Mortgage crisis: 'We can't pay an extra £1,400 a month'

- Published

Victoria and Matthew Watts are facing a huge monthly hike in their mortgage payments

More than 400,000 people will see their fixed mortgage deals coming to an end over the next few months, at a time when lenders are rapidly increasing their rates and pulling deals. How are homeowners coping?

Victoria Watts, who lives with her husband and two children in Norwich, knew her mortgage of £1,300 a month was going to increase but she was shocked to learn by how much.

The 35-year old senior insurance manager received a letter last month saying her fixed-rate deal was coming to an end, and the family would need to find an extra £1,400 a month.

Instead they have chosen to go on a tracker mortgage, which will cost them an extra £700 a month, so they can be more flexible in the hope of rates going down in the future.

Victoria and her husband Matthew both work hard to provide for their children

Meals out, new clothes and holidays are a thing of the past, she says, and improvements to the kitchen and bathroom are on hold.

"My husband and I both work and luckily we've got savings but we're going to have to really cut back and be really cautious. We just don't know when things are going to get better and we might have to consider selling our house in the future," she says.

Lisa Ward has lived in the same house for 25 years and hoped to stay there for many more. But the mother-of-two has put her three-bed home in Cheshunt, Hertfordshire on the market after her mortgage rate went up by nearly 300%.

Lisa Ward is having to leave Hertfordshire after 25 years because of mortgage costs

The 49-year-old was not able to extend her interest-only mortgage when it came to an end recently, and offers from other lenders were not within her financial reach.

"I got a letter saying my mortgage was going up from £289 to £1,150 a month," she says. "Now my mum is having to sell her house too and we are hoping to buy a house together in Norfolk because we can't afford anything in Hertfordshire.

"We don't want to move there but we have no choice. I can't think about the future but I've got to. I've got to be positive and pick myself up and push myself through this."

She is selling her three-bedroom house which she has lived in for half her life

Lisa used to have her own painting and decorating business but had to stop working due to a bowel condition, arthritis and fibromyalgia.

She receives some benefits but they are not enough to cover the huge rise and she feels "very let down by the government".

Lisa rescued her dog Rexi from Romania and also rescues and rehabilitates hedgehogs and tortoises

