How could Labour's plans for greater public ownership work?

- Published

Some critics dismissed Jeremy Corbyn's call for the state to take back control of water, electricity and rail

As Jeremy Corbyn prepares for his first party conference since a stronger than expected general election result, what would his plans for the state to take control of water, electricity and the railways mean for Britain?

Shareholders may not be fully compensated under Labour's nationalisation plans, it is understood.

Investors in companies judged to have behaved poorly since privatisation could lose out. They will not necessarily receive the full market value of their shareholding.

Labour figures believe Parliament should consider how much companies have invested and how they have managed their assets when it calculates compensation.

English water companies would be a priority for public ownership, and Labour may make investors exchange shares for government debt - or gilts.

Prof David Hall, from Greenwich University, says the nationalisation of the failing bank Northern Rock - and a court case that followed - showed it was "perfectly reasonable" for the government to take ownership of a private company without fully compensating shareholders.

In Northern Rock's case, investors were paid nothing.

During Jeremy Corbyn's first leadership campaign John McDonnell - then Mr Corbyn's campaign agent, now shadow chancellor - warned a Labour government might take back recently privatised companies with reduced compensation or none at all.

Prof Hall says: "Some people think of it as the government just buying things on the stock market. That's not how public ownership works."

Labour thinks privatisations in the 1980s and 1990s were a bad idea, and that privatised companies give consumers a bad deal.

'Bargain basement prices'

Mariana Mazzucato is the Director of UCL's Institute for Innovation and Public Purpose and a former Labour adviser.

Prof Mariana Mazzucato warns poorly structured privatisation can sell the public sector short

She doesn't advocate the party's policy, but warns that privatisation without enough conditions attached can see businesses "benefiting massively from publicly created value".

They can get assets at "bargain basement prices," she says, and may not invest further but enjoy short-term profits.

"It ends up in the private sector, having [come] from the public sector, and [the new owner] not having done its part."

Labour says prices would be lower under public ownership because the state can borrow to fund investment more cheaply than private companies.

Disruptive?

Britain would need to borrow tens of billions of pounds to fund nationalisations, but would then hold valuable assets.

Supporters point out water, for example, was never privatised in Scotland and Northern Ireland, and is run by a not-for-profit company in Wales. There are plenty of examples on the Continent of publicly run utilities.

But the details of Labour's likely plans show how disruptive they could be to some businesses.

Taking control of English water companies would see the state ordering companies whose shares are not listed on the stock exchange - some of whose owners are based abroad - to hand over equity in return for public debt.

Opponents say this would alarm investors, driving them and their money abroad.

With electricity, the party intends to take charge of the companies that run regional power networks by changing their licence terms. Private companies would be left owning - but no longer controlling - electricity lines and substations.

Rail franchises - the rights to run trains in different parts of the country - would be taken up by the state as they expired.

Economist Sir John Vickers argues neither public nor private control is innately superior for businesses

To sceptics and critics, there is a hole at the heart of the plan: any evidence that the state would do a better job than private companies.

Oxford economist and former head of the Office of Fair Trading Sir John Vickers says neither public nor private control is innately superior for businesses where consumers can't shop around - such as control of water pipes.

Interference and inefficiency?

Independent regulation can deal with many problems, he says, but adds: "Memories can be short. The previous era, the nationalised era, was not exactly glorious in terms of efficiency, customer service and investment in these sectors."

Put more robustly - nationalisation's critics think it would see a return to political interference and inefficiency.

Who's right? There are clues, in not only longstanding public companies but also new ones.

In Bristol and Nottingham, the city councils own their own energy retail businesses.

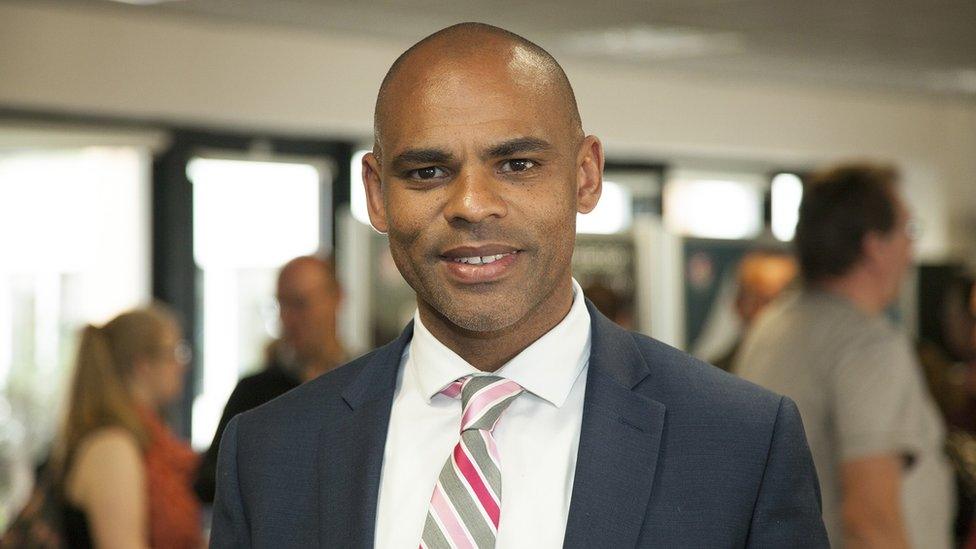

Bristol Energy was set up under a previous independent mayor, but the present Labour incumbent Marvin Rees says: "We are the shareholder as the city. When we make a return, it comes back into the city. People are buying a product off a company that invests in Bristol."

Public ownership for them means not just the principle of control, but ethical behaviour: advice for customers and seeking out the best deals for people who struggle to heat their homes.

Bristol Mayor Marvin Rees argues the Bristol Energy model can work

Crucially, if it works, it will be taxpayers, not shareholders, who benefit - if it works.

For now, Bristol Energy is losing money, more than £10m over two years. The city has given the company loans and guarantees worth £17m. The company expects to be profitable by 2021.

Plenty of new companies lose money, but when I ask Bristol Energy's managing director, Peter Haigh, how much he expects to have lost by 2021, I don't get an answer. As with any business, failure is possible, and here taxpayers would bear the cost.

Neither side in this debate can prove by accountancy or precedent that nationalisation would see consumers better or worse off.

One group has been proven wrong though: those who paid the policy little attention when Labour's manifesto leaked before the general election because they thought the party leader was about to lead his party to political annihilation.

Mr Corbyn and Corbynism survived. The nationalisation debate is back.

- Published10 June 2017

- Published16 May 2017

- Published16 May 2017

- Published11 May 2017

- Published11 August 2015