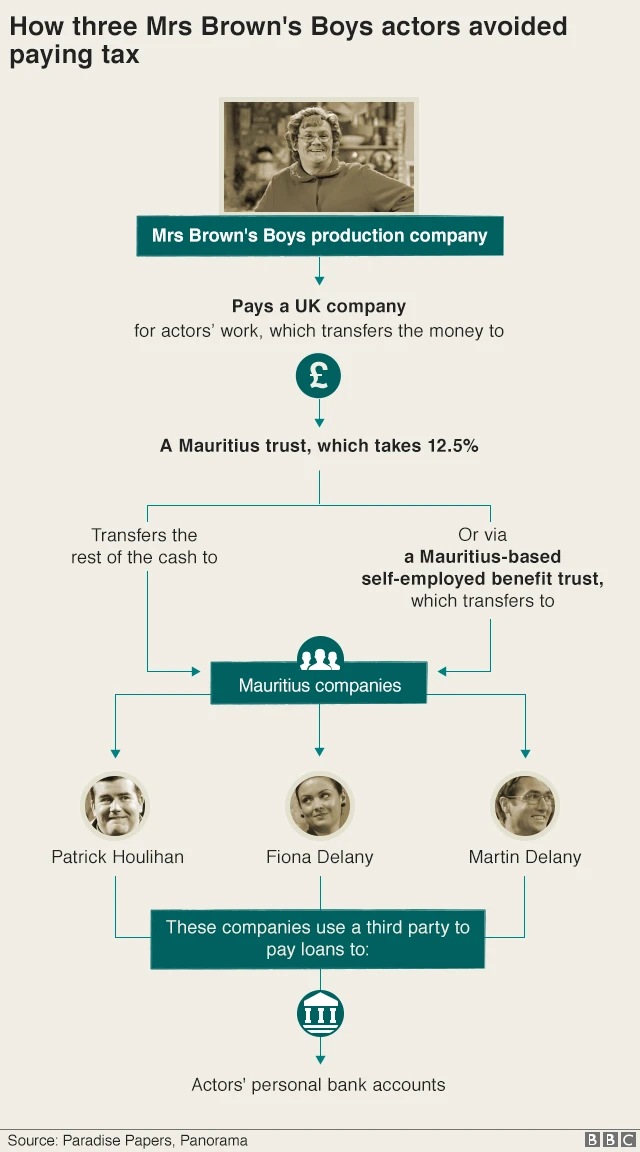

Mrs Brown's Boys: How actors avoided taxpublished at 13:14 GMT 6 November 2017

A complicated scheme involves paying the actors' salaries to a UK company, which transfers the money to a trust in Mauritius, and on via Mauritius companies, until it comes back to the actors in the form of loans.