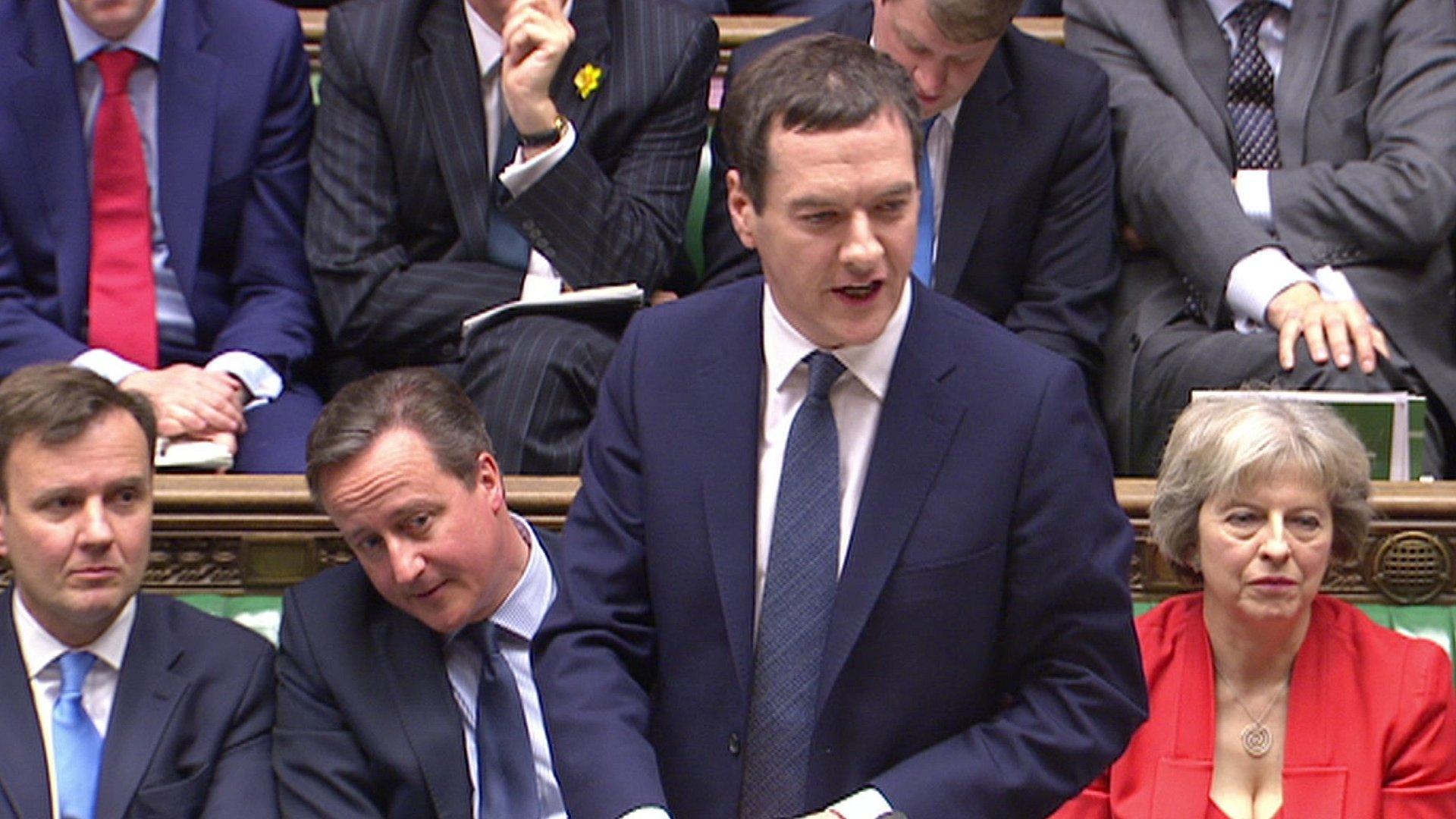

Budget 2016: George Osborne hits back at deficit critics

- Published

- comments

Budget 2016: 'Disability budget going up' - Osborne

George Osborne says the UK will be back in the black by 2020 as promised - provided the economy keeps growing.

The chancellor was forced to revise down his growth forecasts and admit he had missed key targets in his Budget.

He blamed global factors - but Labour said his credibility was "completely shot" and said he was cutting taxes for the wealthy at the expense of the poor.

Mr Osborne insisted on BBC Radio 4's Today programme that he was still on course to clear the deficit.

But he added the proviso that it would happen "in normal times when the economy is growing".

Paul Johnson, of the Institute for Fiscal Studies, said the chance of Mr Osborne hitting his target was "only about a 50-50 shot" and he would need to impose "proper" tax rises or spending cuts if there was any further downgrade in public finances.