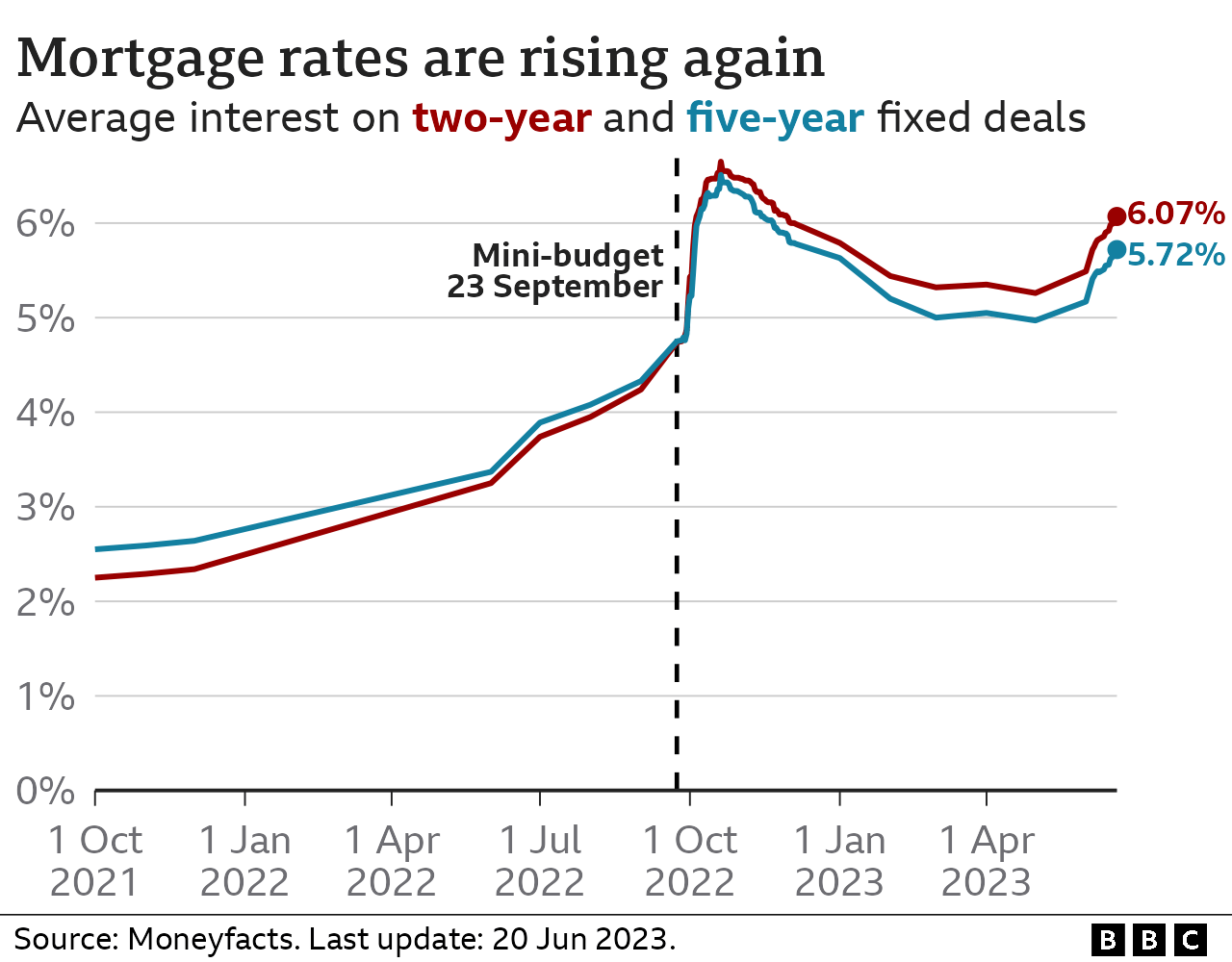

The average rate for a two-year fixed-rate mortgage is now 6.15%, according to the financial information service Moneyfacts.

The Bank of England's response to rising inflation has been to increase the UK's official interest rate, in the belief that people are more likely to save money and less likely to borrow it.

The base rate, currently at 4.5%, will be reviewed on Thursday and is widely expected to increase for the 13th time in a row.

Rachelle Gleed, 53, from Bishop's Stortford, Hertfordshire, describes the situation as "ridiculous, scary and very, very stressful".

The mother-of-two has a rental property with an interest-only mortgage deal that ends in October and is facing an increase from £500 a month to £1,471.

"I can't pass that increase on to a tenant, I have a lovely family who rent from me and they won't be able to afford it. I really don't want to have to sell it, I would feel terrible for the family, but where am I supposed to find that sort of money?".

Rachelle (left) and her husband Darren (right) have worked their whole lives to provide for their children Emily and Jake (centre) and to live comfortably

Rachelle and her husband, who both work full-time, are also worried about the mortgage on their own home which comes up for renewal early next year.

"I have worked since I was 16 years old and we had got to a place where we could live comfortably and go on nice holidays but now I feel like we have gone back to worrying about every penny," she says.

Richard, 61, from Cambridge, had to use all of his £50,000 of savings to get the costs down when his fixed-rate mortgage ended last month.

IT worker Richard has used up £50,000 worth of savings to try to get his mortgage rate down

The IT worker is now on a tracker mortgage, which cost £1,000 in fees to switch to. His monthly interest payments were due to increase from £260 per month to £803 but he managed to get that down to £765 using his savings.

"Why is the Bank of England still raising interest rates?' We got the message to curb our spending months ago.

"The government is concentrating on food prices and fuel. I appreciate that it affects a lot of people very badly. For me, a few pence on the price of a box of eggs is a drop in the ocean compared to a monthly interest payment rise of £500 and everything else to follow."

A government spokesperson said it was providing support worth an average of £3,300 per household over this year and next.

"Central banks around the world are raising interest rates in a collective effort to combat high inflation and the Chancellor has met with mortgage lenders to make clear that borrowers should continue to be supported now and in the future," the spokesperson added.

Additional reporting by Kris Bramwell & Emma Pengelly.

What happens if I miss a mortgage payment?

A shortfall equivalent to two or more months' repayments means you are officially in arrears

Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

Any arrangement you come to will be reflected on your credit file - affecting your ability to borrow money in the future

Follow East of England news on Facebook, external, Instagram, external and Twitter, external. Got a story? Email eastofenglandnews@bbc.co.uk , externalor WhatsApp on 0800 169 1830

- Published19 June 2023

- Published15 June 2023

- Published9 June 2023

- Published4 June 2023

- Published13 June 2023

- Published1 June 2023

- Published30 May 2023

- Published26 May 2023

- Published24 May 2023

- Published9 January 2024