Rishi Sunak refers himself to Boris Johnson's ethics adviser

- Published

Rishi Sunak has referred himself to Boris Johnson's ethics watchdog as he continues to face questions about his family's financial affairs.

The chancellor wants Lord Geidt - the PM's adviser on ministers' interests - to check if he followed the rules.

Mr Sunak's wife, Akshata Murty, last week announced she would start paying UK tax on her overseas earnings.

But Labour says he still has questions to answer about transparency and whether he has used tax havens.

No 10 has confirmed the prime minister accepted Mr Sunak's request for a review by Lord Geidt.

The spokeswoman also said Boris Johnson had full confidence in his chancellor.

Mr Sunak said, external he was "confident" Lord Geidt - who also investigated allegations about Mr Johnson's refurbishment of his Downing Street flat - would find he had appropriately declared all his interests.

Ms Murty owns £700m in shares of the Indian IT giant Infosys - founded by her father - from which she received £11.6m in dividend income last year.

The BBC estimates she would have avoided £2.1m a year in UK tax through her non-domicile (non-dom) status.

She will now pay tax on her overseas earnings, but her domicile remains India, where she has said she intends to eventually return.

Mr Sunak said he had made the Cabinet Office aware of his wife's non-dom status when he first became a government minister in 2018.

He has ordered a leak inquiry into how that information came to be reported in the media.

Downing Street has rejected newspaper reports that its staff leaked damaging stories about Mr Sunak to the media.

Rishi Sunak's reputation has gone from golden to tinfoil. His personal ratings have plummeted and his leader-in-waiting status has been dented, if not destroyed.

But his job as chancellor looks safe for now.

He has the backing of the prime minister so won't get fired.

The number of Conservative backbenchers grumbling about his handling of this appears to be outweighed by the number of colleagues who think he's a good operator so they won't get rid of him. And the review into his declarations of interests isn't likely to cause him too many problems either.

But all of that could change under pressure from the opposition, the media and any further revelations, or if he becomes a threat to the reputation of the government.

What will be fascinating to see is whether this changes the approach Rishi Sunak takes to the rising cost of living.

Will the chancellor accused of being too rich feel he has to do more to help people who are getting poorer?

It feels like Rishi Sunak has gained a lifetime's-worth of baggage in a fortnight.

Most politicians have it - what matters is how much it weighs them down.

Labour's shadow home secretary Yvette Cooper said questions faced by Mr Sunak include whether he had declared his wife's tax status when taking "policy decisions" affecting non-dom households.

"The lack of transparency does raise questions about conflict of interest," she told BBC.

"The fact that they have changed their tax arrangements now shows that they do recognise it's a problem - but they wouldn't have done that if this hadn't been public."

It has also been revealed that Mr Sunak held a US green card until last year, entitling him to permanent residence, a path to citizenship, in that country.

It also means he filed US tax returns, prompting opposition questions about whether he gained a financial advantage from this.

Labour also says the public need to know if Mr Sunak has ever benefitted from tax havens.

It follows a report in the Independent, external which said Ms Murty had received income from companies based in tax havens.

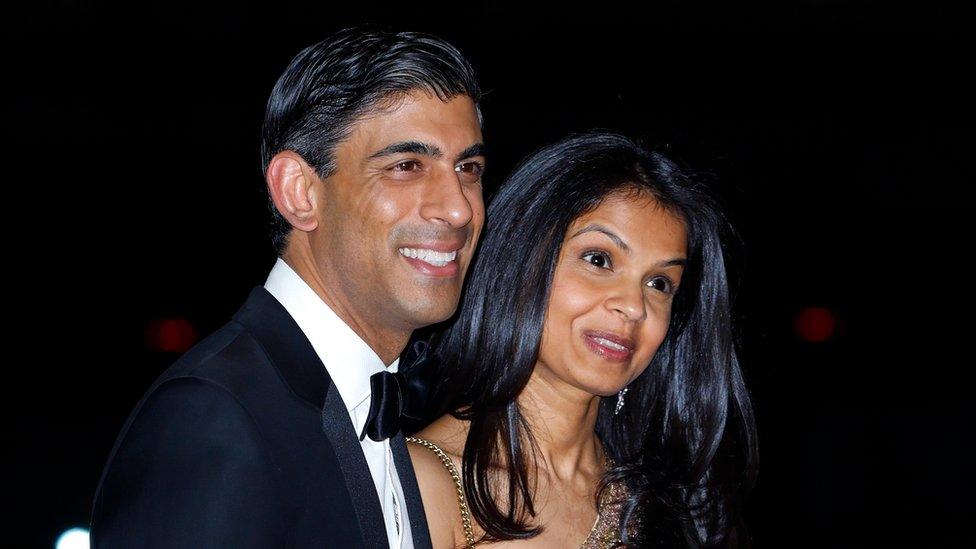

Rishi Sunak married Akshata Murty in 2009, after meeting her as a student in California

What is a non-dom?

A non-dom is a UK resident who declares their permanent home, or domicile, outside of the UK.

A domicile is usually the country his or her father considered his permanent home when they were born, or it may be the place overseas where somebody has moved to with no intention of returning.

For proof to the tax authority, non-doms have to provide evidence about their background, lifestyle and future intentions, such as where they own property or intend to be buried.

Those who have the status must still pay UK tax on UK earnings but do not need to pay UK tax on foreign income. They can give up their non-dom status at any time.

Ms Murty has chosen to be domiciled in India via her father, the billionaire Narayana Murty.

Read more here.

Related topics

- Published10 April 2022

- Published9 April 2022

- Published8 April 2022

- Published8 April 2022

- Published8 April 2022

- Published8 April 2022

- Published7 April 2022