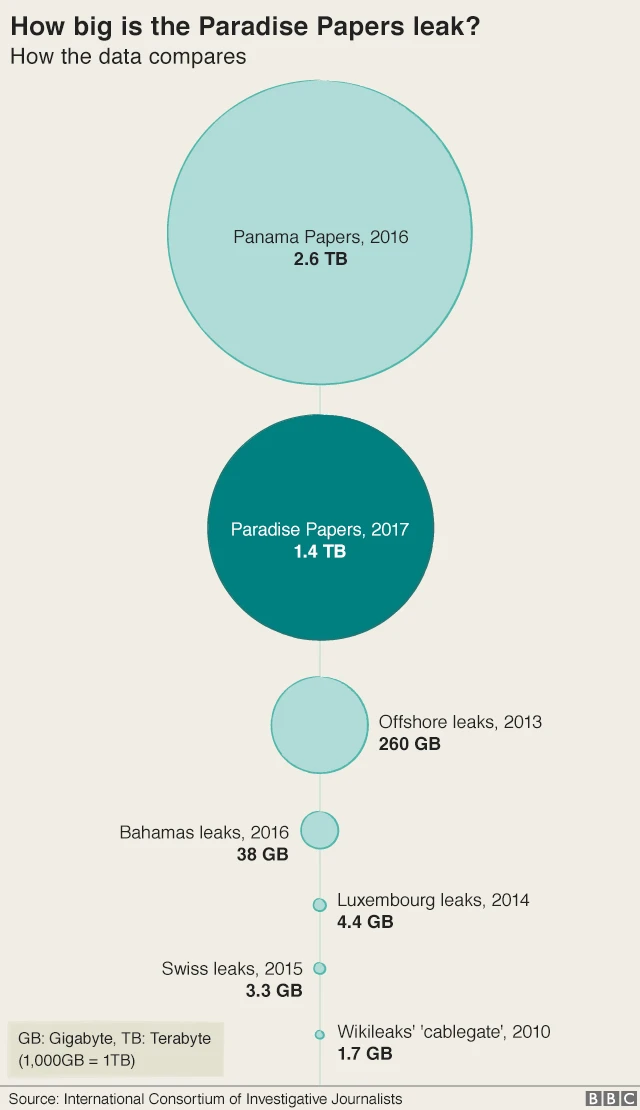

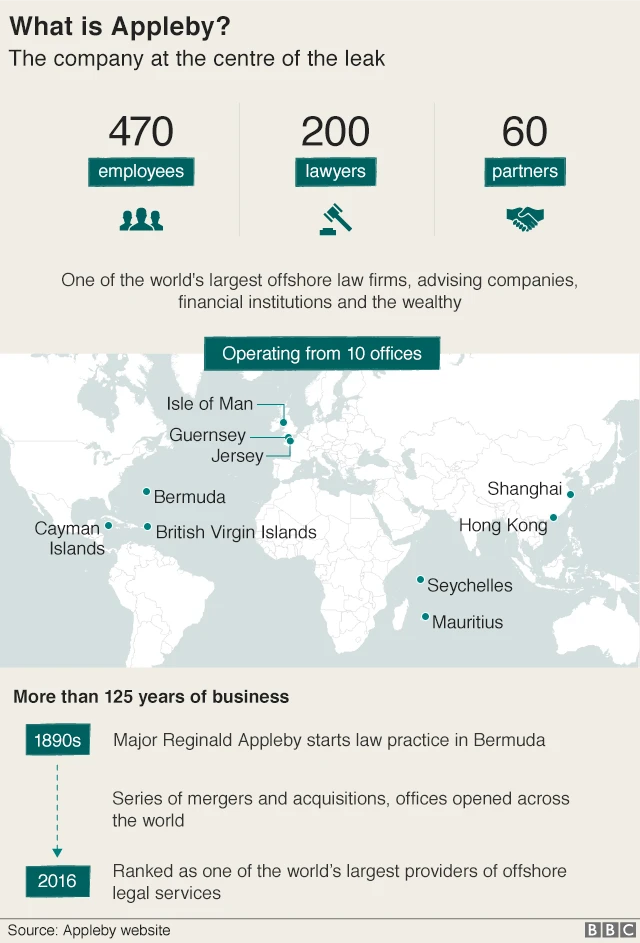

- There has been a massive leak of documents, mostly from one leading financial law firm based in Bermuda

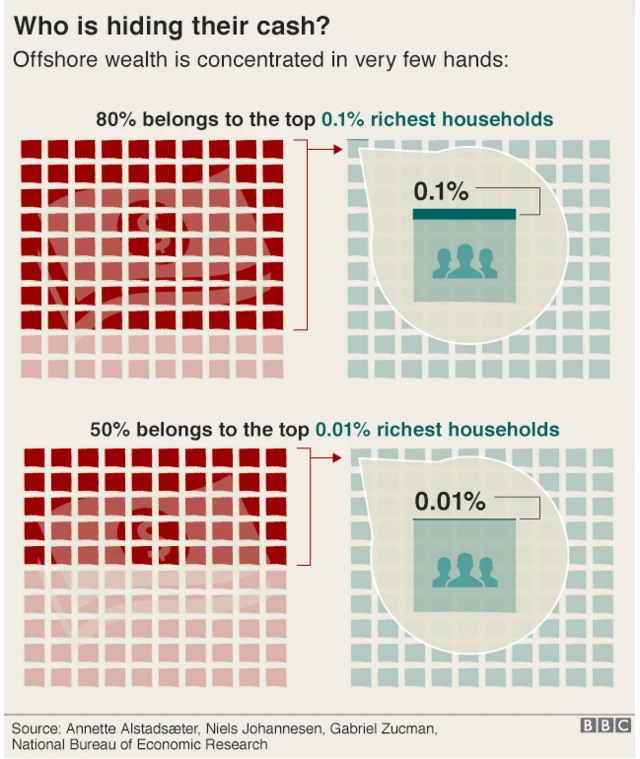

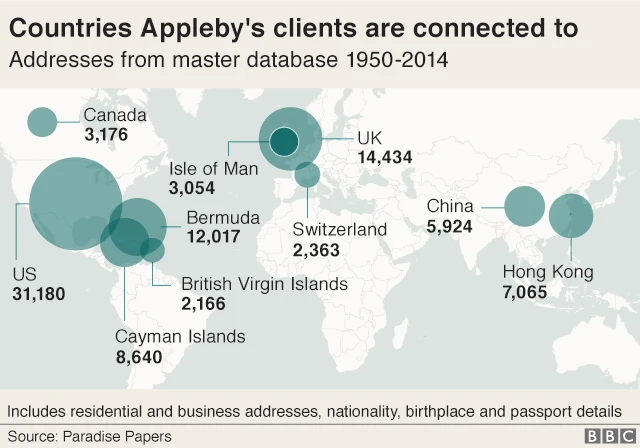

- The 13.4 million documents shed light on how the super-rich and powerful of the world hide their wealth to avoid paying tax

- In the US, Wilbur Ross, commerce secretary in Donald Trump's administration, has business links with Russian allies of President Vladimir Putin who are under US sanctions

- In Canada, Stephen Bronfman, chief fundraiser for Prime Minister Justin Trudeau's party is linked to offshore schemes that may have cost the nation millions of dollars in taxes

- About £10m of Queen Elizabeth II's private money was invested offshore

- Questions have been raised about the funding of a major shareholding in Everton Football Club

You can explore all the BBC's stories in one place here and if you're in the UK you can watch BBC Panorama's special edition on the leaks here.

And there are plenty more stories to come from this through the week so stay tuned.