He said the chancellor had "managed to shift quite a lot money around" to try and meet his target but he can only "get away with this once".

The IFS has said in a report that there will have to be an extra year of austerity as a result of Wednesday's Budget, with £10bn in spending cuts pencilled in for after the next general election.

"Even if we get a surplus the surplus in 2019/20 we will have to have another year of pain to stay there the following year," Mr Johnson told BBC Radio 4's The World at One..

He also questioned the chancellor's decision to freeze fuel duty, which raises about £30bn a year, for the sixth year in a row, particularly as falling oil prices had already reduced the cost of driving a car to its lowest level in decades.

"If this continues not to rise - and it is beginning to look like it will never go up again - that is a big black hole in the public finances for the medium term," he added.

The chancellor has also missed his target to get debt falling as a proportion of national income and his self-imposed cap on welfare spending.

Sugar tax

Shadow Chancellor, John McDonnell told the BBC News Channel: "I think George Osborne's credibility is completely shot. He has missed virtually every one of his targets. People are rightly sceptical that he will now miss his surplus target."

He said Labour would spend more to grow the economy but would have the "additional discipline that you reduce debt as a portion of GDP within the 5 years".

He also criticised Mr Osborne's "morally reprehensible" £1.3bn a year cut to disability payments under the Personal Independence Payment (PIP) scheme.

He claimed Mr Osborne had "declared war on the disabled" - a charge which the chancellor denied, saying overall spending on disability was increasing and the government was making "sure we help the most vulnerable in our society".

Sugar in fizzy drinks

35g

The amount of sugar in a 330ml can of Coca-Cola (7 teaspoons)

30g

The recommended max. intake of sugar per day for those aged 11+

-

£520m The amount George Osborne expects the sugar tax to raise

Mr Osborne's headline grabbing announcement of a tax on sugary drinks to combat childhood obesity was welcomed by Labour.

But a Conservative rebellion is brewing over VAT on sanitary products, which is currently charged at 5%, the lowest rate allowable under EU law.

More than 300,000 people have signed a petition calling for sanitary items to be exempted from tax altogether.

'Tampon tax'

In his Budget Mr Osborne said the proceeds of the tax would be distributed among women's organisations.

He has rejected calls from Eurosceptic Conservatives to defy the EU by unilaterally scrapping the tax, telling the Today programme he expected to get agreement from Brussels on it "in the next few days".

Prime Minister David Cameron is set to raise the issue "on the margins" of a summit he is attending in Brussels, Downing Street said.

Labour MP Paula Sheriff has, meanwhile, tabled an amendment to the Finance Bill that would scrap the so-called "tampon tax". Labour will back the motion, which it said was attracting cross-party support.

BBC experts analyse the Budget

With three months until the referendum on the UK's EU membership, the chancellor also used his Budget speech to warn against voting to leave.

He quoted a line from an Office for Budget Responsibility report which said there appeared to be "a greater consensus that a vote to leave would result in a period of potentially disruptive uncertainty while the precise details of the UK's new relationship with the EU were negotiated".

Leave campaigners, including London Mayor Boris Johnson and Commons Leader Chris Grayling, have dismissed claims there would be years of uncertainty as scaremongering.

The chancellor opened his 2016 Budget with comments about the UK economy

Jeremy Corbyn: Osborne's Budget is culmination of "six years of his failures"

Office for Budget Responsibility chairman Robert Chote told the BBC's Newsnight programme the organisation had not done any projections about the implications of a Brexit - and the chancellor was wrong to imply it had.

A number of economists had said there could be a period of uncertainty which could have implications for financial markets, which the report cited, "but we made no explicit judgement ourselves", he said.

Analysis

By BBC political correspondent Alex Forsyth

The chancellor has staked his reputation on his economic credibility, even imposing a set of tight fiscal targets on himself. So far he's missed two; cutting debt as a proportion of GDP this year and capping welfare spending.

Now economic analysts warn he could struggle to meet his most coveted - a budget surplus by the end of the Parliament.

Today the Institute for Fiscal Studies will focus on the chancellor's ability to clear the deficit - particularly in light of changing economic forecasts and downward revisions in growth.

Mr Osborne said he was taking difficult decisions to provide long-term stability for the next generation.

He found money to cut income tax and business rates, help savers and invest in roads and schools - but some in the chancellor's own party are questioning his decision to cut disability payments.

And Eurosceptic MPs are threatening to rebel unless the government listens to calls to abolish tax on sanitary products - which is set by the EU.

- Published16 March 2016

- Published16 March 2016

- Published11 March 2020

- Published16 March 2016

- Published16 March 2016